Hey, that wasn’t so bad. Dow Jones VentureSource has released its data on venture capital investments during the second quarter of 2009, and while the numbers might look bleak in most years, given the broader context, they look … okay.

Hey, that wasn’t so bad. Dow Jones VentureSource has released its data on venture capital investments during the second quarter of 2009, and while the numbers might look bleak in most years, given the broader context, they look … okay.

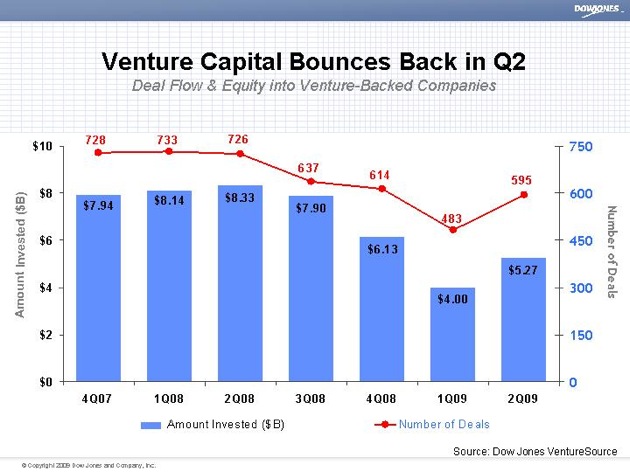

In Q2 (from April to June), venture capitalists invested a total of $5.27 billion in 595 deals. That’s pretty meager compared to the $8.33 billion invested in 726 deals during the same period last year but, as you may be aware, that was a very different time, economically speaking. It’s a big jump from the $4 billion invested last quarter, so we might even begin to start talking about a recovery. To look at it another way, last quarter’s investment numbers were the lowest since 1998, while this quarter is about on-par with 2005.

Of course, not all startups are created equal, from a VC’s perspective and otherwise. For example, software startups probably shouldn’t feel too relieved — investment in the sector dropped 52 percent from the same period last year, to $696 million. Information services startups, which VentureSource says includes most Web 2.0 startups, dropped 29 percent to $562 million; renewable energy, which includes most cleantech companies, fell 70 percent to $317 million.

Meanwhile, previously released data shows that the market for exits (initial public offerings and acquisitions) is improving. It hasn’t come back completely, though, and VentureSource says some of the corporate money that previously went to acquisitions is going into startup investments instead: There were 10 corporate rounds totaling $401 million last quarter (or $201 million, if you exclude the $200 million raised by Facebook).

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

After the Q1 numbers came out, Adeo Ressi of TheFunded wrote that the numbers weren’t as bad as they looked and predicted that investments would pick up towards the end of Q2. That seems to have been borne out. He also predicted that despite a small uptick, the VC industry as a whole was still due for a big contraction — and that, too, may be coming true.

Normally, VentureSource and the National Venture Capital Association/Thomson Reuters release their venture investing numbers at the same time. This quarter, however, we’ll have to wait until Monday to get the NVCA data and see how it matches up.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More