Game startups continued to score big investments in 2009, but the amount of money raised in the year fell considerably compared to 2008. We’ll be discussing the funding levels at our GamesBeat@GDC conference on Wednesday in San Francisco at the Game Developers Conference.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":155194,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"B"}']Our revised analysis shows that 115 game startups raised $663.1 million in 2009, down 29 percent from a year ago. Last year we tallied 112 companies that raised more than $936.8 million, not counting fundings with undisclosed amounts.

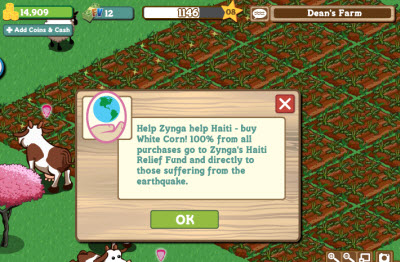

The 2009 year was looking pretty weak until Zynga scored $180 million in a deal with Russia’s Digital Sky Technologies. Zynga has more than 235 million monthly active users playing games such as FarmVille (pictured, right), and it makes money on its free games through the sale of virtual goods. Zynga’s funding actually beat out the biggest funding of last year: China’s 9You, which raised $100 million in the spring of 2008, long before the financial crisis hit in the fall of last year.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

Clearly, valuations were down because of the recession. Were it not for Zynga’s big raise, 2009 would have been an abysmal year, down 48 percent from a year ago. This year, the average amount raised was $5.7 million, while last year it was $8.3 million.

These fundings mean lots of innovation ahead and continued employment for game industry veterans. Not all of these companies will last. But the successful ones will create revenues, profits and jobs in the years ahead. We’ve ranked them here in order of the amount of money raised, and I’ve linked to our coverage of them. Fundings where the amounts weren’t made public are listed at the end. If you’ve heard of others, please note in the comments and we’ll add to the list. The list includes companies that raised funds in prior years but disclosed for the first time in 2009. It’s likely that some companies from last year’s list or this year’s have gone out of business. If so, let us know in the comments.

We’ll acknowledge our method is imperfect. As was the case last year, we have dozens of deals where we don’t know the exact amount raised (we have listed them alphabetically at the end). We know that OnLive raised a substantial round, but the exact amount wasn’t disclosed, and so it is not included in our figure for 2009. We expect that we’ll be revising the list upward as we add more deals that we didn’t know about in the coming weeks.

2. Playdom — $43 million for social games on Facebook, MySpace and other platforms. Investors: Rick Thompson, Lightspeed Venture Partners and Norwest Venture Partners.

3. Smith & Tinker — $29 million (includes seed round) for hybrid web-toy Nanovor game. Investors: Alsop Louie Partners, DCM, Foundry Group, Leo Capital Holdings and billionaire Paul Allen’s Vulcan Capital.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":155194,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"B"}']

5. Zula — $20 million for science-based kids virtual world, Zula World. Investors: anonymous investor.

6. Zynga — $15.2 million for social games on Facebook. Investors: Kleiner Perkins, Foundry Group, Avalon Ventures, Institutional Venture Partners and Union Square Ventures.

7. Offerpal Media — $15 million for special offers for online social games. Investors: D.E. Shaw, Interwest Partners and North Bridge Venture Partners.

[aditude-amp id="medium2" targeting='{"env":"staging","page_type":"article","post_id":155194,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"B"}']

8. Emergent Game Technologies — $12.5 million for game development tools. Investors: Hopewell Ventures, Worldview Technology Partners, Jerusalem Venture Partners, Walker Ventures and Adena Ventures.

9. gWallet — $12.5 million for virtual currency and offer provider. Investors: Adams Street Partners, Trinity Ventures, Stanford University and others.

10. SendMe — $12 million for direct-to-mobile entertainment and games. Investors: Triangle Peak Partners, Spark Capital, Amicus Capital, GrandBanks Capital, and True Ventures.

11. Caustic Graphics — $11 million (announced in 2009, raised earlier) for ray-tracing graphics chips: Investors: undisclosed.

