Seismic, a sales enablement platform, is announcing a $40 million Series C round led by growth equity firm General Atlantic. This type of platform gives marketing teams the ability to deliver content to sales reps at the “right time and right place” to positively impact the sale. Marketing then tracks the sales rep’s interactions to help the platform learn and improve, and to prove ROI. It’s a compelling problem that literally hundreds of companies are tackling.

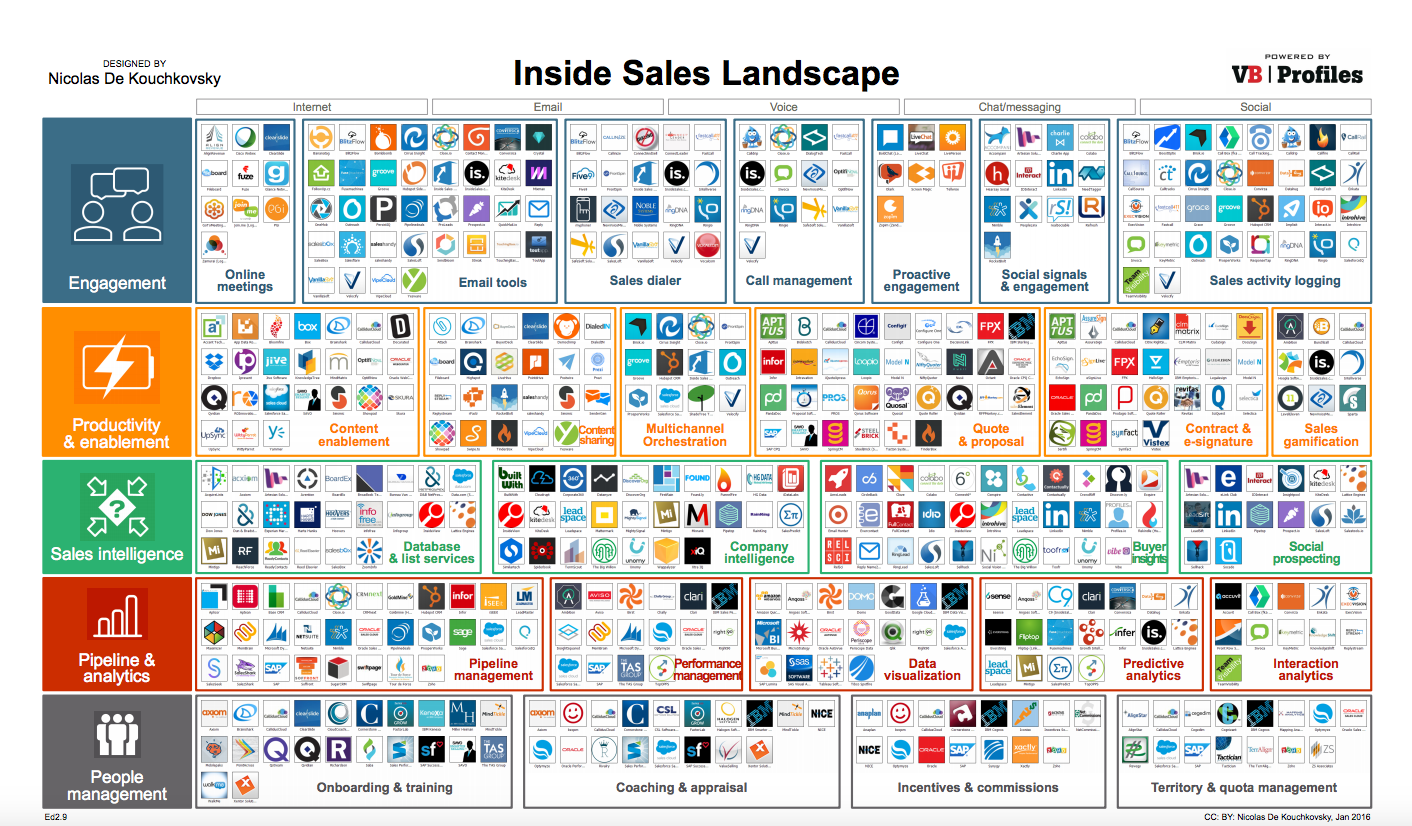

While we’ve observed thousands of companies pop up over the past few years to support the marketing function, inside sales has also proved a compelling space for investors. Venture capitalists have pumped around $10 billion into B2B sales enablement tools in the past three years. That includes $1.4 billion in the productivity and enablement sector, specifically in content enablement systems like Seismic, $652 million in data visualization, and another $618 million in the contracts management sector.

Why is inside sales such a hot space? Essentially, sales has become a more challenging job in recent years, so new tools are popping up to solve these new problems — namely, figuring out how to help extremely informed buyers.

A high-resolution version of the VB Profiles Inside Sales landscape is available here.

(Disclosure: VB Profiles is a cooperative effort between VentureBeat and Spoke Intelligence.)

“Sales has gotten harder because the buyer today is so much more informed before they show up at the table then they’ve ever been. They’ve done the research, looked at the website, know the competitors — and probably the price. They know more about you than a junior salesperson that was just hired knows about you,” Seismic CEO and founder Doug Winter told me in an interview.

These extra-educated buyers have given rise to broadly adopted, high-touch, one-on-one strategies like consultative selling. When upwards of eight or nine people are involved in a platform decision process, the problem of delivering the right information at the right time is compounded by figuring out who you should be selling to in the first place, as well as identifying what new information you could present the potential buyer.

To further compound the issue, many organizations fall prey to the idea that marketing and sales are from two different planets. It’s commonly said that sales is stuck wondering why marketing is sending them junk leads while marketing is wondering why sales can’t close their leads.

A sort of mediator group called “sales enablement” has emerged, as a result, and this is Seismic and competitor platforms’ primary sales target. This group plays an increasingly important coordination role in the enterprise — like “business operations,” a corporate function emerging to help optimize for business metrics like revenue while utilizing marketing and sales teams. If this sounds like a Silicon Valley thing…it is. Both sales enablement and business operations are increasingly popular in high-growth SaaS companies. Seismic is unique in that it has blue chip customers well outside the Silicon Valley echo chamber, including top companies in areas like insurance or financial services.

“If you ask the marketers, they’ll tell you they’ve got great content, they understand perfectly what the buyers are looking for — and sales can’t figure it out. And the sales team will say, ‘Hey we work really hard and try and have a conversation with them and don’t have the right content’,” Winter said.

One thing is clear with respect to this flurry of new platforms — particularly those that automate basic functions in the sales process: “We are definitely entering a world of fewer, more effective sales people,” Winter said. And that’s a powerful paradigm shift for any business.

Seismic’s capital raise is significant, given the challenges faced by startups that are trying to grow in 2016. Investors have doled out around $200 million this year for inside sales, but that’s far off the pace of the last few years. “The broader stock market people would call it a ‘return to quality.’ Basically, VCs and investors are more grounded in the fundamentals of the business — in terms of how it’s scaling and how it’s being run — than they were a couple of years ago. You can call that a bubble being deflated,” Winter said.

“But when you see a slide with as many logos as you’ve got [in the inside sales landscape], it screams out immature, ill-defined, still-evolving space. We look at that slide and see a lot of features — great features that are exceptionally well done. But what customers want is to tie these things together, and don’t want to do a lot of work to do it. Some will probably die and go away, others will be acquired.”