If that doesn’t quite match LinkedIn’s meteoric IPO, when shares more than doubled on their first day of trading, well hey, it’s early. It has been a steady climb since Pandora first filed for its IPO — shares were initially priced between $7 and $9, then were set at $16 for the IPO, and started trading at $20 this morning.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":299242,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,media,","session":"A"}']The current share price values Pandora at more than $3 billion, which is pretty good for a company that brought in $137.8 million in revenue during its most recent fiscal year. There are still concerns about its long-term business model, especially about its rising music costs. But today seems like a good day, not just for Pandora and its investors, but also for other Web companies that plan to go public, including Groupon.

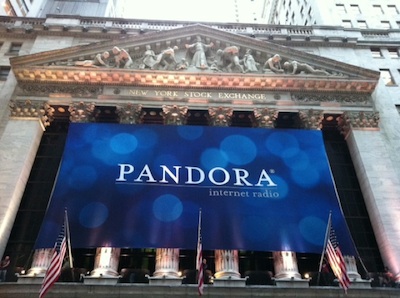

[photo by Pandora CTO Tom Conrad, via Foursquare]

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More