The stock market is like a deep forest, filled with cleared pathways, hidden snares, and an ever-present sense of the unexpected.

The stock market is like a deep forest, filled with cleared pathways, hidden snares, and an ever-present sense of the unexpected.

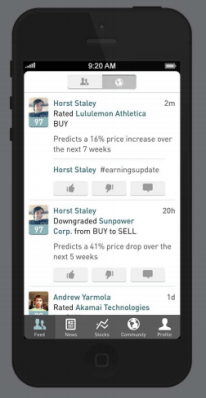

Robinhood launched an iOS app today to guide you through the dangerous woods of stock market investing. The startup wants to be “your stock market companion.” Robinhood’s app is a social network for stock market investing, creating a place where people can exchange information and ideas, and make predictions.

“Robinhood is a modern interpretation of the investment advisor,” founder Vlad Tenev said in Q&A. “Financial advisors, brokers, and investment research firms derive much of their edge from being gatekeepers of this information. With Robinhood, we aim to make a transparent and free social platform for investing ideas by harnessing the wisdom of the crowd to provide simple, informative, and trustworthy insights into the stock market.”

The community on Robinhood is supposed to act like the band of “Merry Men” from the story. Users share their predictions for the future, past experiences, or insights that could lead to successful bets. The individuals who perform best rise to the top, gaining more exposure and recognition, while those who are less knowledgeable still benefit from the diversity of opinion and success of others.

The community on Robinhood is supposed to act like the band of “Merry Men” from the story. Users share their predictions for the future, past experiences, or insights that could lead to successful bets. The individuals who perform best rise to the top, gaining more exposure and recognition, while those who are less knowledgeable still benefit from the diversity of opinion and success of others.

Founders Tenev and Baiju Bhatt met as undergrads at Stanford while studying math and physics. This is their third company together in the financial space, although it’s their first time building a consumer-facing product.

“We identified several inefficiencies in the investment advisory and brokerage spaces that we felt could be addressed through technology and great design,” Tenev said. “We believe the dominant financial services companies of the future will be social and will follow a Spotify-like business model, where high quality core services are free and people pay for premium features on top.”

Of course, this is not a risk-free approach and bad advice inevitably gets mixed in with the good. But then again, the stock market itself is a risky place, and the founders have built in social controls that hopefully limit the amount of fraud or deceit. Each user has a profile that contains their percentile ranking within the community, rating accuracy, overall points, and average points per stock. If you make terrible suggestions, Robinhood will show it.

Robinhood will also suggest relevant stocks based on your location and community activity and will create a watchlist of your investments. The platform personalizes a news feed based on your portfolio, and you can check how the stock market is doing from within the app. Tenev said that Robinhood is distinguishable from competitors by being mobile-first, expressly designed for users on-the-go. Furthermore, he said, Yahoo Finance and Google Finance lack a social layer, and Stocktwits suffers from a lack of structure that “invariably leads to a low signal/noise ration.”

Robinhood will also suggest relevant stocks based on your location and community activity and will create a watchlist of your investments. The platform personalizes a news feed based on your portfolio, and you can check how the stock market is doing from within the app. Tenev said that Robinhood is distinguishable from competitors by being mobile-first, expressly designed for users on-the-go. Furthermore, he said, Yahoo Finance and Google Finance lack a social layer, and Stocktwits suffers from a lack of structure that “invariably leads to a low signal/noise ration.”

“Robinhood data is much more structured,” he said. “Every message contains a prediction about the future performance of a stock; this makes it much more accessible to newcomers and results in a data stream that is 100% signal. It also allows us to assign a track record and performance metrics to users.”

Whether this model will lead users to fame and fortune is still unknown. Tenev acknowledged that with social networks, as with the stock market, the future is uncertain.

Robinhood is based in Palo Alto and backed by Google Ventures.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More