[aditude-amp id="medium3" targeting='{"env":"staging","page_type":"article","post_id":155194,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"B"}']

12. IMVU — $10 million for 3-D virtual chat rooms and virtual goods business. Investors: Best Buy Capital, and existing investors Menlo Ventures, Allegis Capital, and Bridgescale Partners.

14. Nurien Software — $10 million for realistic fashion-oriented virtual world. Investors: Northern Light Venture Capital, Globespan Capital Partners, New Enterprise Associates, and QiMing Venture Partners.

15. Super Secret — $10 million for kids virtual world. Investors: Opus Capital.

[aditude-amp id="medium4" targeting='{"env":"staging","page_type":"article","post_id":155194,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"B"}']

16. Scene Systems — $8.3 million to use video game tools to reconstruct accident scenes. Investors: Philip Swinstead, Cem Cesmig (Newtonmore Advisors), Sophia Antipolis, and Caprilles Investment Fund.

17. Asetek — $8 million for liquid cooling for game PCs. Investors: Northzone Ventures, Sunstone Capital, and KT Venture Group.

18. Bigfoot Networks — $8 million for faster networking cards for gamer PCs. Investors: North Bridge Venture Partners, Palomar Ventures and Raven Venture Partners.

19. Outspark — $8 million for free-to-play massively multiplayer online games. Investors: Syncom Venture Partners, SBI Investment, Mille Plateaux, DCM, Tencent and Altos Ventures.

[aditude-amp id="medium5" targeting='{"env":"staging","page_type":"article","post_id":155194,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"B"}']

21. Greystripe — $7.5 million for mobile ad network for games and other apps. Investors: Peacock Equity, Incubic Venture Fund, Monitor Ventures and Steamboat Ventures.

22. Major League Gaming — $7.5 million for professional gamers league. Investor: Oak Investment Partners.

23. Vindicia — $7.5 million for online billing. Investors: ONSET Ventures, with participation from previous backers Bertelsmann Digital Media Investments, DCM, and Leader Ventures.

24. Wooga — $7.5 million for social games. Investors: Balderton Capital, Holtzbrink Ventures

25. Dreambox Learning — $7.1 million for educational games site. Investors: variety of tech industry angels.

26. Aviary — $7 million for virtual goods. Investors: Spark Capital, Jeff Bezos.

27. PaymentOne — $7 million for alternative payments. Investors: AER Investments

28. Six Degrees — $7 million for sports-related web games at Action All Stars site. Investors: Time Warner Investments. Clearstone Venture Partners and Prism VentureWorks.

29. WonderHill — $7 million for online casual games such as Green Spot and Dog World. Investors: Charles River Ventures and Shasta Ventures.

30. Fuhu — $6.25 million for virtual avatar business. Investors: Acer Group, VIA Technologies, UMC Capital, Industrial Bank of Taiwan, Alorica, and several angel investors.

31. Ohai — $6 million for massively multiplayer games on Facebook. Investors: August Capital and Rustic Canyon Ventures.

32. Posit Science — $5.6 million for brain-training games. Investors: Aberdare Ventures, Cooley Godward Kronish, Draper Fisher Jurvetson and VSP Capital.

33. Conduit Labs — $5.5 million for Loudcrowd social music game site. Investors: Charles River Ventures and Prism VentureWorks.

34. Unity Technologies — $5.5 million for browser-based 3-D game engine. Investor: Sequoia Capital.

35. Watercooler — $5.5 million for sports-based social networking games. Investors: Betfair and Canaan Partners.

37. Jambool — $5 million for virtual currency Social Gold for social games. Investors: Madrona Venture Group and Bay Partners.

38. OMGPop — $5 million for casual web games. Investors: Spark Capital and Baseline Ventures.

39. Vector Entertainment — $5 million (announced this year, raised earlier) for Vector City Racers online game. Investor: Meakem Becker Venture Capital.

40. Viximo –$5 million for sale of virtual goods provided by thousands of artists. Investors: North Bridge Venture Partners and Sigma Partners.

