Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

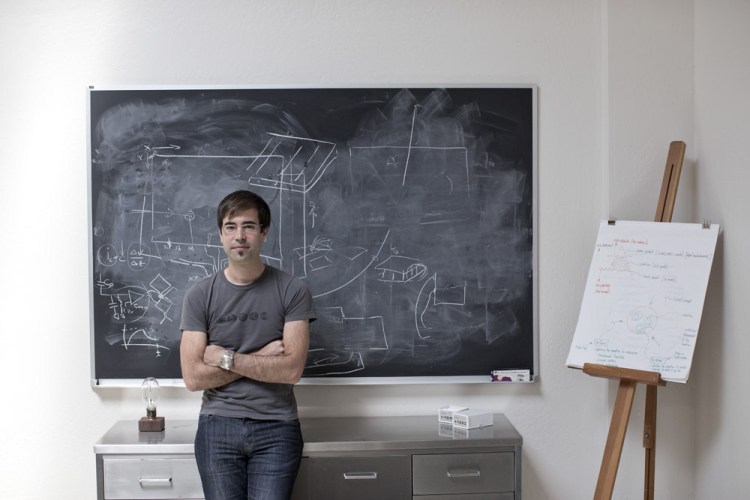

Jeffrey Schox is a patent attorney to Silicon Valley’s startup stars — and sometimes, he’s their investor too.

Schox, an attorney and the owner of Schox PLC, a boutique patent law firm nested in San Francisco’s startup-heavy SoMA neighborhood, has been in business since 2003. For the last several years, he’s used his firm to generate deal flow — identifying startups he might invest in.

Later this year, he’ll take his investing a step further with the launch of a seed fund and the expansion of his team of patent agents’ role in the investments he makes into clients.

Selective practice

With the reputation he’s built, and constrained by the small size of his team, Schox works with a select number of clients, and invests in about 10 of the 30 to 40 new clients he takes on every year.

“We have the luxury of picking clients,” Schox said during an interview at his office with VentureBeat, adding that his team turns away about 80 percent of the companies that reach out.

His clients include Project Ara, Dropbox, Mailbox, Twilio, Duo Security, Karma, Estimote, Tactus Technology, Runscope, Eero, Cruise, Farmlogs, Ginger.io, and many more.

To evaluate potential clients, he and his team ask themselves two questions: Would they invest in this company? And how much enjoyment would they get from working with it? (“Would we get a beer with these guys?” as one employee put it to me.)

They also have to consider potential conflicts of interests and stay away from working with competitors of current clients. So while Schox is working with two drone companies, for example, he says they’re approaching the space in completely different ways, which removes that conflict.

Schox’s early post-law school days looked different, however. Back in Ann Arbor, Michigan, where Schox went to school and later worked for a large law firm, there was no incentive to turn away work. Under the old — and still prevalent — model, attorneys only care about how many clients they book and the hours they bill.

“I wanted a model that gave me the freedom to do additional research on my client,” Schox said. “I wanted to do high quality work for folks that needed it. That meant startups.”

At his firm, he charges flat rates, a practice slowly gaining popularity, though he says that many of the big firms still view Schox as a disturber of the lucrative model they’ve imposed for so long.

While the pricing may be simple, Schox’s firm doesn’t shy away from clients with complex needs. His clients’ products include microelectronics, hardware, and software, which is not so surprising given that he has degrees in mechanical, electrical, and software engineering. And that’s been an asset, especially as companies’ products are increasingly following the same pattern. “Smart hardware” is all three of the above, Schox pointed out.

But he hasn’t always been as good at picking winners. For the first few years, Schox was more conservative and lacked the keener investor eye he has today.

Then, he joined a couple of investing groups, and observantly listened to other investors’ questions, comments, and probing during company pitches. He absorbed other investors’ insights and sharpened his own evaluation skills.

“When I started picking better clients, then we grew when they grew,” Schox said. Prior to his investor mentality, Schox PLC grew at about 20 percent year over year; since then, it’s been a 30 to 40 percent rate.

I first heard about Schox back in September, when a matchmaking service I considered reviewing set me up on a blind date with one of his employees. Schox recruits from Stanford University, where he teaches a patent law class for law and engineering students. My date told me about his job, his employer, and their clients. It turned out, I had unknowingly written about many of Schox’s clients already, which in hindsight, is not surprising given Schox’s focus on picking winners.

“We often take this role of an in-house patent counsel because we have invested so much of time and energy upfront,” he said. “We have this trusted advisor seat at the table.”

A new seed fund

His investment-picking skills will be tested even more as he launches a small seed fund later this year, separate from his personal investments. He’s already dabbled in having limited partners through a couple of AngelList syndicates he’s set up. Schox is also working to expand his senior team members’ role in the investments he makes into clients by setting up an LLC.

Schox has been cutting small checks for some of his clients for years now, from his personal money. But later this year, he’ll officially launch a small seed fund he’s been quietly working on.

The fund, which he’s raising with the help of an investment partner, will be about $15-20 million in size, Schox said. And it will have a thematic focus: transportation and mobility.

“I grew up outside of Detroit, huge love of cars,” he said.

Currently, transportation-related companies make up about 10-20 percent of Schox’s clients, including Cruise, Zendrive, Boosted, and Tactus.

Tactus is not a very obvious transportation company — its first product is an iPad mini case that “grows” a physical keyboard when you need one — but that’s exactly the kind of technology that actually makes a lot of sense in a car, Schox explained. Car makers have been putting touchscreens in them in the last few years, but really, you want something you can figure out through touch while you’re driving to keep your eyes on the road.

Unfortunately — or fortunately, for Schox — venture capitalists have shied away from companies seeking to get their technology into cars, which takes about eight years, he said, a timeline that’s too slow for most VCs.

It’s only recently that a few “halo companies,” as Schox described them, have shown investors that’s there’s money to be made in the space. The driverless car craze has also attracted a lot of attention recently, including Schox’s.

“I have a client in that space [Cruise], it will happen and the roads will be safer,” he said.

Cruise was part of Y Combinator’s Summer 2014 class, and is building a system that’s somewhere between cruise control and a self-driving car, and can be mounted on an existing car. It’s planning to release its first product later this year with a $10,000 pricetag.

But despite his soft spot for transportation, Schox’s practice will remain diverse in its clients. Along with the usual suspects — hardware, connected devices, software, health tech, and artificial intelligence companies — Schox said that he has all the resources to work with more biotech companies, which he hasn’t focused very much on.

And I wouldn’t be suprised if he does.