The gaming industry in the United States is about to open up about some of its most guarded data.

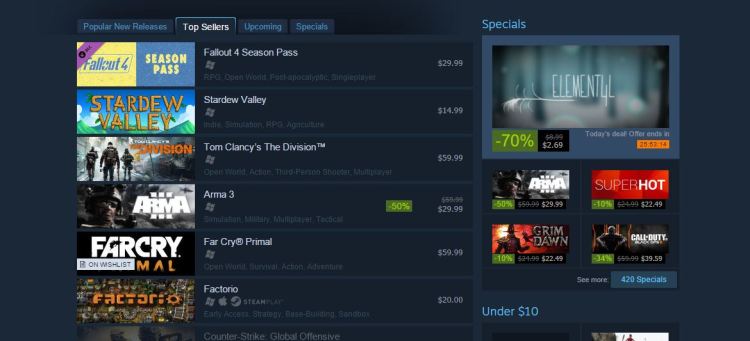

The sales-tracking intelligence firm The NPD Group is expanding its monthly gaming report to include point-of-sale information for digital games sold through PlayStation Network, Xbox Store, and Steam. Those are the three major distribution channels for digital console and PC sales in the United States — although it does leave a gap when it comes to Nintendo products sold through the eShop on Wii U, 3DS, and the upcoming NX console. NPD is also not including mobile. Gaming is a $99.6 billion business worldwide, and a growing portion of that total is all digital — by including that data, NPD is ensuring that the information it provides its corporate clients stays relevant well into the future.

To get these sales figures, NPD is partnering with publishers. The company is getting digital data from the following companies:

- Activision Blizzard

- Capcom

- Deep Silver

- Electronic Arts

- Square Enix

- Take-Two Interactive

- Ubisoft

- Warner Bros. Interactive Entertainment

Between Activision, EA, WB, Take-Two, and Square Enix, NPD has the largest third-party publishers covered. Again, however, it is missing data from Nintendo. Additionally, Blizzard isn’t sharing data from its Battle.net PC gaming service, nor is EA with its Origin portal. Steam is the only PC store, and NPD is explicitly saying that it isn’t trying to represent the entire PC-gaming market.

“This is significant because this is the first service like this in the U.S. where we have something with a methodology sourced directly from publishers at a granular level,” NPD analyst Liam Callahan told GamesBeat. “No extrapolation or interpretation. Pure data from the publishers.”

To start, NPD plans to inform its clients and the public about data that is missing rather than trying to fill in the blanks with extrapolation. Competitors like SuperData Research use algorithms to determine who well games sell digitally, and NPD is trying to distinguish itself from that competition.

“The biggest thing here is this will bring a level of transparency to the industry that has never been seen before,” said Callahan. “It’ll change the conversation about physical and digital, and it’ll change how these publicly traded companies speak about their business.”

These changes won’t just impact the data NPD reports to its clients. It is also shifting what it reports to the media. Now, instead of sending out a report on the second Thursday of every month, NPD will report a combined physical and digital sales chart on the third Thursday. It will only include full-game downloads and not add-on content — at least for the first few months — and it is shifting from units sold to dollar sales for the monthly best-sellers.

Callahan explained that NPD has tracked this data for a while, so it will still have 1-to-1 comparisons to show how the overall industry is performing. And as it brings on more partners, it will get historical sales to ensure it can maintain the integrity of those year-over-year comps.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More