“This is not the time for tech companies to be cutting back,” leading Silicon Valley investor Peter Thiel tells BusinessWeek in an article examining Facebook’s future growth plans. “This is the time to be hitting the accelerator.” Thiel’s statement, of course, is in direct contradiction to the Sequoia Capital “RIP: Good Times” presentation we obtained last month, which outlinined the need for startups to immediately make drastic budget cuts in order to survive a prolonged recession.

The article adds some interesting new details to what we’ve already been hearing from people close to the company, which is that Facebook is not going to die. Instead, it’s going to keep trying to take over the world.

Its moves to grow, not cut, have been the subject of scrutiny for the past several months. This year, it has already become the largest social network in the world, with more than 120 million monthly active users, according to its internal statistics. Rumors have abounded that Facebook is running out of cash, although we’ve consistently been told by sources close to the company that this is not the case.

So, here’s how the BusinessWeek article compares to what’s already been published.

Revenue

Revenue is indeed not going to meet the original goal of between $300 million and $350 million for the 2008 fiscal year, sources close to the company now say. Previous reports suggested that it would come in at $265 million — although the fiscal year doesn’t end until December 31st, so any number is premature. The company apparently revised its expectations downward to between $250 million and $300 million as of this spring, sources tell BusinessWeek.

Costs — and growth

It also appears that costs have not eaten deeply into Facebook’s coffers — it has raised a total of around $500 million in its lifetime. The company has enough cash to get it through the next three to four years, Thiel tells BusinessWeek. Some rumors have pegged Facebook to be losing money in spite of its revenue this year; Thiel says it is “slightly cash-flow negative.” It may actually be thriftier than others have guessed — a source in the data storage industry has previously told us the company has been building out its own servers and saving money that way, for example.

Or maybe Facebook has managed to close that round we and others heard it was raising from Middle East investors last month. Gideon Yu, the company’s chief financial officer — and the one spotted in Dubai recently, tells BusinessWeek that the company may even buy smaller rivals in other countries to help it continue gaining market share around the world. Facebook has apparently shifted engineers from ad-focused projects to features that will encourage worldwide growth — like pushing its user-driven translation program into the South African language Xhosa.

The company has grown its employee headcount from around 400 last year to what will likely be around twice that at the end of this year. “If we stopped growing, we could make money, but it makes no sense for us to stop growing,” Thiel says.

Despite the emphasis on growth over money, the article says that Facebook has expanded its ad team to 130 people, who work in conjunction with 400 people at strategic investor Microsoft who are charged with selling ads on the social network.

New initiatives

Facebook also began implementing its employee stock sale plan earlier this month, we’ve heard — a plan intended to put more money in employees’ pockets as it stays private for what is likely years to come. BusinessWeek says that to do this, it recently got an unusual exemption from the Securities and Exchange Commission:

Typically, private companies that exceed 500 shareholders must start disclosing their financial results publicly. (This is the law that helped push Google to go public in 2004.) Facebook is approaching that threshold, so the company asked the SEC for a waiver that will allow it to keep hiring and handing out restricted stock without public disclosure. The SEC granted the request on Oct. 14.

So, for the time being, Facebook will continue experimenting with new ways to grow and new ways to make money. The article hints that the company is still looking to offer services to help third-party developers on its platform make money — maybe the payment system the company announced long ago but has yet to introduce?

And then there’s the launch of Facebook Connect, a service that will let users access Facebook data on other sites. Local reviews site Citysearch has integrated Connect to help you see your friends’ reviews on its site more easily.

In sum Facebook’s billion-dollar revenue streams may not yet be clear, but its strategy is.

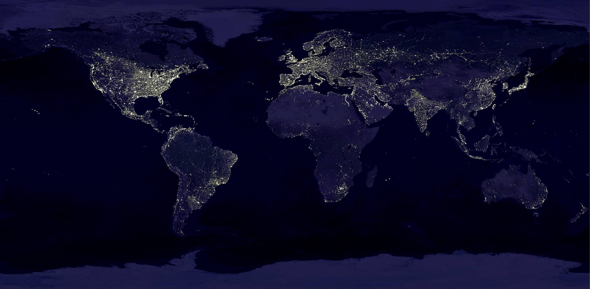

[Earth at night image via NASA.]

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More