Like any real market, when a new genre of Facebook applications starts getting popular, their developers start banding together. The latest example is happening among social gaming app developers: Category leader Social Gaming Network has bought developer outfit Esgut (creator of Entourage, Superlatives, and Text Twirl), as well as Facebook applications Oregon Trail, Nicknames, Friend Block and Free Gifts.

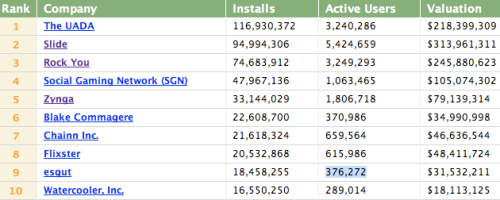

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":91097,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"D"}']Zynga, SGN’s archrival, bought CLZ, the developer of a group of Facebook gaming applications, in February, which at the time added four hundred thousand daily active users to its existing base of one million daily active users. SGN has 66,425,391 total installs of its own games to date, while Zynga has only about half that (33,144,029), if you believe Facebook app analytic service Adonomics’ numbers. However, Zynga’s user base appears to be far more active — 1,806,718 daily active users versus SGN’s 1,439,737. See the Adonomics table above for more, including its current valuations for each company.

Both companies are not only buying up games, they’re trying to develop ad networks that bring in independent game developers. These are cross-promotional ads, where you’ll be playing a game on one app, and see an ad for another game app — an app that’s also a member of either SGN’s or Zynga’s network.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

Many have expected social games to explode on Facebook as developers better understand how to tie in the often-complex features of a game into Facebook users’ behavior on the site.

Consolidation has already happened in easier-to-create categories, including among general-purpose app companies, and analytics and ad companies. Examples: Within the first days and weeks of Facebook’s developer platform launch last May, top Facebook app companies RockYou and Slide bought up a number of smaller applications. Both companies understood that they needed to grow big as fast as possible to capture the general market. A couple months later, the same thing happened among Facebook statistics applications. Appsaholic was bought by social ad network Social Media and became its analytics service. Appaholic, a similarly named rival, was bought by and became part of Adonomics, the analytics service mentioned above, that’s also an ad platform.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More