41. WebWars — $5 million (or less) for web-based Weblings cross-web treasure hunt game. Investor: Mike Heisley.

42. Turtle Entertainment — $4.7 million for social games. Investors: N/A.

43. GameGround — $4.1 million for gamer social network. Investor: Sequoia Capital.

44. Blade Games — $4 million for game development tools. Investor: California Technology Ventures.

45. Atakama Labs — $4 million for Chilean company doing games for social good. Investor: Austral Capital and COPEC-UC.

46. NeoEdge — $4 million for in-game ads for casual downloadable games. Investors: Vanedge Capital (Paul Lee) and Jefferson Partners.

47. Open Sports Network — $4 million for fantasy sports games for FoxSports.com and other sites. Investors: Fox and others.

48. Tonchidot — $4 million for augmented reality games. Investors: DCM and Itochu Technology Ventures

49. Virtual Fairground — $4 million for online soccer game based on Galactik Football. Investor: anonymous.

50. Astro Gaming — $3.5 million for gamer audio gear. Investors: Triangle Peak Partners, Fayez Sarofim & Co., Nixon Watches co-founder Chad DiNenna, NBA star Gilbert Arenas, and Astro Studios.

51. 5 Minutes — $3.5 million for social games in Chinese market. Investor: Draper Fisher Jurvetson.

52. One Season — $3.5 million for fantasy sports games. Investor: Charles River Ventures.

53. Omek Interactive — $3.3 million for gesture-controlled video games enabled by 3-D capture cameras. Investors: Everett Partners and and Equity Group Investments.

54. Z2Live — $3 million for multiplayer iPhone games. Investors: Madrona Venture Group.

55. Scoreloop — $2.8 million for mobile social gaming platform. Investors: Earlybird Venture Capital and Target Partners.

56. eRepublik — $2.7 million for online strategy game. Investors: AGF Private Equity.

57. mEGO — $2.5 million for avatar chat business. Investors: undisclosed angels.

58. Tribal Nova — $2.5 million for kids online games. Investors: iNovia Capital and ID Capital.

60. Roblox — $2.3 million for casual games and virtual world. Investors: Altos Ventures.

61. OneTxt — $2 million for payment systems for social media. Investors: Metamorphic Ventures with KPG Ventures, New York Angels Fund, and individual angel investors.

62. RotoHog – $2 million for fantasy sports games. Investors: DFJ Dragon and Mission Ventures.

63. Aurora Feint — multiple millions for social gaming platform for iPhone games. Investor: DeNA

64. Robonica — multiple millions for robot/game hybrid business. Investor: South African government’s investment fund.

65. Rekoo — $1.5 million for social games in Asia. Investor: Infinity Venture Partners.

66. Foursquare — $1.35 million for location-based gaming. Investor: Union Square Ventures

67. MMO Life — $1.3 million for online game news portals. Investors: Klaas Kersting and Alexander Roesner.

68. Limelife — $1 million for women’s lifestyle entertainment. Investors: Monitor Ventures, U.S. Venture Partners, Core Capital Partners and Rustic Canyon Partners.

69. MangaHigh — $1 million or so for math-based web games site. Investor: Toby Rowland.

70. Spawn Labs — $1 million amount for playing console games on laptops. Investor: undisclosed.

71. ThreeMelons — $600,000 for casual web games. Investor: Santander Bank.

72. Heyzap — $500,000 to $1 million for Flash-based widgets and virtual goods platform. Investors: Union Square Ventures and YCombinator.

73. Massiverse — $500,000 for cross-media game properties such as Dragons vs. Robots. Investors: undisclosed angels.

74. TransGaming — $500,000 for on-demand games. Investor: Intel.

75. Junebud — $312,000 for game development. Investors: N/A.

76. MyMiniPeeps — $300,000 for kid-friendly massively multiplayer online game. Investor: Tech Coast Angels.

77. Cyber AI Entertainment — $223,000 for next-generation Internet services. Investors: Takashi Usuki and Ken Kutaragi.

79. Gametube — $136,000 for video streaming for gamers. Investors: N/A.

80. Voxli — $15,000 for voice chat tool for online gamers. Investor: YCombinator.

81. Gambolio — $2,000 for flash gaming portal. Investor: Alex Kearns.

82. 4mm Games — undisclosed amount for company formed by ex-Rockstar Games creators. Investors: CEA Autumn Games.

