Nintendo needs cash fast, so it’s going to bring Mario and Luigi into the physical world … maybe it can do the same thing with Mario’s coins and hit up one of those cash-for-gold places.

Following its dismal financial report on Wednesday, Nintendo held an investor event early yesterday to detail how it will return to profitability and boost lagging Wii U sales. That led to Nintendo president Satoru Iwata dropping some info about a few of the company’s biggest projects. First, he revealed that the publisher will introduce games and action figures that interact with one another similar to Activision’s Skylanders, which have made over $2 billion since launching in 2011. The other big announcement was that the Kyoto-based hardware manufacturer plans to develop new machines for emerging markets like China. These are both moves that could help turn the company around, but after losing $229 million for its fiscal 2014, it may need something more.

Nintendo didn’t provide many details on either project, but what it did say about new hardware and China didn’t really jive with Cowen & Company analyst Doug Creutz.

“I’ll be honest. I don’t understand that at all,” Creutz told GamesBeat. “If you make new hardware, then are you going to have to make different software for it as well?”

Nintendo’s home console, the Wii U, is performing very poorly. The company only sold 310,000 of these consoles last quarter. Getting into China could help as the country recently lifted its 14-year-old ban on consoles. Iwata, however, doesn’t just want to repackage the same device for the vastly different market.

“We want to make new things, with new thinking rather than a cheaper version of what we currently have,” Iwata told investors gathered in Tokyo yesterday. “The product and price balance must be made from scratch.”

Again, Nintendo isn’t saying how this will all work, but it has previously released hardware in China. In 2003, the company released the iQue Player, which was a controller capable of playing Nintendo 64 games off a memory card. Customers could go to stores and kiosks to fill up the storage stick with software. The system complied with China’s strict (and defunct) console ban, and that history gives Nintendo some insight into the country (albeit decade-old insight).

Microsoft already announced plans to launch the Xbox One in the country in September, so Nintendo probably won’t have an advantage of getting into the market first. Since it wants something with “new thinking,” this is probably OK with Japanese game maker.

“Nintendo has a good relationship with partners in China thanks to the iQue device,” IDC Research analyst Lewis Ward told GamesBeat. “They’re aware what it takes to work in that market, and what this would be is probably another variant on the iQue.”

While that insight is aging, the fact that Nintendo has relationships at all will help. Of course, it will also have to put an effort into learning what has changed in China since it last was in the country, which is just as important.

Nintendo released the Wii Mini in Canada and the U.K. recently, which was a cheaper, revised version of the Wii for $100, but that seems exactly like the thing that Iwata doesn’t want.

“So maybe they’re talking about something like a dumb box that they can serve software to through the cloud,” said Creutz. “China has an issue with piracy, and maybe they don’t want a disc-based console that would enable people to rip off games.”

Piracy and software delivery are all big concerns when launching in China, but these issues might not even really matter if the gamers don’t show up.

The Asian nation already has a massive gaming industry. In 2013, consumers spent $13 billion on games. Nearly $9 billion of that was on PC software. Games like World of Warcraft, Hearthstone, and League of Legends are huge, and they already carry a cultural cachet that consoles will have to fight. Nintendo would also enter the market after smartphones are well established and growing. Games on mobile devices made $1.8 billion in 2013 and will likely make something along the lines of $3 billion in China this year.

Nintendo knows that grabbing attention is the real hurdle, which is why it’s thinking about ways to introduce something different. But that’s going to cost money now.

“As much as China is an exciting opportunity, the reality of that market is that any console is going to have a very rough time,” said Creutz. “So are they going to throw a ton of R&D money at new hardware? Is that the best use of their cash?”

