The drive to qualify incoming leads so that marketing teams are seen to be producing high-quality prospects, and in order that salespeople have the best chance of closing those opportunities, is pushing smaller companies to invest in the latest lead scoring technology.

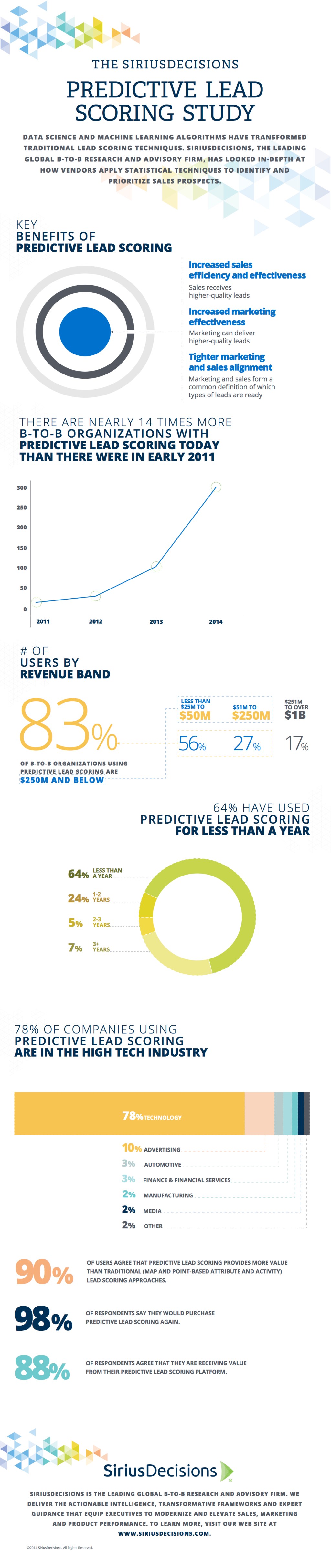

And according to a new report from research firm SiriusDecisions, 83 percent of predictive lead-scoring product users are companies with annual revenue of less than $250 million.

While smaller companies are using these sophisticated marketing technologies to gain a competitive advantage, the technology still has a long way to go; the report reveals that most companies are new to analysis-based lead scoring. Sixty-four percent have been using predictive lead scoring for less than a year.

Predictive scoring systems differ from traditional lead scoring because they don’t rely on totting up points for each end-customer based on distinct actions.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

With older, points-based attribution systems, if a visitor to your website decides to look at the pricing page, you might give them more points than someone who just visits the homepage. If someone downloads a white paper or adds a product to their cart, that person’s score may gain more points than someone who simply reads a blog post.

With older, points-based attribution systems, if a visitor to your website decides to look at the pricing page, you might give them more points than someone who just visits the homepage. If someone downloads a white paper or adds a product to their cart, that person’s score may gain more points than someone who simply reads a blog post.

Predictive scoring differs in that it looks at contact profile and behavioral information from your customer-relationship management and marketing-automation solutions. Then, by investigating internal data and third-party sources, including Internet sources, these technologies discover patterns in the data that rules-based scoring or gut instinct would simply miss.

The key findings of the report, which takes in data from customers of 6Sense, Fliptop, Infer, Lattice,

Leadspace, Mintigo and Salesfusion, also shows that high-tech companies are more likely to make use of predictive lead scoring.

I asked SiriusDecisions why this might be the case.

Looking for a marketing automation system?

Get the VB Marketing Automation Index.

“It’s not surprising that 78 percent of B2B [business-to-business] companies using predictive lead scoring platforms are in the high-tech industry,” Jill Stanek, a research analyst in the technology practice at SiriusDecisions told me in an email. “One of the primary target audiences for predictive lead scoring vendors are organizations that already have marketing automation in place.”

Marketing automation, of course, is still the ‘new kid on the block‘. Even with 70+ vendors in the category, it is largely the high-tech audience that has bought into the benefits of tools like Pardot, Eloqua, Marketo and Act-On. SiriusDecisions agrees.

“Our research indicates there is a 65 percent adoption rate of marketing automation platforms in high-tech B2B organizations. Compare that to an 8 percent adoption rate in the manufacturing industry and a 4 percent rate among financial services organizations,” Stanek wrote.

So is predictive lead scoring better and more accurate at qualifying leads and opportunities than point-based attribution, or is it that the customer using those systems haven’t configured them properly?

So is predictive lead scoring better and more accurate at qualifying leads and opportunities than point-based attribution, or is it that the customer using those systems haven’t configured them properly?

“We think that predictive lead scoring is likely to have more value than point-based attribution for a couple reasons,” Kerry Cunningham, a research director for demand creations strategies at SiriusDecisions, wrote in an email.

“First, the values — assigned to attributes or behaviors — are generated based on their statistical relationship with outcomes of interest, rather than an assumed but unverified relationship between the attribute or behavior and the outcome of interest,” Cunningham said.

The value of predictive lead scoring is not just in the internal analytics and findings, but also in the data and insight being brought in from third-party sources.

“All the predictive lead scoring vendors we have evaluated offer their clients a substantial number of data points outside of the client’s own data stores, some of which are likely to help distinguish strong prospects from weak prospects,” Cunningham said. “This is, of course, not the case all the time, but having access to these exogenous attributes can only help sellers identify high likelihood prospects.”

Check out the full infographic — produced exclusively by SiriusDecisions for VentureBeat — below to learn more about the current state of predictive lead scoring.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More