Stripe might be best known for enabling online merchants and websites to process payments more easily, but its team also strongly believes in decentralized payment networks and cryptocurrencies.

Today, Stripe announced that it has invested $3 million into Stellar, which is an open source project, a currency-exchange network, a currency in its own right, and a non-profit. Stellar also launches today.

Stellar, like Bitcoin, is a decentralized payment network and protocol. Unlike Bitcoin, it supports traditional currencies such as U.S. dollars, euros, and so on.

From Stripe crypto specialist Greg Brockman’s blog post:

Stellar’s goal is to build a great transport layer for transmitting monetary value. Figuring out how to efficiently move money is something we support very strongly: Stripe spends a lot of effort integrating different banking and finance protocols in various countries (17 at last count). We’ve always considered it unlikely that these systems would be just as fragmented in twenty years. Bitcoin has already changed the world by drawing attention to the value of open, distributed protocols that enable the transmission and storage of money. Stellar aims to advance this success by providing a way to transact in one’s currency of choice, whether that currency is fiat or digital.

Here’s how Stellar works: You can use the network to send and receive payments in a pair of currencies (sending dollars that arrive in euros, for example), or you can hold a balance with a gateway, which is a network participant that accepts a deposit in exchange for credit on the network, according to Stellar’s site.

Stellar also has its own native currency, the stellar. Its value will be market-determined, and its main purpose is to provide a conversion path between currencies.

“All the financial structure today is fragmented and out of date. They can’t communicate with each other,” said Stellar executive director Joyce Kim, in an interview with VentureBeat.

“Bitcoin hasn’t really made it mainstream. What we decided to do with Stellar is create this common language,” she said.

She added that the trouble with Bitcoin and other cryptocurrencies is that they’re challenging to understand and can even be hard to acquire, as they must be “mined” or bought from specialty exchanges, which creates a lot of friction. Stellar, she says, is creating a universal network.

As for Stellar, the non-profit, it will be in charge of distributing the coins only. “Money, [the stellar coins], is now is for the people, by the people…It shouldn’t be owned by anyone,” said Kim.

The network will initially have 100 billion stellars, and will grow 1 percent per year. The coins will be distributed as follows: 5 percent for operating costs of the nonprofit, 50 percent for people who sign up for an account, 25 percent for other non-profits working on financial inclusion, and 20 percent to current bitcoin and Ripple holders.

The 25 percent for non-profits is particularly important to Stellar. While Facebook’s Internet.org and Google’s Project Loon are working to bring internet to the whole world, “bringing the next billion [people] onto the Internet economy is even harder than bringing them online,” said Kim. This chunk of the stellars will go to nonprofits working on micro-lending, community banks, and the like.

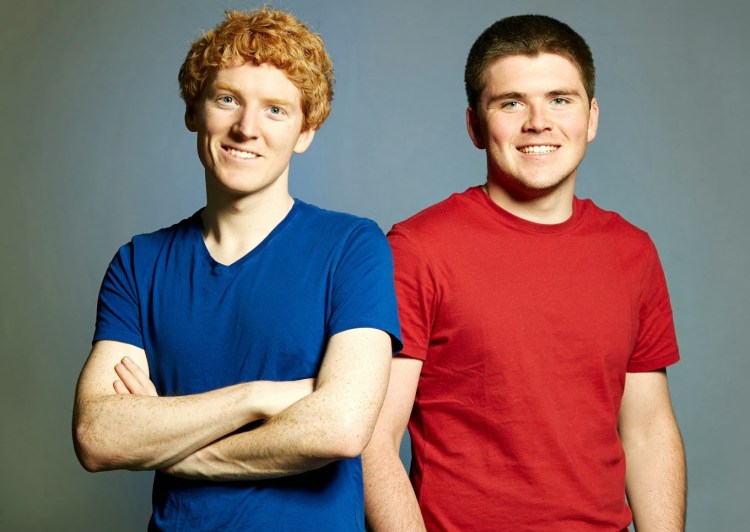

Stellar’s board includes Khosla Ventures’ Keith Rabois, Stellar developer Jed McCaleb, and Stripe chief executive Patrick Collison. Its advisors include Sam Altman, Naval Ravikant, Matt Mullenweg, and a host of others.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More