The worldwide adoption of smartphones has turned mobile gaming into a mammoth business.

This was the year that mobile gaming revenues reached $30 billion and that China generated more money for that sector than any other nation — even the United States. But those aren’t the only big milestones and changes to come to this space, according to a new report from research firm Newzoo that looks back at 2015. Entirely new regions turned into major players as device and networks penetrated deeper into emerging markets and some big-time acquisitions empowered tradtional gaming powers to finally get a significant grasp on this still-growing business.

Big growth in 2015

When it comes to growth, nothing is bigger than Asia. Those countries are coming online at a rapid rate with Android and iOS smartphones, and that saw Southeast Asia spending balloon to $1.8 billion in 2015 — that’s up a whopping 69 percent year-over-year. China, meanwhile, only saw growth of 46.5 percent. That was enough to help it eek out $6.5 billion in smartphone- and tablet-gaming sales. That makes it as big as all of North America, which also generated $6.5 billion but with a growth rate of only 15.1 percent.

China’s ascendance means that it now outgrosses both the United States and Japan, and it creates a worldwide market where global appeal is more important than ever.

But while China and Southeast Asia kept thing interesting with raw earnings, it was Call of Duty and World of Warcraft publisher Activision Blizzard that captured the biggest headlines for mobile gaming over the last 12 months. That’s because the game-making company, which has excelled in the console and PC market for decades now, spent $5.9 billion to acquire Candy Crush Saga megadeveloper King.

Activision’s tectonic shift into mobile gaming makes it clear that not only is this sector probably worth the money — but it also requires a level of expertise that makes King valuable.

After buying King, Activision is now the second largest game company in the world behind Chinese giant Tencent, which runs the billion-dollar free-to-play PC phenomenon League of Legends.

The power users that make mobile gaming so lucrative

The Newzoo report doesn’t dwell on results — it attempts to explain why this market is as big as it is. And the firm points to one key factor: power users.

The company defines two kinds of power users. The first is free marketers, which rarely or never spend money but play for 10 hours per week and provide word-of-mouth buzz for games among their friends, on forums, and across social networks.

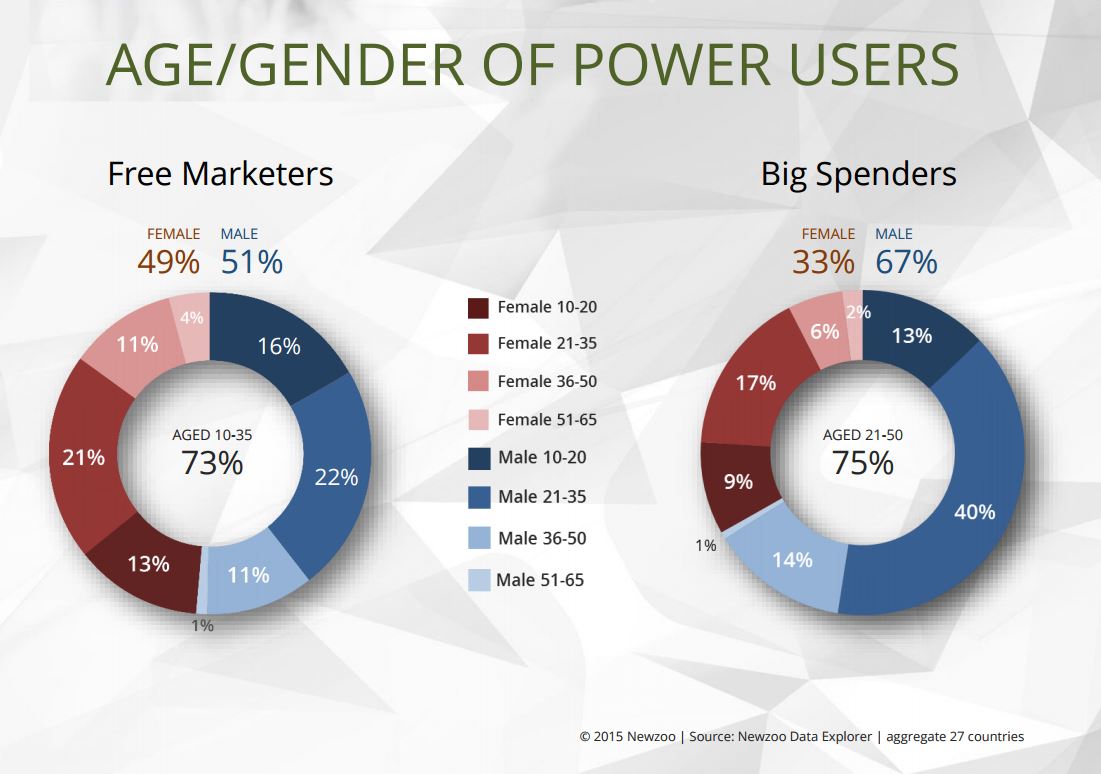

In terms of demographics, free marketers are evenly distributed along gender and age groups. Spenders, however, are primarily male, and they’re mostly in their 20s to early 30s.

