deltaDNA, a mobile games-focused analytics and marketing company, is today announcing it is getting into in-game advertising.

SmartAds is the name of its new offering, and the Edinburgh, Scotland-based company said the new platform can target players by how responsive they are to in-game ads.

Previously, deltaDNA’s specialty was targeted in-game messaging and push notifications, sometimes called “interventions.”

“These are messages that would be designed by a marketer to encourage players to return to a game, for example,” CEO and founder Mark Robinson told me via email. The messaging might also be used to encourage in-app purchases, which is one way publishers of free-to-play games make money.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The other way they make money, of course, is in-game ads. Just as deltaDNA’s messaging is designed to know when you’re about to leave a game so it can encourage you to stay with a message, SmartAds is intended to know what ad strategy works for each player.

VB produced Mobile games monetization: What successful game developers do differently

$499 on VB Insight, or free with your martech subscription

“What we do is connect the ads with the player,” Robinson said, through analytics that know how engaged the player is and how likely she is to respond to the ads. The new platform segments players by their in-game behavior, and targets them accordingly.

“We know novice players love ads,” he said, “but expert players hate them.” An expert player, then, might see fewer ads, while a “grinder who has no intention of making a purchase but likes to interact with ads,” including ones with rewards, will see more of them.

“Players who make [in-app purchases] within a game would generally be protected from seeing ads,” he said, but added that this represents only about 5 percent of players.

Those players who wait before making a presented in-app purchase will be shown some ads, but fewer ones than purchase-averse players.

Additionally, the SmartAds platform is supposed to know how many ads each player will tolerate, so the ad density — the frequency at which ads are shown — can be maximized for each player.

This kind of per-user targeting benefits the advertiser and the game publisher, Robinson said, because the ads will be shown to users more likely to interact, and these higher-value players mean higher ad payments.

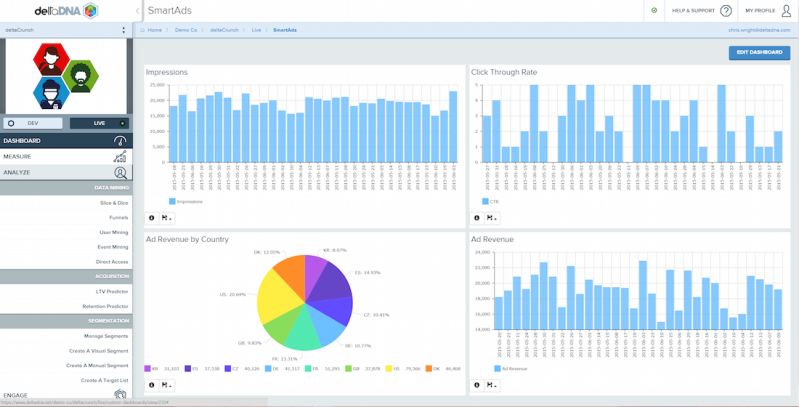

Different ad networks will pay differently for these pruned audiences, so SmartAds dynamically “selects which of more than 120 ad networks will pay the most for each player.” It also pulls all the analytics from different networks into one dashboard.

Players benefit because they get the kind of ad environment most suited to them, he said, resulting in better game experiences, higher store ratings, and more organic downloads.

deltaDNA “is the only company that does [in-app purchases] and ads through one platform” for free-to-play games, Robinson added. He said the dashboard includes all revenue-generating mobile data via one SDK, covering app downloads, in-game behavior, in-app marketing and purchases, in-app ads, and data from a large number of ad networks.

Competitors on the analytics side include Swrve and Upsight, he noted, “but they don’t provide ad serving.” The ad network side includes such companies as InMobi and AdMob, “and these are our partners.”

“The advantage to us in covering both [purchases and ads] is that by combining all that data, we know so much more about player [behavior] and consequently we can create better player experiences and improve monetization,” he said.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More