Songkick, the company behind the music-monitoring app that lets you track when and where all your favorite bands and artists are playing live, has raised another $15 million in funding from Access Industries.

This latest funding comes eight months after the U.K. startup nabbed $10 million from Access Industries, and takes its total amount raised past the $60 million mark.

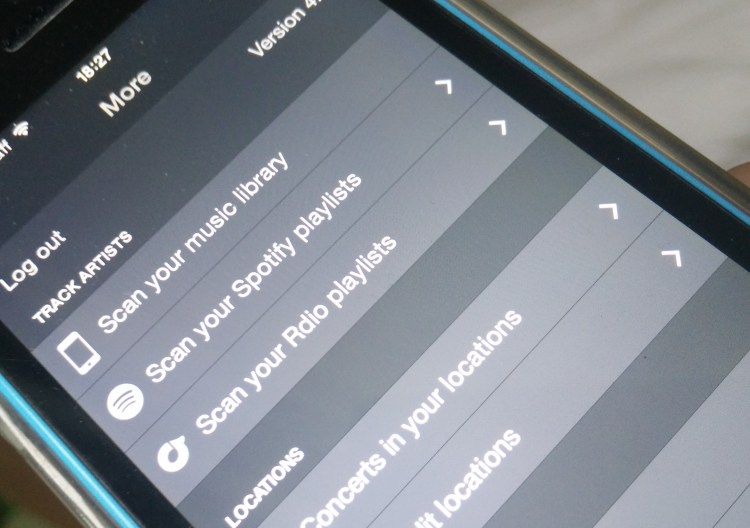

Founded out of London in 2007, Songkick has built a solid brand in the music realm for the way it helps users discover live shows based on the music they listen to. The mobile and desktop service links in with a user’s music collection — either in the cloud (e.g. Spotify) or locally stored — and matches it with Songkick’s inventory of live gigs. This means that users don’t have to manually keep tabs on when their favorite band or singer is performing nearby, as they receive alerts whenever they’re scheduled to be in town.

In June last year, Songkick announced it was merging with artist-ticketing service Crowdsurge, in what was a natural extension to Songkick’s existing offering. Unlike other ticketing services, Crowdsurge serves as a direct bridge between the artist and fans, cutting out the middlemen. This is no small-time venture for unsigned acts or rising stars — Songkick now claims a number of notable artists selling tickets through the platform, including Paul McCartney, Adele, the Red Hot Chili Peppers, and Metallica. The motivation for using Songkick is twofold: It gives artists greater control over how their tickets are sold, but more importantly, the platform is designed to curb the scourge of scalpers who buy as many tickets as they can and sell them on secondary marketplaces for a vastly inflated fee.

Songkick hasn’t revealed exactly how its system works, but in an interview with VentureBeat last year, co-CEOs Ian Hogarth and Matt Jones explained that it uses “proprietary software to determine which ticket sales are likely to scalpers” and then cancels the transactions. And this has been one of the core selling points in getting new artists on board.

With $15 million more in its coffers, Songkick said that it plans to continue with its mission to “enhance the connection between artists and fans,” increase ticket sales, and continue to thwart scalping.

“We’ve always been focused on aligning with artists and connecting them directly with their fans,” said Jones, who was formerly CEO at Crowdsurge before joining Hogarth in the post-merger hotseat. “The biggest myth in live music is that ticket scalping is somehow impossible to prevent, but with the right focus and the right tools, these issues can be solved, and Songkick is at the leading edge of solving them. Through our technology we’re reducing scalping, giving real fans a better chance of getting tickets to the shows they’ve waited so long to attend, and generating more revenue for artists along the way.”

Since we last covered Songkick, Hogarth has stepped away from the co-CEO position to serve as chairman, leaving Jones in sole charge of the company.