Tesla Motors, the company behind the Roadster electric vehicle, might look for additional funding from equity sales to help pay for development of its third electric car — the sport utility vehicle styled Model X — according to the company’s CEO Elon Musk.

Tesla Motors, the company behind the Roadster electric vehicle, might look for additional funding from equity sales to help pay for development of its third electric car — the sport utility vehicle styled Model X — according to the company’s CEO Elon Musk.

The company is working on another electric car model that’s geared toward car buyers interested in an SUV or a minivan. Details about the Model X have been scarce — one of the few facts known about it is that it will use the same power train as the Model S — and the car should be unveiled at the end of the year, Musk said. And while the company is on track to be profitable in the future once it releases the Model S, it might look into selling additional equity to help ramp up production of the Model X.

“We do have enough capital to reach cash-flow positive without raising another dollar,” Musk said on the earnings call. “There’s a decent chance we will raise a secondary for the Model X activity and some additional potential headroom growth on the Model S production.”

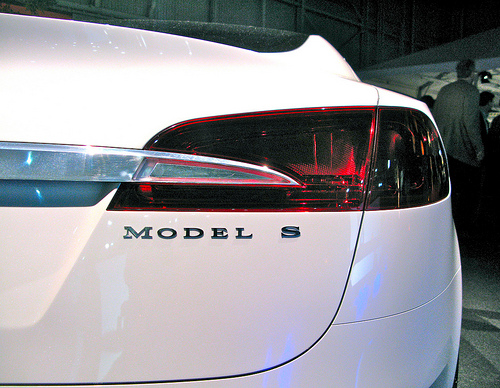

The electric car manufacturer is still working on its second car, the Model S sedan that’s geared toward more casual car buyers and first-time electric car buyers. It recently completed its alpha models for the Model S and has begun quality testing them, meaning demonstration models for press and analysts will be out by the end of the summer, Musk said. The production model will come out in the United States around summer next year, and then in Europe toward the end of 2012.

The company added 900 new reservations for the Model S last quarter — which requires a cash down payment of $5,000 — bringing its total reservations for the Model S up to 4,600. Tesla Motors also sold 1,650 Roadsters and is on track to run out of Roadsters at the end of the year. The company’s debut electric car was a sports car based on the Lotus Elise chassis that carries a hefty initial price tag of $109,000. The Model S is priced at $57,000 before government incentives for purchasing an electric car.

Most of the reservations for the Model S come from U.S. consumers — but that’s how Tesla Motors wants it, because recalls will be easier to manage if there are any problems, Musk said. About 75 percent of the reservations for the Model S came from U.S. car buyers, while the rest came from European buyers.

Most of the reservations for the Model S come from U.S. consumers — but that’s how Tesla Motors wants it, because recalls will be easier to manage if there are any problems, Musk said. About 75 percent of the reservations for the Model S came from U.S. car buyers, while the rest came from European buyers.

Tesla Motors’ cars have some of the largest plug-in electric car ranges. The Tesla Roadster can travel around 200 miles before needing to recharge, and the Model S is expected to have a range of up to 300 miles between charges. The Nissan Leaf — though much cheaper, at $32,000 — can only travel around 100 miles before needing to recharge. Musk didn’t indicate what kind of range the Model X will have, though it will probably be somewhere between the Roadster and the Model S if it uses the same power train as the Model S with a larger chassis.

Tesla Motors posted a lower-than-expected quarterly loss, hemorrhaging $48.9 million, or 51 cents per share. Wall Street analysts were expecting the company to lose 53 cents per share and bring in $47 million in revenue. The company brought in $49 million in the first quarter this year, more than double the $20.8 million it picked up in the first quarter last year. The performance pleased shareholders, bringing the electric car manufacturer’s shares up 3.7 percent to $27.67.

Most of the performance came from the company’s sale of battery components and chargers to Daimler for its Class-A and Smart Fortwo electric vehicles. Development services revenue also rose because Tesla Motors partnered with Toyota to provide powertrain systems for the company’s RAV4 electric vehicle program.

[Photo: norio.nakayama, jurvetson]