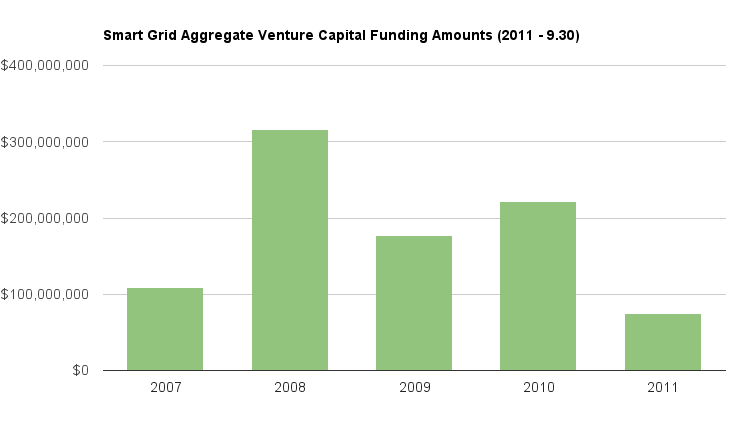

Venture capital industry interest and investment in smart grid startups has been up and down over the past five years, ranging from a peak of nearly $316 million in 2009 to around $100 million or less in 2011 (as of the end of September). There’s reason to be optimistic about the future growth of the sector, however. Powerful fundamental factors — the shift to cleaner, renewable energy sources and market deregulation among them — continue to support growth, as do smart grid proponents and technology providers.

Venture capital industry interest and investment in smart grid startups has been up and down over the past five years, ranging from a peak of nearly $316 million in 2009 to around $100 million or less in 2011 (as of the end of September). There’s reason to be optimistic about the future growth of the sector, however. Powerful fundamental factors — the shift to cleaner, renewable energy sources and market deregulation among them — continue to support growth, as do smart grid proponents and technology providers.

The initial focus was on developing smart grid infrastructure. Now, the market and industry financing focus has shifted to developing business models that promote changes in customer behavior on the energy demand management side, as well as improving customer relationships.

Recent History

2007: Redwood, California’s Silver Spring Networks could serve as the “poster child” for the up-and-down fortunes of smart grid startups over the last five years. Having raised $40 million in a Series C round in 2007, and nearly $200 million in follow-up rounds in subsequent years, Silver Spring had to cancel a $150 million IPO in July, 2011. Offering utility companies an integrated smart grid system platform that provides insight into customer behavior as well as helping them improve energy resource utilization, Silver Spring might have gotten a little bit ahead of itself and the market’s development, which was focused on developing and proving the “plumbing” to realize greater resource efficiencies.

2010: By 2010, the smart grid market had developed to the point where technology providers and utilities were beginning to change focus and concentrate more on customer engagement. Gloucester, Massachusetts-based Grounded Power was offering a smart grid platform — its “Interactive Customer Engagement System” — that integrated real-time energy monitoring with analytical behavioral tools. The platform is designed to promote and foster behavioral change on the part of energy consumers that result in sustained energy consumption and carbon savings while building closer, better relationships between utilities and their customers. Grounded Power was acquired by Boulder, Colorado’s Tendril Networks in 2010.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

2011: The increasing focus on shifting to taking advantage of the enhanced demand-side management and customer relationship building capabilities of smart grid platforms continued in 2011. Indicative of this trend were first-round financings for Bridge Energy Group, which raised $11 million to provide IT integration and implementation services to enterprises carrying out smart grid initiatives, and Clean Urban Energy, which raised $7 million in its first-round financing. Chicago’s Clean Urban Energy developed smart grid software that enables commercial building owners in large metropolitan areas to improve energy efficiency and enhance their energy conservation potential.

Charts

The charts below, compiled by VentureDeal, shed some light on the ups and downs of this venture sector.

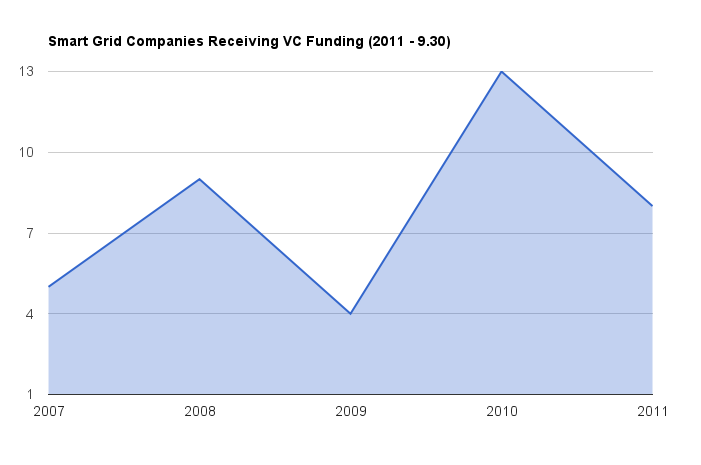

The number of companies receiving institutional venture capital funding has been uneven, though the average trend line has been positive.

Aggregate funding amounts peaked in 2008, then dropped in 2011 to under $100 million for the first time in the last five years, though the 2011 numbers are only through September 30.

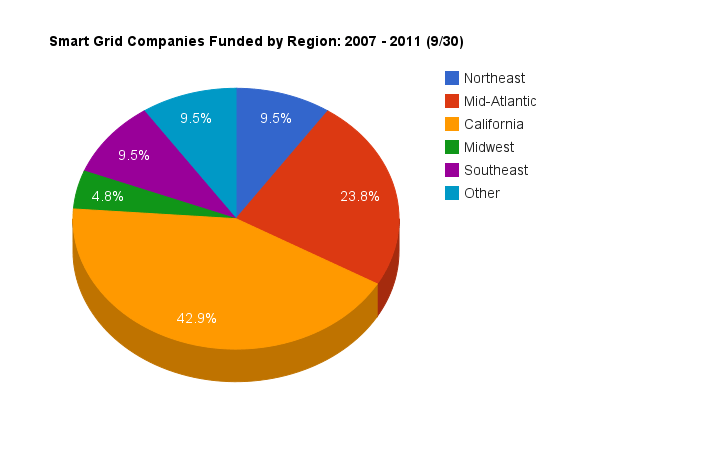

California companies accounted for 42.9 percent of funding activity, almost double that of the mid-Atlantic region at 23.8 percent.

Investment in the smart grid industry focused on companies able to successfully develop and implement the “plumbing” of smart grid systems platforms — smart meters and advanced metering infrastructure (AMI) — during the early part of the last five-year period.

Now, however, investment and market focus has shifted toward customer engagement and developing business models that can take advantage of the enhanced demand side management capabilities smart grid platforms provide, particularly when it comes to enhanced energy conservation, improving energy efficiency and reducing carbon dioxide and greenhouse gas emissions. Expect this trend to continue as the industry looks ahead to greater deregulation.

VentureTrends is a research service of VentureDeal, a national venture capital database based in Menlo Park, Calif.

Photo credit: Christian Haugen/Flickr

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More