Flint, a payment service for mobile devices on iOS and Android, has just cleared a new $6 million round of funding, the startup announced today.

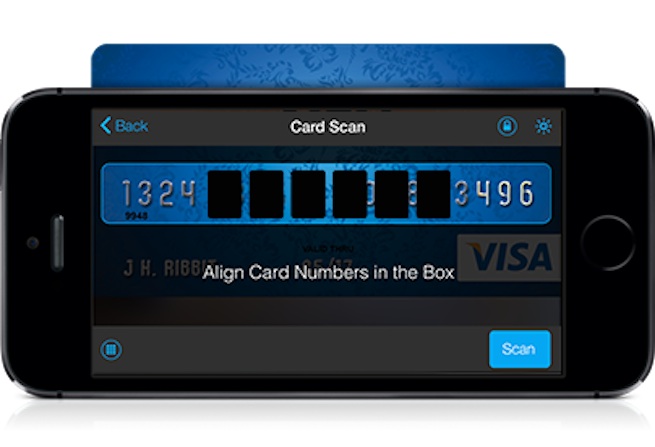

Flint provides small businesses and entrepreneurs with a point-of-sale service that’s entirely independent of hardware or other POS systems — sort of like a Square without the need of a dongle. To receive a payment, Flint users just snap a photo of a customer’s credit or debit card to grab all the proper information. That data is then encrypted and sent through Flint’s transaction platform immediately, leaving no information on the device. It also offers better transaction fees than other mobile payment services (1.95 percent for debit transactions and 2.95 percent for credit transactions — both with an additional $0.20 surcharge).

“While many others in the industry are replacing retail POS systems and cash registers with tablet apps, we’re focused on empowering the ’non-countertop’ businesses that operate outside of a store and have different requirements,” Flint CEO Greg Goldfarb said in a statement. “As a result of strong demand for our unique approach, we’ve seen transaction volume grow by more than 10 times in under a year.”

Flint said it plans to use the capital to hire additional employees, increase customer growth, and further develop its mobile payments technology. The new funding round was led by Digicel, with participation from SVG Ventures, True Ventures, and Storm Ventures.

Founded in 2012, the New York-based startup previously raised a $3 million round and now pulled in $9 million in total funding to date.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More