Graphics chip maker Nvidia reported earnings for its fourth fiscal quarter that beat Wall Street’s expectations.

Nvidia’s results are a bellwether for the PC industry, as the company is one of the largest makers of graphics chips. Its results are also indicators of the health of sectors such as PC gaming hardware, graphics-enhanced data center computing, and car computing. The PC market isn’t growing like it once did, but Nvidia still did well.

The Santa Clara, California-based company reported non-GAAP earnings of 52 cents a share on revenue of $1.4 billion.

Analysts had expected non-GAAP earnings of 32 cents a share on revenue of $1.31 billion. Nvidia itself predicted revenue of $1.3 billion, plus or minus 2 percent. Nvidia has an estimated 81 percent share of the discrete graphics card market, according to Jon Peddie Research. Nvidia’s stock is up 6 percent in after-hours trading.

Nvidia’s graphics processing unit revenue was up 10 percent. Gaming revenue was up 25 percent from a year ago, thanks in part to interest in virtual reality and strong sales of holiday games.

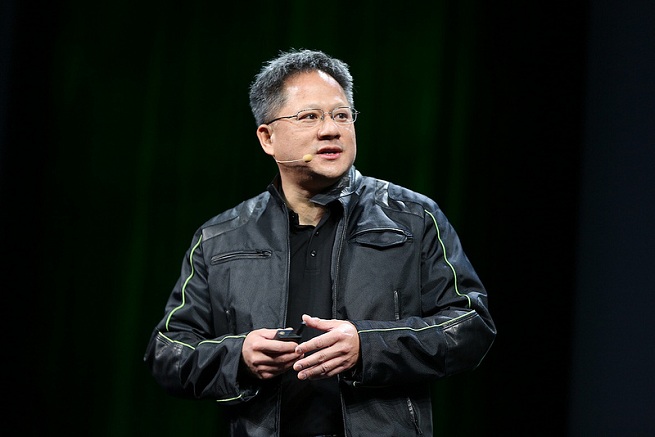

“We had another record quarter, capping a record year,” said Jen-Hsun Huang, cofounder and chief executive officer of Nvidia, in a statement. “Our strategy is to create specialized accelerated computing platforms for large growth markets that demand the 10x boost in performance we offer. Each platform leverages our focused investment in building the world’s most advanced GPU technology.”

He added, “Nvidia is at the center of four exciting growth opportunities — PC gaming, VR, deep learning, and self-driving cars. We are especially excited about deep learning, a breakthrough in artificial intelligence algorithms that takes advantage of our GPU’s ability to process data simultaneously.”

And he said, “Deep learning is a new computing model that teaches computers to find patterns and make predictions, extracting powerful insights from massive quantities of data. We are working with thousands of companies that are applying the power of deep learning in fields ranging from life sciences and financial services to the Internet of Things.”

Huang has dedicated most of the time in Nvidia’s recent press conferences to Nvidia’s attempts to create supercomputers for cars, which could fuel innovations such as dashboard electronics, infotainment systems, and self-driving cars.

Nvidia is engaged with 3,500 companies in the deep learning market, said Colette Kress, chief financial officer, in a conference call with analysts today. It’s a good thing that the emerging markets are taking off, as Nvidia made a big move into mobile chips and then decided to exit that market.

“Nvidia is firing on all cylinders right now in both their traditional markets and even emerging segments like automotive and neural network workloads in datacenters,” said Patrick Moorhead, analyst at Moor Insights & Strategy. “It is making their exit in smartphone hardware somewhat of a ‘who cares.’ There’s a vicious fight for the self-driving car and it’s important for them to rack up big designs.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More