SAN FRANCISCO — “Venture capital” didn’t exist in 1972, until Don Valentine and Tom Perkins forged a new model for financing upstart companies.

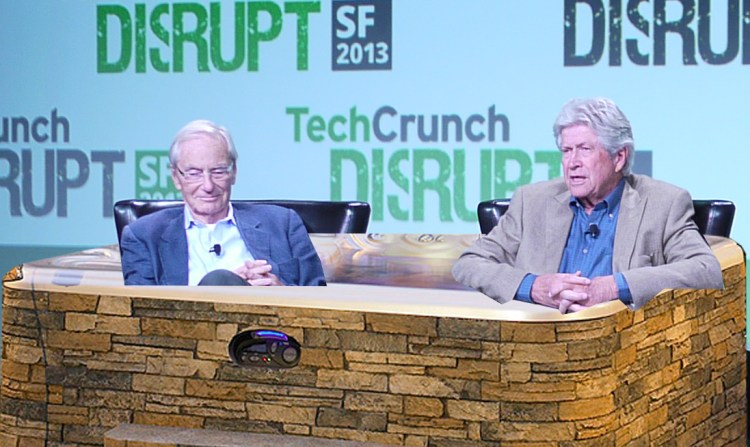

These “grandfathers” of the venture capital industry spoke today at TechCrunch Disrupt about the origins of the venture capital industry and what it takes to be a good VC.

“The key to making great investments is to assume that the past is wrong and do something that is not part of the past, do something entirely differently,” Valentine said onstage. “People who say they have never done anything outrageous, I don’t want them drinking my wine and wasting my time.”

Valentine founded Sequoia Capital in 1972 and was one of the original investors in Apple, Atari, Oracle, Cisco, EA, Google, and YouTube. Before getting involved with investing, he founded National Semiconductor and served as a sales executive for Fairchild Semiconductor. He saw how hard it was for some of these silicon companies to raise money, and so he formed what was, at the time, “the largest fund in the world” of $8 million.

“Silicon Valley hadn’t been created yet; venture capital hadn’t been invented yet,” he said. “Atari board meetings were conducted in hot tubs with bad red wine. It was a world with a lot of humor involved and opportunities to doing things differently.”

Valentine repeatedly emphasized that the ability and willingness to be different is an important trait for entrepreneurs.

“The last person you want to hire is the HR person,” he said. “They are the destroyers of companies. They write the binders and tell you what the rules are and how much everybody gets paid.”

Both Valentine and Perkins agreed that good venture capitalists must have been entrepreneurs before, and learned what its like to build a startup from the trenches. Perkins founded Kleiner Perkins Caufield & Byers. He started his career working at Hewlett Packard and founded the venture firm in 1973.

“Entrepreneurs need to have judgement, which comes from experience,” Perkins said. “They have to have got through tough things and solved problems. They need daring and tremendous ambition. It is tough for a company if CEO isn’t as ambitious as VC backers.”

Sequoia’s first investment was Atari, where Steve Jobs was a junior employee at the time. Perkins said one of his first and worst investments was a company that converted motorcycles to snow mobiles.

“It was called Snow Job — I am not making this up,” he said.

Snow Job aside, Perkins said the investment he is most proud of is Genentech, a company that develops drugs to address significant medical needs.

“There has always been a debate of what is the better investment — the idea or the person,” he said. “That debate goes on forever. I vote for idea because bad people don’t have good ideas.”