Your money in a bank makes money for the bank. But Atlanta-based Cardlytics also helps them make money on your digital trail — and it has just scored a whopping $70 million to expand beyond banks as it readies for IPO.

The six-year-old company uses the transaction history of customers in participating banks — credit card payments, checks written, debit card withdrawals — to define customers’ buying patterns. The company said it is integrated into nearly 400 banks (Bank of America and PNC among them), representing 83 million of the 110 million households in the U.S.

“Banks have a pretty full picture of how [its customers] are spending money,” CEO and cofounder Lynne Laube told VentureBeat. The company calls this view a “whole-wallet perspective.”

Advertisers then offer credit card-based discounts to boost purchases at places you are likely to shop or eat. Aside from the money savings, consumers benefit by not having to manage loyalty cards or coupons, either virtual or physical.

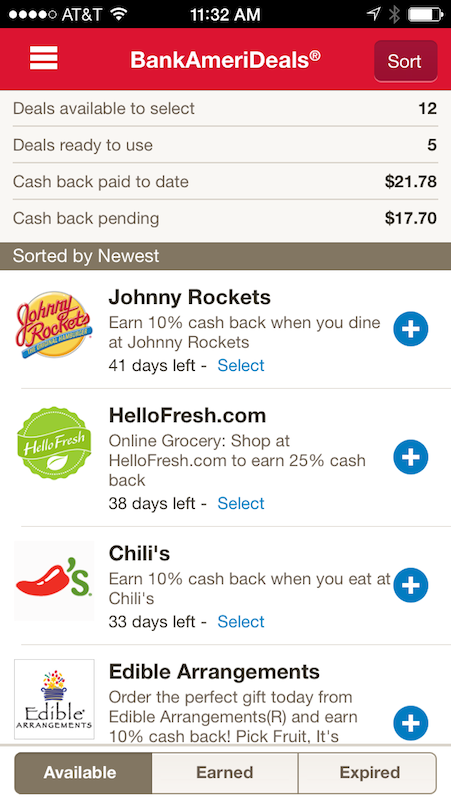

For example, a customer of a Cardlytics-connected bank logs onto the bank’s website. Based on the customer’s spending history, the Cardlytics software might present several possible discounts — such as one to McDonalds — on the welcome screen, a transaction page, or a special discounts area.

If accepted, the virtual discount is attached to the bank’s credit card, which when used at McDonalds, automatically discounts the purchase price by depositing the savings into the consumer’s bank account.

At this point, you might be wondering if all your bank-associated purchases are an open book for the McDonalds of the world.

Not so, Laube told us.

Card-linked Marketing

“Banks don’t give us transaction data,” she said.

Instead, there are two parts to the Cardlytics software: one resides in the bank, and the other with Cardlytics. The bank version processes transactions, but sends only analyzed results — not the specific data — to Cardlytics. The external Cardlytics software can send queries to the bank version: “How many people shopped on Amazon last month?” Or issue directives, such as: “Give a discount coupon to everyone who went to McDonalds in the last six months.”

And, Laube said, all customers are identified outside the bank only by an anonymous number.

“Every offer we show you is based on your history,” Laube told us. The company calls it Card-Linked Marketing, and although other companies conduct credit card-related marketing, Laube said her company “invented this space [and] is the only company to use this transaction data at scale.”

While a few companies, such as Edo, have “tried to play in this space,” she said, there currently is no one “in second place.”

“By far, our biggest competitor is [other kinds of advertising], like TV, direct mails, and coupons.”

The Series F round, led by Discovery Capital, brings the total raised by Cardlytics to slightly over $170 million.

The new funds will be used in three main ways, Laube told us. First, it will help boost awareness of current products that enable the insights from these transactions to be used outside bank channels: not the actual data, but the resulting analysis that can help determine a brand’s market share by zip code, for instance, or can help offer recommendations on where a brand should be advertising.

A second area: expanding awareness of a new Cardlytics product that can recommend what types of messaging — ads, YouTube videos — might attract segments of users to a given retailer. A slice of bank customers may never have visited a GoPro website, for instance, although their purchases show they like the outdoors. Targeted marketing could convince at least some of them to give GoPro a look.

The third area, Laube said, is to “make sure we have a strong balance sheet as we get ready for an IPO.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More