Nintendo’s interactive toys

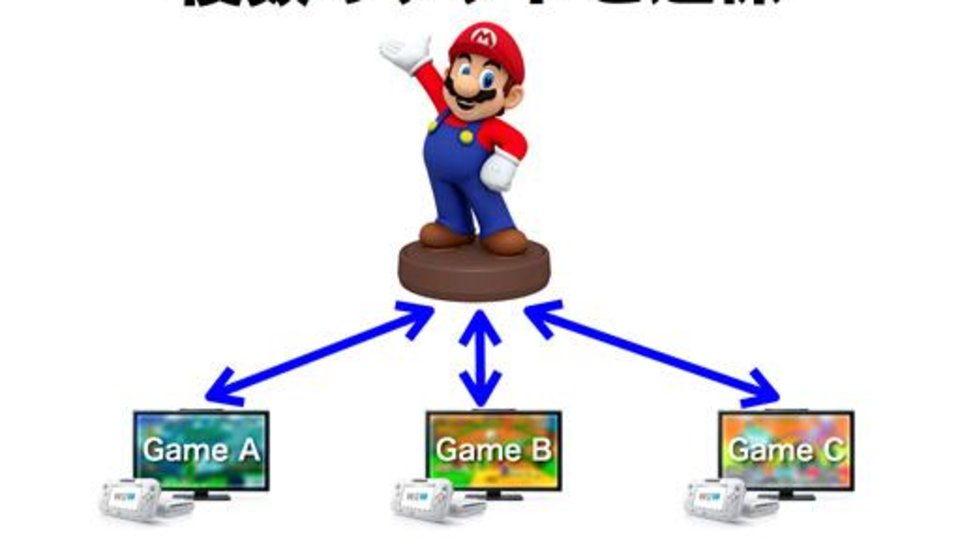

The Wii U’s GamePad controller has a built-in capability called “near-field communication” that enables it to speak with other NFC devices that are near it. Nintendo will leverage this technology to introduce a line of figurines from the Mario universe that gamers can have as physical toys that will also interact with a line of games. It is calling the games and toys NFP.

“The figurines, which consumers can buy and collect, are going to work with multiple software titles to be released in the future, and we are aiming to develop more software titles [that are] compatible with the figurines,” Iwata told investors. “Nintendo has a lot of well-known characters that originated in video games, and we have been regularly releasing titles from game franchises that make use of this character IP.”

These figurines will also work with the 3DS through the use of a wireless NFC device that connects to the handheld. Having handheld compatibility will give Nintendo a bigger potential audience, and it will enable the company to sell more games that work with these toys.

“I’m of two minds about Nintendo’s figurine game,” said Creutz. “On the one hand, their intellectual property is incredibly potent with boys. I think, given that there’s been some success in that market, it does make sense that they would try to get into it.”

Activision invented the interactive-toy genre when it launched developer Toys For Bob’s Skylanders in 2011. The company has gone on to release a new one each year since, and the franchise is already one of the publisher’s most successful. The game makes more than half of its money from toy sales.

Last year, Disney introduced its Infinity franchise, which is like Skylanders with characters from the popular properties like Cars, Toy Story, and Pirates of the Caribbean. That game was the 10th best-selling physical game at retail in the U.S. last year.

This probably has Nintendo kicking itself.

“Nintendo had the opportunity to pick up Skylanders a couple years ago, but it passed on the game,” said Ward. “It had a shot at this, and you have to think that something like this is right up its alley. It feels like a natural fit.”

Now, Nintendo and Mario are third into a competitive market, and it will have to differentiate itself. Having the toys work with multiple games is a start. Iwata claims this will enable each toy to feel custom. Players will find that their own Mario figure has a history, different gear, and unique attributes based on the things the gamer did with it before.

That could work, but Skylanders and Disney Infinity both have an inherent advantage.

“You’ve got the issue that whatever Nintendo does is only going to be available on its platforms,” said Creutz. “Unfortunately, their platforms don’t really have a very wide reach right now. They addressed that by making NFP compatible with the 3DS and the Wii U, but the thing with the 3DS — kids don’t want to lug a bunch of figures around with them. For example, the 3DS versions of Skylanders haven’t sold as well as the console versions.”

Despite this, like its foray into emerging markets, Nintendo could see a decent return on NFP.

But again, is this the answer to the question that faces Nintendo?

What about Nintendo on mobile devices?

Nintendo cannot hold a meeting with its investors without one of them asking about putting Mario and other games on iOS and Android. People who hold stock in Nintendo look around and see companies like Clash of Clans developer Supercell making hundreds of millions of dollars from one game. Maybe Nintendo could do the same — well, it doesn’t want to, and it says it isn’t an easy process.

