Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

“Now is the best time in history to be an entrepreneur in Europe.” That is one of the banner conclusions from a new report, The State of European Tech, published today by VC firm Atomico and Slush, the organisation behind of the Finnish tech conference of the same name.

The expansive report, which surveyed founders, investors and other members of the European startup community, details a changing Europe that still faces a wealth of challenges but whose ecosystem is maturing, putting the region in an ever-better position to take those challenges on.

The report also analyses data from Dealroom.co, Invest Europe, LinkedIn, and several others, which further demonstrates that the environment for tech startups to thrive in Europe has been steadily improving since 2011. Despite ups and downs along the way, overall it’s easier than ever for young tech companies to attract funding, find talent, and scale their businesses to the next level, the report shows.

Compared to 2015, 88% of respondents are either more or equally optimistic about the state of European tech. This growing confidence in the ecosystem is further evidenced by the 56% of respondents who are repeat entrepreneurs. Even the looming spectre of Brexit hasn’t rocked confidence, at least not yet. However, one German founder in the survey, who has registered their company in the UK said the affair still “puts uncertainty on our shoulders” for the next three years.

The report details several areas where European entrepreneurs have improved and where opportunity awaits.

Long-term outlook bright for European venture funding, despite recent dip

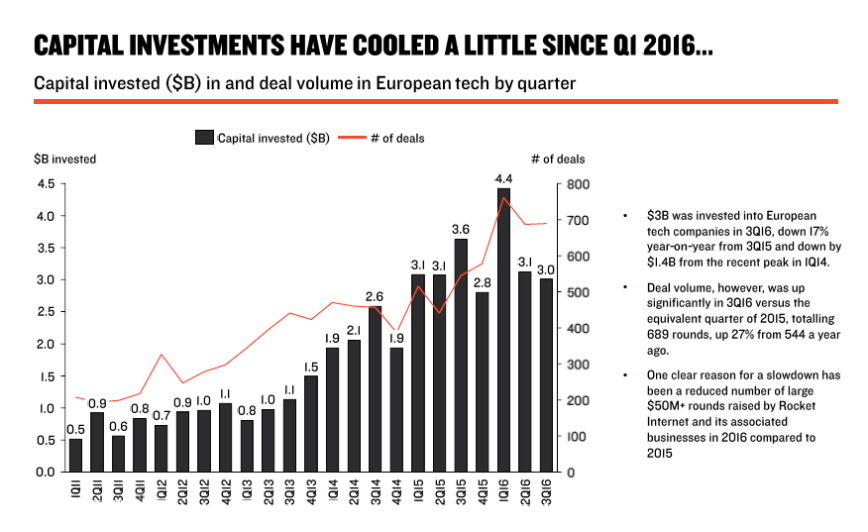

There has been some cooling off on investments across Europe in 2016 compared to last year. The year was off to a hot start with investments in European tech companies totaling $4.4 billion in Q1 but dipping to $3.1 billion in Q2 and $3 billion in Q3. Nevertheless, projections for the final weeks of 2016 from Atomico and Slush show that 2016 will still finish as a record year when it comes to both deal volume and capital invested.

“We should not play the game of quarterly capitalism and obsess over short-term metrics. We should focus on the long-term trend and the fact that capital is being deployed in Europe at a level that is nearly five times bigger than 2011,” said Andrus Ansip, Vice President for the European Commission’s Digital Single Market (DSM), said in the report.

The European tech ecosystem is diversifying in terms of industries, per the report. B2C still draws in more investments than B2B but the figures also show that music accounts for the most investment dollars over the last five years while fintech has seen the highest number of deals.

Fintech’s activity has been interesting but its potential still remains untapped when you consider the number of financial companies that are still awaiting disruption, according to Kathryn Mayne, Managing Director of American private equity firm Horsley Bridge.

The report shows there is a “healthy and growing pipeline” of early stage companies. It’s easier than ever to start a company and as a result there are “record numbers” of companies raising seed and Series A rounds. On the flip side, between 2009 and 2013, the number of companies graduating beyond that has shrunk and there has been a reduction in the number of funding rounds above $25 million. However, that could be addressed by the emergence of more large funds in Europe.

Bridging the funding gap

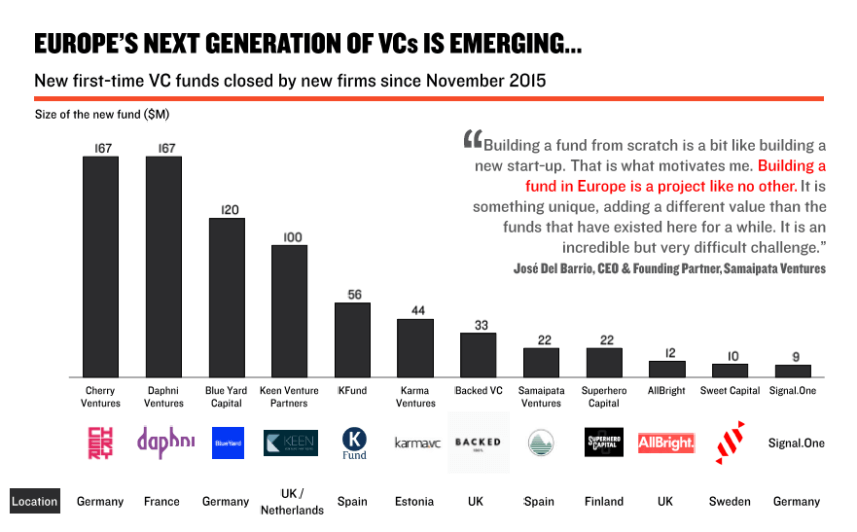

Much is made of the funding gap between the US and Europe, with European companies having a harder time raising later stage rounds due to an apparent lack of sizable funds. The Atomico and Slush report says that this gap is now narrowing as much larger funds emerge in Europe. In 2015 the total funds closed by European VCs stood at €4.3 billion, representing year-on-year growth of 35%.

