Intel executives did their best to paint a rosy picture of the company’s outlook in the second half of the year in an analyst conference call today about the company’s stellar second-quarter results.

Intel executives did their best to paint a rosy picture of the company’s outlook in the second half of the year in an analyst conference call today about the company’s stellar second-quarter results.

But they were peppered with interesting questions that reflect the concerns about what could go wrong with the company’s fledgling recovery from the economic crisis. Of course, Intel is the world’s biggest chip maker and a bellwether for the computer economy. So wherever goes Intel, so goes the tech economy.

Here’s a focus on the issues at hand:

1. How healthy is the recovery of the PC industry?

Intel chief executive Paul Otellini said that demand for computers strengthened during the second quarter and got progressively stronger in June. Sales normally drop from the first quarter to the second quarter. But this time, second quarter sales were up 11 percent from the first quarter. Consumer laptop sales led the way. Desktop sales and enterprise sales were weak, but Atom (for netbooks, which are smaller than laptops) and server chips sold well. Most territories saw increases except for Europe, which saw sales fall 9 percent in the second quarter. Europe typically sees a 15 percent drop in the second quarter.

2. Is there a risk of an inventory buildup?

Otellini said Intel saw inventories drop to healthy levels at major computer makers, among computer resellers, and in its own warehouses. Customers are now ordering enough inventory to refill their stocks. Typically, at this time of year, computer makers start ordering chips for back-to-school sales. Consumer laptops are likely to be strong sellers during back-to-school, but Otellini did not make a prediction about just how good sales would be.

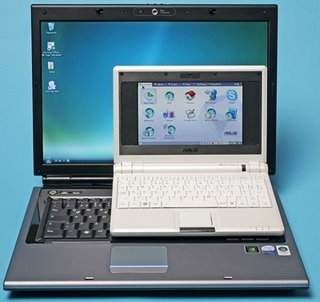

3. Are netbooks cannibalizing laptops and, if so, will that hurt Intel’s margins?

Intel is selling its Atom chips to makers of netbooks. Atom saw 65 percent sales growth in the quarter. But at $362 million revenues, Atom was still only 4 percent of Intel’s $8 billion in sales. Atom-based netbooks are hot sellers. If there is cannibalization, Otellini said it is at the low-end of Intel’s processor product list, such as the Celeron-branded chips that go into the cheapest desktops and laptops. The loss of margin, consequently, isn’t that big a deal yet.

On top of that, the Atom chips are expanding the market. The Atom chips are also doing well in non-PC markets, for embedded devices. In the embedded market, there are 1,200 Atom designs in the works. Those are replacing older Intel processors and are expected to steal market share from embedded chips such as PowerPC and MIPS. Otellini also said a new wave of laptops — dubbed ultrathin — will hit the market and shift demand to higher-end portables. Otellini said netbooks may be good for surfing the web, but aren’t so good when it comes to playing 3-D games and running Office software.

It will be interesting to see if Intel holds onto its traditional, near-monopoly level of market share in netbooks. It will face more competition in that category as it faces off against chip makers doing ARM-based low-power chip designs.

4. Will the October launch of Microsoft’s Windows 7 operating system lead to a big revival in PC sales?

Otellini was hesitant to say what consumers would do when this comes out. He said the typical pattern among businesses is that they will evaluate it now and then make volume purchases of it this year. Sales patterns are becoming more predictable, but enterprise is still weak.

Some analysts were no doubt hoping that Otellini would say glowing things about Microsoft’s new operating system, which is getting higher praise than Windows Vista (to say the least).

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More