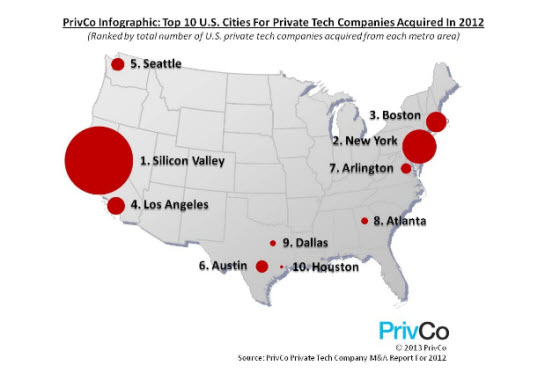

Silicon Valley headed the list of the top 10 U.S. cities in terms of tech acquisitions in 2012.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":628282,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,","session":"A"}']PrivCo, a New York company that tracks private investments, said that Silicon Valley (combining San Francisco and the region around it) led the country in terms of the value of acquisitions of companies. It was followed by New York City (100 deals), Boston (62), Los Angeles (55), and Seattle (43). Rounding out the list were Austin (40); Washington, D.C. (39); Atlanta (36); Dallas (33); and Houston (30).

The top 10 was ranked by the total number of U.S. private tech companies acquired last year in the region. But the biggest acquisition of a private tech company acquisition was in New York, as Zayo acquired AboveNet (in nearby White Plains, N.Y.) for $2.2 billion.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

Traditional regional centers for acquisitions that fell off the list: San Diego and Research Triangle, N.C.

Silicon Valley saw 226 private tech companies acquired in 2012, PrivCo said. That was more than double the number in New York City. Silicon Valley had nearly as many acquisitions as the top five metro areas combined.

Silicon Valley’s biggest deal was Oracle’s acquisition of Taleo for $1.9 billion. In Boston, the biggest deal was for Berkshire Partners’ acquisition of Lightower Fiber Networks for $2 billion. In Los Angeles, it was Thermo Fisher Scientific’s acquisition of One Lamda for $890 million. In Seattle, the biggest deal was EQT’s purchase of UC4 for $271 million.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More