Since late 2015 there are have been several new funds have been closed by new firms. These include Cherry Ventures ($167 million), Daphni Ventures ($167 million), Blue Yard Capital ($120 million), and Keen Venture Partners (€100 million), as well as a number of smaller funds under $30 million. At the same time, there has been increased activity in US VCs investing in Europe with big names like Andreessen Horowitz, Sequoia Capital, and Bessemer Venture Partners.

“As a globally-focused investor based in the US, we look to European markets as the ultimate test-bed for products and platforms that inspire new modes of consumer behaviour and can proliferate on an international scale,” Mood Rowghani, general partner at US firm Kleiner Perkins, commented in the report.

Despite these gains, there remains a perception among respondents, namely investors and founders, that Europe is still dependent on the US ecosystem in order to succeed.

Spotlight on deep tech

Europe is becoming more and more focused on deep tech – AI, machine learning, driverless cars, AR, VR, the internet of things, etc. – with the report observing an increase in the developer base in these sectors. At the same time, funding activity is vibrant.

Since the start of 2015, $2.3 billion has been invested in European deep tech, more than a 50% increase over the two years prior. Breaking it down by country, the UK has seen the most capital invested by far followed by France, Germany, and the Netherlands. The Nordic countries have also seen a lot of activity in this area.

Deep tech talent is spread out across the continent. Unsurprisingly there are clusters of AI, VR, and AR professionals in hubs like Berlin while international companies have set up deep tech engineering centres around Europe as well including Google, Facebook, Twitter, Apple, Microsoft, and IBM.

Corporations spot an opportunity

Europe’s largest corporations have acquired more than 50 tech companies and made more than 250 investments since 2011.

Meanwhile, Silicon Valley giants have scooped up dozens of European companies over the same time period.

2016 is proving to be a noteworthy year for mergers and acquisitions. We’ve seen “landmark transactions” such as Japanese giant SoftBank’s acquisition of UK chip maker ARM for $31 billion and NXP Semiconductors buy out by Qualcomm for $47 billion.

When it comes to IPOs, the report notes that there have been more European tech IPOs than US ones, coming from a wide range of sectors such as IT services, software, hardware, semiconductors, and internet services. However these European listings are much smaller than those in the US. In the first nine months of 2016, European public tech companies raised $17 billion in initial and follow-on offerings. Europe is lacking in publically-listed tech giants.

There have also been some notable IPO setbacks in Europe too like Misys pulling its listing in October.

Rising talent

When it comes to tech talent, the report shows that perceptions aren’t in line with reality. Five of the world’s top 10 computer science institutions are in Europe and one in five MBA grads from top business schools are entering tech.

However, 29% of founders stated that there’s a lack of engineering talent while 25% said the talent pool is “adequate” and 31% said it’s “good.” Only 10% said it is “very good.” Only 10% said it is “very good.”

Most developers in Europe are centered in hubs such as London, Paris, and Berlin. At the same time, according to Stack Overflow and LinkedIn data, several countries have seen a very fast growing tech worker population between 2015 and 2016, with Ireland, Germany, and the UK topping the list. The UK remains the top destination for engineers.

One interesting survey question noted that most founders, whether experienced or newcomers, would in fact prefer to set up and build their companies in their home countries.

Tech communities are going from “strength to strength” with cities hosting more and more meetups and events for founders and startups. Cities like London, Berlin, Stockholm, and Helsinki have been the most active when it comes to fostering tech communities.

There still needs to be more promotion of tech communities in emerging tech hubs, like Zurich and Munich, that builds links with the bigger cities. “Silos and barriers have no place in the digital economy,” said Ansip, of the DSM.

There are an increasing number of women involved in the organising of these meetups and communities. “I think this is the first step,” said Marianne Vikkula, CEO of Slush, “this trend will eventually spill into women entrepreneurship too.” Right now European tech is still predominantly male. More than 80% of companies that have raised money between January 2014 and September 2016 had all-male founding teams.

An optimistic outlook

“I’m not that old, but I can’t see when it would have been a better time to be a technology entrepreneur than now,” said David Helgasson, founder of Denmark’s Unity Technologies. Europe has much to be optimistic about but the report’s respondents still have huge reservations about a number of potential risks to their businesses and the wider ecosystem.

Up to 40% of respondents cited business issues like funding, talent and risk aversion as still being challenges, 30% said they had concerns about matters such as regulation, taxation, and the economy while 22% expressed worries over EU issues like Brexit and the free movement of workers. The remaining 8% said international issues were a concern. Nevertheless, optimism is still high.

“The European ecosystem has matured a lot. There’s no reason why a European company couldn’t be as successful, or even more successful than any US company,” said Cherry Ventures cofounder Filip Dames. “The infrastructure is here, the success stories are here, the exit market is developing, the availability of capital has improved significantly.”

The State of European Tech report was conducted by Atomico and Slush. It surveyed founders, investors, startup and scaleup employees, corporates, public workers, and students. Several data partners contributed to the report: Dealroom.co, Invest Europe, The Startup Heatmap Europe, LinkedIn, London Stock Exchange, Priori Data, Meetup, Signal, Quid, Stack Overflow, SimilarWeb, and Teleport.

Tech.eu reporter Shaheen Samavati contributed to this post.

This post first appeared on Tech.eu.