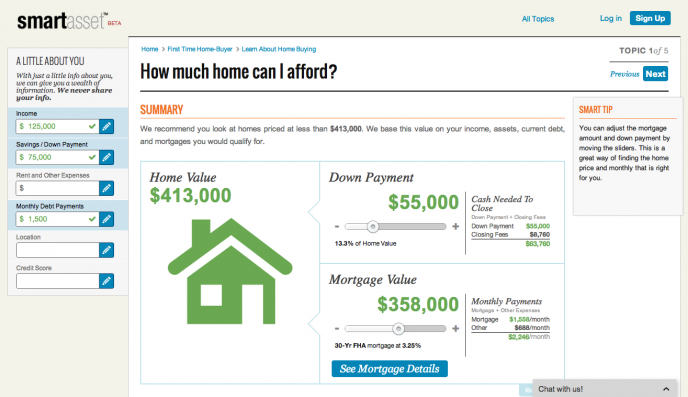

When users first arrive at SmartAsset, they are prompted with a series of questions about their income, deductions, assets, geography, expenses, and more. Based on the responses, the technology generates personalized advice on what is affordable and why, how a purchase will affect cash flow, tax consequences, and a prediction of the investment’s evolution over time.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":496464,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"C"}']Right now, the company focuses on home buying, but there are 23 other decisions in the pipeline that deal with issues such as retirement and education.

Founder Michael Carvin focused heavily on user experience while building the product, striving to make it as easy to understand and interactive as possible. He was inspired to bring a higher level of transparency to home buying after experiencing how confusing and frustrating the process could be and witnessing the collapse of the real estate market.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

“I had been working in finance for a while and what I thought would be straightforward, particularly for someone with my background, was far more complicated,” he said. “Realtors told me one thing, brokers and banks another, and the information was wrong or biased. All the advice I found online was static or anecdotal — nothing was customized to a specific problem set.”

As every individual or family has a unique set of circumstances, building an engine that could generate personalized and accurate advice is the core of Carvin’s endeavor. He initially built a system to help himself make the best possible decision about a mortgage, and then shared the model with family and friends. The positive and gratified reaction gave him proof of purpose and he began searching for a technical cofounder.

Together with Philip Camilleri, Carvin spent seven months building out the back-end platform and researching the market. The two raised a seed round in the first week of May and have tested the product on thousands of users to make sure the visual language is clear and helpful.

Users input their personal information, but external factors such as federal, state, and local tax codes, transaction expenses, and dynamic property values are included as well.

“No-one is incentivized to tell you about things like transaction expenses until you are already committed to a purchase,” Carvin said. “This practice is called shrouding and allows vendors to have more sway. We give people all the information they need and tell them what is actionable.”

Since the financial crisis, consumers have expressed a desire for greater control over their finances. They trust major financial institutions less and feel more cautious when it comes to budgeting. Carvin describes home ownership as the tip of the iceberg and plans to launch dozens of verticals over the next couple years. Ultimately, his vision is for SmartAsset to become the first point of reference for anyone about to make important personal finance decisions.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":496464,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"C"}']

SmartAsset currently has five employees and is based in New York, although Carvin is currently doing a three-month stint in Mountain View for the Y Combinator program.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More