With the financial crisis sending the American economy into a tailspin, no corner will be spared.

With the financial crisis sending the American economy into a tailspin, no corner will be spared.

The innovative start-ups here in Silicon Valley are no exception and some people say we’re in a recession that will last a very long time. That’s why we’ve organized “How to manage your start-up during the downturn.”

We’ve invited some of the most experienced and respected business leaders in Silicon Valley. The spirit of this event is to come together quickly to debate the current fallout and provide advice to start-up founders and executives about how to manage the mess we’re in. We’re organizing the event into two sessions: 1) a round-table of investors, followed by 2) a round-table of entrepreneurs.

It all takes place Oct 29. from 8am to 12pm at the Stanford Park Hotel in Menlo Park.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

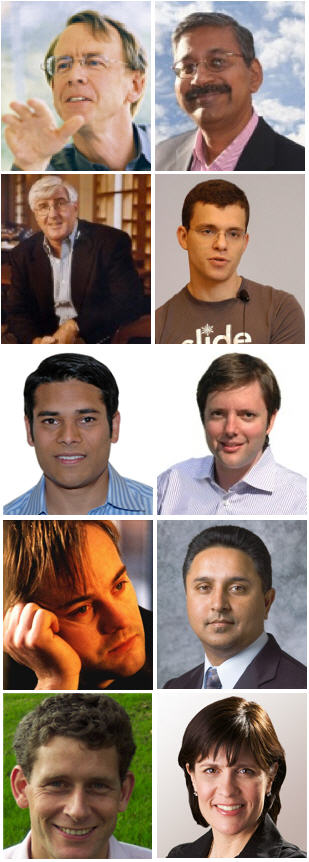

On hand will be the following (images are from left to right, top-down):

- John Doerr, venture capitalist at Kleiner Perkins (backer of Google, Sun, Amazon and scores of other companies);

- Ram Shriram, the early investor in and founding board member at Google;

- Ron Conway, arguably the most prolific angel investor, who wrote a memo to his companies advising serious financial caution;

- Max Levchin, the Slide founder and PayPal co-founder who helped lead that company through the first IPO after the last bubble popped;

- Nirav Tolia, the Epinions co-founder who was the unnamed subject of Benchmark partner Bill Gurley’s recent memo to Benchmark portfolio companies (Tolia is the one who laid off 70 percent of his staff during the last downturn but who somehow managed to turn a profit for his investors);

- Matt Cohler, the former executive at Facebook (he provided adult supervision there during the early years), who recently joined Benchmark as its latest partner. He worked at McKinsey & Co. during the last downturn.

- Jason Calacanis, the Sequoia-backed founder of Mahalo and writer of a controversial letter predicting doomsday for the vast majority of Web 2.0 start-ups. Shortly afterward, Sequoia stirred the valley by holding a mandatory meeting for the CEOs of its portfolio companies.

- Kittu Kolluri, the partner at the valley’s largest venture firm, New Enterprise Associates, who built and then sold Neoteris during the last downturn, chalking up one the biggest successes of that trying time.

We may be adding one or two others in the coming days. I’ll be moderating the investor panel, and AllThingDigital‘s Kara Swisher (bottom right) will moderate the entrepreneur panel. Together, we’ll explore what these investors and entrepreneurs did to survive and thrive through the last downturn, how this recession is different, and what that means for decision-making over the next six months.

Unfortunately, due to limited space, we’re forced to be selective. We are limiting attendance to CEOs and startup founders. If you’re interested and you qualify, please email us at events@venturebeat.com and provide these details:

- Name:

- Company Name:

- Title:

- Raised capital (yes/no):

- Investors:

- Short Description of your start-up:

We will be selecting attendees to ensure diverse viewpoints.

Tickets for the event will be $189 and will include breakfast.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More