The flash-storage mob has returned.

Investors have dropped $225 million into Pure Storage, a company that sells fast-acting flash-storage boxes for data centers. And now Pure carries a pre-money valuation in excess of $3 billion, the company said in a release it issued tonight.

The new funding could help Pure postpone a debut on public markets, which would otherwise have been imminent. In December the Register speculated that Pure might have already achieved a $100 million revenue run rate.

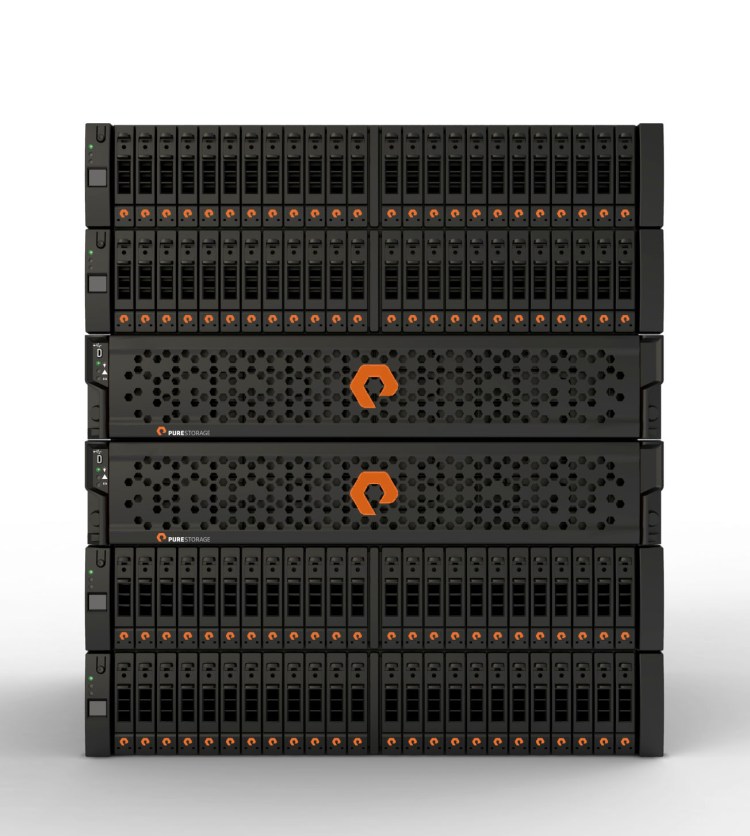

The company argues that its flash drives offer better performance than hard disk drives for storing and retrieving data for applications. It competes with vendors like Violin Memory, EMC, and NetApp, all of which makes all-flash arrays of their own, as well as companies with flash-disk combinations, like Nimble Storage.

Flash had quite a week in September, with acquisitions from Cisco and Western Digital that together broke the billion-dollar mark. Now, with such a big funding round for Pure, the flash excitement could return.

T. Rowe Price Associates, Inc., Tiger Global, Wellington Management Company, Greylock Partners, Index Ventures, Redpoint Ventures, and Sutter Hill Ventures all participated in Pure’s new round. The new money will help Pure continue to expand internationally.

Mountain View, Calif.-based Pure Storage was founded in 2009. As of last August, it employed around 230 people, and plans called for a doubling of that number. Customers include Riverview Hospital, the San Jose Sharks, and Yodle.

To date the company has raised $470 million, including a $150 million round last year, a $40 million round in 2012, and a $30 million round in 2011.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More