Playnomics, which is making a science out of figuring out which players are the most valuable to a game company, has raised $5 million in a second round of funding from Vanedge Capital.

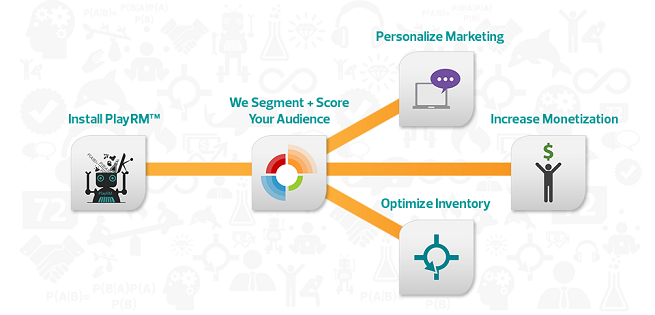

That’s a vote of confidence in the company’s PlayRM service, which predicts which monetization or retention schemes work best with online and social-game players. Last week, San Francisco-based Playnomics extended that service to mobile platforms.

Existing investors FirstMark Capital and XSeed Capital also participated in the round. That should help Playnomics on its mission of democratizing the use of scientific analytics for the larger game development community.

With Playnomics’ technology, mobile, social, and online game makers can target consumers with special offers at the moment when they are most likely to stop playing a game. The method resembles how enterprises manage their customers via customer relationship management software. In short, it’s tool that can help game makers design their apps and promotions so that companies can retain users and make more money.

Playnomics has profiled more than 100 million unique players across dozens of online games and brands.

“Playnomics has always been focused on determining why and how audiences play and enabling game developers and brands to measurably increase player retention, engagement, and monetization using our PlayRM platform,” said Chethan Ramachandran, chief executive of Playnomics. “With this new round of funding, we’ll be able to further expand the features and capabilities of the platform to meet the growing needs of our partners worldwide. Developers can expect several new product releases this year that leverage our predictive scoring and segmentation engine.”

In an interview with GamesBeat last week, Ian Atkinson, the vice president of business development at Playnomics, said that early results from beta partners on the mobile product show a 150 percent increase in player retention during the first week of using the platform.

With the service, customers can segment their audiences by different game behaviors and then target those players with custom in-game messages on an individual basis. Developers can also re-target people to bring back valuable players who have stopped playing. They can also cross-promote games to prequalified players. While other analytics packages help explain why someone left the platform, Playnomics wants to help companies predict which players are toying with quitting a game.

Playnomics was founded in 2009 and was the winner of VentureBeat’s Who’s Got Game contest at GamesBeat 2010. Playnomics is used in more than 100 games with more than 30 million monthly active players. Playnomics processes more than 5 billion in-game events a month. Other prior investors include Accelerator Ventures, Metamorphic Ventures, and TriplePoint Capital.

Vanedge Capital, which focuses on investments in interactive entertainment and digital media, was founded by former Electronic Arts veterans Paul Lee and Glenn Entis.

Tony Lam, principal at Vanedge Capital, will join the Playnomics board.

“As veterans in interactive entertainment and video game technology, we recognize that access to big data science, improved analytics, and advanced marketing software are absolute requirements for successful games,” said Lam.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More