“Our games such as Mario and Zelda are designed for our game machines, so if we transfer them into smartphones as they are, customers won’t be satisfied,” said Iwata. “If customers aren’t satisfied with the experience, it will decrease the value of our content.”

Basically, Iwata is saying that even if he did want to put Nintendo’s franchises on an iPhone, its fans wouldn’t even want that.

He went on to explain that the smartphone market is competitive and no developer has yet to string together huge success over multiple years. He compared that to Nintendo’s console business, which is has sustained for over 30 years.

“They keep talking about how it’s not as simple as porting their games to mobile — and I don’t think it’s simple either — but it’s not as complicated as they’re making it out to be,” said Creutz. “They are just making it out to be more complicated because they don’t want to do it.”

But Nintendo doesn’t want to do it for good reason.

Once Mario and Zelda go mobile, Nintendo is probably on an irreversible path to getting out of the hardware business. Right now, the company keeps its properties exclusive because it’s the big reason that people buy Wii U systems and 3DSes, obviously. But how well would Mario Kart 8 sell at $60 if most people were playing the free-to-play version on their iPad?

“As well as the 3DS is doing, if you start putting big Nintendo games on mobile, then you’re pretty much putting a bullet in that thing’s head,” said Creutz.

Nintendo could go mobile, but it would come at the expense of the only things that are making it money right now. It’s not really a great strategy, but the company also might not have much of a choice.

Nintendo’s real problems

Nintendo has a lot of money in its bank account. It can afford to bleed cash for several more quarters. That’s what it is doing right now. So that’s probably why it feels comfortable taking some shots at returning to profitability with China and its own take on Skylanders. The company is also looking at getting into the business of selling products and services related to health, fitness, and quality of life.

If one or more of those strategies pays off, Nintendo could find itself back to profitability, but it is still facing some deeper problems that it isn’t addressing.

“I just don’t think that Nintendo is answering the question they are really facing,” said Creutz. “They’re avoiding the real issue.”

For Creutz, that issue is the fact that Nintendo’s characters and properties are worth more than its hardware. Mario has the potential to make more money than the Wii U. That wasn’t always the case. The Wii was probably worth more to Nintendo than its software, but both performed well.

“The answer for Nintendo is to go where the customers are,” said Creutz. “For Nintendo’s type of games, the customer is increasingly on mobile platforms. The other possibility is for Nintendo to make itself more of a core-gamer company and ape what Microsoft and Sony are doing — but Microsoft and Sony are already doing that very well.”

Some thought that Nintendo might quickly abandon the Wii U and move on to its next console. Iwata told investors that it’s not afraid to start something new, but it won’t do so until its satisfies its current customers. That likely means the company is sticking with the Wii U for the next couple of years.

IDC’s Ward thinks Nintendo’s real problem is relevancy. While the company loses money, it’s also losing fan interest as gamers move on to PlayStation 4 and iPad. He thinks that Nintendo, if it’s not going to release something new, needs to get aggressive with Wii U now.

“The figurine game and the emerging markets both have potential to move the needle, but in the near term they need to — if it’s possible — take another $50 off the Wii U,” said Ward. “They’ve historically been comfortable playing the value position in the console battle. I think the Wii U is not quite differentiated enough on price at this point, and a second $50 cut two years into its life is not crazy.”

The Wii U is especially struggling in North America and Europe … which are hugely important regions. Ward thinks that a focus on big games can help that now.

“Mario Kart 8 has to crush it. I believe that Smash Bros. Wii U has to crush it, and I believe Nintendo has a few other exclusives in the pipeline,” he said. “To ensure the Wii U is still in the game by the end of 2015, those are the two things that I would focus on. Great exclusive software and a $50 price cut.”

Next month, as part of its presence at the Electronic Entertainment Expo tradeshow in Los Angeles, Nintendo will host a “digital event” to talk about its new games and more. That includes the NFP figurines and software, and we’ll see if the company can start turning things around.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More