83. Blabbelon — undisclosed amount for online game audio chat service. Investor: Ed Ikeguchi.

84. Earlier Media — undisclosed amount for GameClassroom educational games web site. Investors: Milan Ventures.

85. Gambit — undisclosed amount for special offers for monetizing online social games. Investor: Naval Ravikant.

86. GamersFlux — undisclosed amount for WoWPals social network for World of Warcraft players. Investors: self-funded.

87. Gazillion Entertainment — came out of stealth in 2009 but raised undisclosed amount earlier for massively multiplayer online games. Investors: undisclosed.

88. Good Game Productions — undisclosed amount for Facebook and iPhone game company. Investor: Grantley Day.

89. GraffitiGeo — undisclosed amount for location-based iPhone app akin to Mob Wars. Investor: YCombinator.

91. Hoplon Infotainment — undisclosed amount to create online games such as Taikodom. Investors: Idee Tecnologia and others.

92. iLemon — undisclosed amount for virtual world business. Investors: GSR Ventures and others.

93. iMo — undisclosed amount to create iPhone joystick for PC games. Investors: not disclosed.

94. Ironstar Helsinki — undisclosed amount for Facebook games such as Moipal. Investor: Michael Wildenius.

95. Jerry Bruckheimer Games — undisclosed amount to make high-end games. Investor: Hollywood producer Jerry Bruckheimer.

96. Linden Lab — undisclosed amount from private equity firm for owner of Second Life virtual world. Investors: Stratim Capital.

97. Loose Cannon Studios — undisclosed amount for unannounced console games. Investors: self-funded.

98. Meez — undisclosed amount for virtual chat business. Investors: Anthem Ventures.

99. Next Island — undisclosed amount for adventure and time-travel-based virtual world. Investor: David Post.

100. OnLive — undisclosed amount for server-based game network. Investors: AT&T Media Holdings, Lauder Partners, Warner Bros., AutoDesk, and Maverick Capital.

101. Open Entertainment Network — undisclosed sum for parent-friendly prepaid game cards. Investors: LTI Global and Payletter in South Korea.

102. Optrima — undisclosed amount for 3-D gesture-control cameras. Investor: Softkinetic.

103. Origin PC — undisclosed amount for gamer PC maker. Investors: Kevin Wasielewski, Hector Penton and Richard Cary.

104. Pixelmatic Entertainment — undisclosed amount for GamerBook app for gamer social network on Facebook. Investors: undisclosed.

105. Platogo — undisclosed amount for casual game site with user-generated content. Investors: Seedcamp and city of Vienna’s Departure program.

106. Portable Zoo — undisclosed amount for iPhone games. Investor: Don Traeger.

107. Pugpharm — undisclosed amount for social networking game Snoget. Investors: National Research Council of Canada Industrial Research Assistance Program and Telefilm’s Canada New Media Fund.

109. Resistor Productions — undisclosed amount for Disciple fantasy role-playing game on Facebook and other social titles. Investors: Sanjay Reddy.

110. Runic Games — undisclosed amount for Torchlight web game. Publishing advance from Perfect World Entertainment.

111. Sibblingz — undisclosed amount for social game development platform. Investor: YouWeb.

112. Stupid Fun Club — undisclosed amount for hybrid game and toy business, founded by Sims creator Will Wright. Investor: Electronic Arts.

113. Tarver Games — undisclosed amount for iPhone games such as Ghosts Attack. Investor: self-funded.

114. Twinity — undisclosed amount for virtual cities. Investors: N/A.

115. Xsens Technologies — undisclosed amount for motion-capture body suits for game production. Investors: undisclosed.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More