OpenTable, the online restaurant reservation company has filed to go public, making it the first technology company initial public offering in many months. It comes, counterintuitively, at a when people are cutting back on expenses — and eating out less.

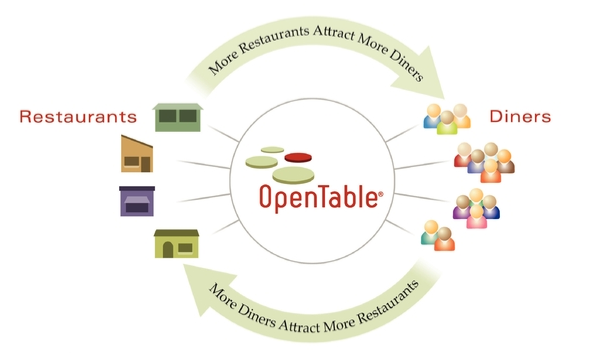

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":103364,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"A"}']The company works with more than 10,000 restaurants, using a combination of software and hardware to allow people to make online and mobile reservations. It made $41.3 million in revenue through September 30 of last year, a sharp increase over the previous year, according the IPO filing (available here, with excerpts below).

Indeed, last June Matt Marshall conservatively estimated the company was making nearly $15 million a year with the potential to be a $100 million company based on its growth. It charges $1 per diner seated through its web site, and $0.25 per diner if the OpenTable reservation is made through a restaurant’s own site, along with other reservation-related revenue streams.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The number of shares and the price range have yet to be determined. The bookrunning manager will be Merrill Lynch & Co. with co-managers Allen & Company LLC, Stifel, Nicolaus & Company, Inc, and ThinkEquity LLC.

San Francisco-based OpenTable brought in Paypal and eBay executive Jeff Jordan in 2007, to help “take the company to the next level.” Despite the current economic downturn — which is hitting restaurants as hard as anyone — OpenTable has few competitors and an established brand. The company aims to raise $40 million by going public, according to the filing.

Founded in 1998, it has previously raised $50 million in funding from Benchmark Capital, Impact Venture Partners and Integral Capital Partners.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More