Cake Financial, a startup that lets you compare stock picks with other investors, is unveiling three features that may help separate it from a large pack of competitors.

The San Francisco, Calif.-based company already lets users import historical stock-investment data for up to 10 years from 70 brokerage firms. Now it’s leveraging that data to provide a stock rating system, an index fund based on the holdings of its top ten percent of investors, and an investment idea generation engine that, when launched, will automatically make transactions on the behalf of the user.

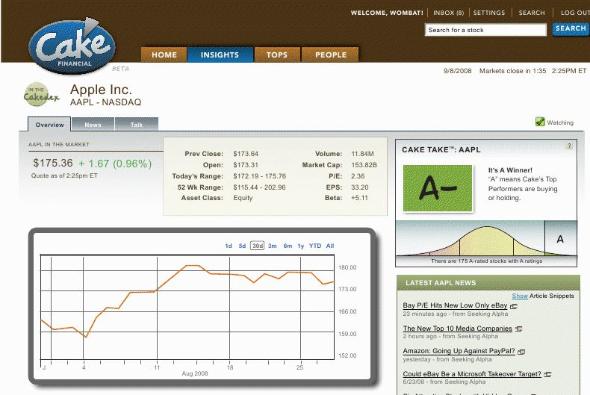

The stock rating system, called Cake Take, generates rankings A through F based on the investor’s stock portfolio activity — purchasing, selling, and holding of securities. It automatically updates 2,100 stocks multiple times per day. It’s similar to Morning Star and Charles Schwab’s 5-star systems that rank stocks for ‘sentiment’ around the relative value of a particular security.

There’s always a question of how accurate a stock rating can be based on user data, but Cake’s algorithms analyze three principal activities in stock trading — buying, selling, and owning stock. It incorporates data like volume of trades, the number of people, and the user rankings of those individuals, in order to produce the most accurate rating possible based on the data. As Cake chief executive Steve Carpenter put it, “if Morning Star has 125 paid analysts, are those 125 people better at picking the expected performance of one stock that gets updated quarterly, or would you rather take thousands of people and their actions updated hourly and use that data?”

As of now, Cake covers over 2,000 stocks, exchange-traded funds, and mutual funds, compared to Schwab’s 3,000 and Morningstar’s 4,000.

CakeDex, the stock index of the top 10 percent performing users’ aggregated holdings, will show the changing value of hot stocks. For example, Research In Motion (the company behind the BlackBerry) is number seven this month, but last month was number 98. This can also be a useful investment tool for retail investors to whom Cake plans to sell this information. Users next year will be able to buy an exchange-traded fund through their brokerage accounts based on the CakeDex.

The third product, the investment idea generator, suggests securities that a user might consider purchasing, determined by comparing an individual’s portfolio with another user who is better than you at investing over the same period of time that you invested with similar assets & risk. The algorithm provides a list of companies that you might want to consider buying. The company has already analyzed 1 million transactions from its users to help shape these recommendations, and in 2009 will automatically make trades on the behalf of the user.

The automated trade execution would allow for those of us amateur investors who, even if we have access to the information don’t always have the time to do the necessary research, to improve our portfolio returns. Cake’s data has shown that the holdings of the average investors (who underperform markets) and the top performers (who greatly outperform markets) don’t differ at all. What is different is the asset allocation and the timing — this makes all the difference in the success or failure of a portfolio, and it’s where Cake comes in.

All three products are tightly woven together. Cake ranks its users based on their historical performance. Those rankings determine the CakeTake as well as the top performers’ holdings — the CakeDex — and it includes other measurements (number of trades per year, asset allocation, sharp ratio — return per unit of risk, etc.) to generate CakeScout. Although you can still follow individual users’ portfolios, it’s the insights from the data of the aggregate that makes Cake so attractive.

While competitor Zecco allows actual trading, Covestor creates virtual portfolio managers and charges users to follow certain managers, and Motley Fool’s Caps builds off of its fantasy stock trading system, Carpenter says Cake has the clear advantage because it leverages the real historical data of users’ investment portfolios.

The 20-employee company has raised an undisclosed amount of investment from Alsop Louie Partners and Baseline Ventures and other angel investors.

David Adewumi, a contributing writer with VentureBeat, is the founder & CEO of http://heekya.com a social storytelling platform billed “The Wikipedia of Stories.”