When it comes to employment, both kinds of power users mostly have jobs — although the students with no job make up 19 percent of free marketers. But all of that extra time makes these kinds of players valuable in another kind of way, according to Newzoo. The company points out that 49 percent of free marketers actively use Instagram. That’s compared to only 38 percent of all mobile nonspenders. These players are also a big reason that 28 percent of people discover new mobile games through friends and family.

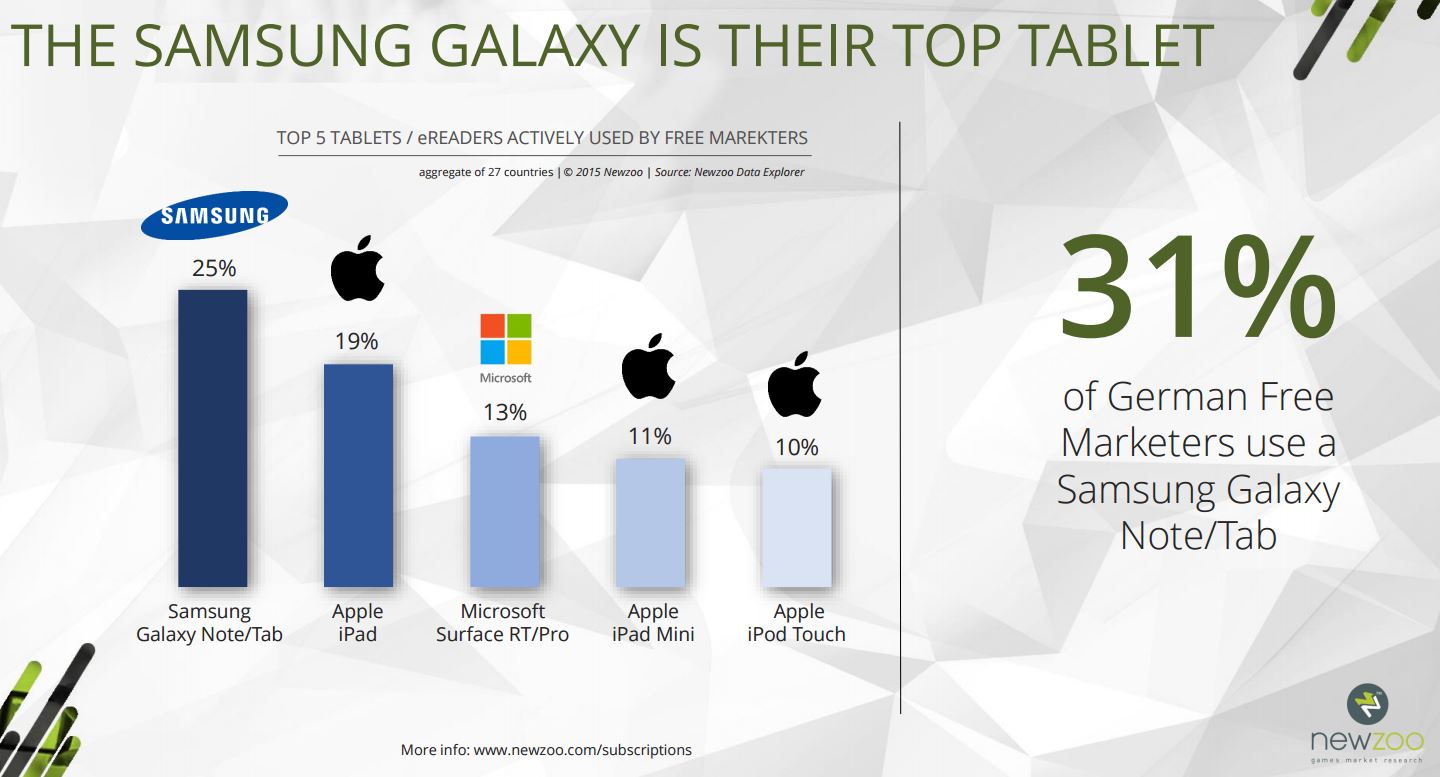

Newzoo also reveals something a bit surprising: Free marketers are more likely to use a Samsung Galaxy Tab than the iPad or any other tablet.

When it comes to “big spenders,” however, Newzoo reveals that they are all about doling out those Benjamins no matter where they’re playing gmaes. It turns out that 71 percent of mobile gamers spend big on console and 69 percent also spend a lot on PC. I guess money is green no matter what kind of device is playing your games. That’s compared to 11 percent and 8 percent for all mobile gamers on console and PC, respectively.

Spenders also often absorb themselves in every type of content. 87 percent of these kinds of power users watch game videos on YouTube and 67 percent watch them on Twitch.

Finally, Newzoo reveals a common trait among a large majority of big spenders: they love to use prepaid cards. You might’ve guessed that by the size of those prepaid card stands at every grocery store and gas station you visit, and it’s true — 71 percent of big spenders buy a prepaid card at least once a month. Newzoo found that 38 percent of these gamers buy a prepaid card at least once a week.

In a mature market like the United States, you can see that most developers are already building their games around these various kinds of gamers. You make something fun to play and shareable for the free marketers while giving the big spenders a reason to go pick up a prepaid card or two. Having those kinds of groups playing off one another can then lead to something like Clash of Clans or Candy Crush Saga making $1 billion every year.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More