Three days ago, when Global Equities Research projected more than 300,000 reservations for the Tesla Model 3 electric car by the start of this week, that number seemed outlandish.

And yet, by the end of Saturday, the global total had reached 276,000, according to a tweet by Tesla CEO Elon Musk.

When the Model 3 was first unveiled in California on Thursday evening, the number of deposits that day alone had already crossed 100,000.

With an additional day and a half, Saturday’s total of 276,000 has likely crossed the magic 300,000 mark by now unless the pace has suddenly slowed to a crawl.

And that clearly caught even Tesla off guard, with Musk tweeting that the company would have to rethink its production plans for the 215-mile, $35,000 electric car that won’t hit the roads for almost two years under a best-case scenario.

Musk promised one more report on reservation totals, this one to come exactly a week after the Thursday evening introduction.

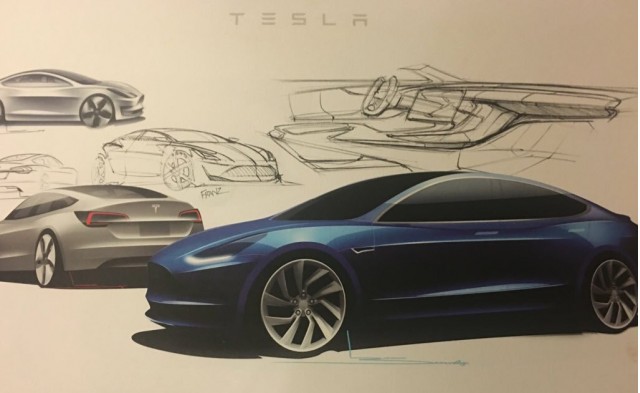

Tesla Model 3

Not all of those reservations will convert to actual orders, of course. But even if only half of them do, 150,000 Model 3s would amount to more plug-in electric cars than General Motors, Toyota, Ford, BMW, or VW Group has sold in more than five years. Only Nissan has sold more (slightly over 200,000 as of last month).

The response over the weekend to the Model 3 totals was predictable but nevertheless fascinating to watch. Tesla fans and investors were ecstatic, proclaiming that the Model 3 was the breakthrough vehicle that electric cars had required to enter the mainstream market.

Some went as far as to suggest that the Tesla Model 3 of 2018 would be just as revolutionary as the first Ford Model T, introduced 110 years before in October 1908.

The Model T became the world’s highest-volume production car over the next 19 years, selling more than 15 million copies—a record that stood until 1972, when it was passed by the Volkswagen Beetle.

Many hurdles remain before the Model 3 can definitively be spoken of in the same light as the “car that put the world on wheels,” however.

Tesla must complete the Model 3 design, test and validate the car, get it certified by dozens of different regulators around the world, and tool up its factories for production levels 10 times as high as its best to date.

Tesla Model 3 design prototype – reveal event – March 2016

It must also bring its massive battery Gigafactory online not only to assemble battery packs from imported cells, as it does now, but to fabricate and produce the actual cells themselves in the highest-volume battery plant in the U.S.

And if the company is to meet its recently confirmed deadline of starting Model 3 production by the end of next year, it has to do all that in 18 months.

As is much noted by commentary, Tesla Motors has not yet met an announced deadline for starting production of any of its vehicles: not the Roadster, not the Model S, and not the Model X.

Finally, many financial analysts suggest that Tesla will have to raise additional capital, especially if it believes it needs to boost its Model 3 production volume beyond what it expected to build before the surge of post-debut orders.

It customarily costs $200 million to $500 million to equip a high-volume production line, one capable of building 150,000 cars a year.

Tesla has plenty of extra plant space in the Fremont, California, facility it bought from Toyota in 2009. But it will still need to tool up for higher-volume production.

Tesla Model 3 design prototype – reveal event – March 2016

And while 300,000 deposits of $1,000 apiece—funds that are not placed in escrow, by the way, but pooled with the rest of the company’s assets—amount to $300,000,000, some analysts have suggested Tesla Motors may need to raise another $1 billion or so to sustain itself until it begins to break even in 2020 or later.

Under generally accepted accounting principles, or GAAP, Tesla Motors has never turned a profit as a company. And CEO Musk said a couple of years ago he didn’t expect that to happen until the Model 3 was in volume production in 2020 or thereafter.

Thus far, however, the company has been remarkably successful at raising money—which it may have to do again sometime in the next two years.

So that’s where Tesla stands today: surprised at how many deposits have been put down for the Model 3, presumably recalculating its financial projections over the next five years—but likely basking in the glow of an exceptionally positive response from paying customers to its first real volume car.

And the rest of the industry?

It is almost surely hyperbole to proclaim, as one of last night’s headlines did, that the Tesla Model 3 poses an “existential crisis for the auto industry.”

2016 BMW i3

Nissan, GM, BMW

But we still have to suspect that the product executives at Nissan, General Motors, BMW, and other global makers who see themselves on the forefront of electric-vehicle production are going to have to answer questions about what the deluge of Model 3 reservations means.

Could BMW, for example, with its reputation for sporty performance cars, have cashed in on those customers if its i3 had been a sexy, compact four-door sport sedan with a 200-mile range instead of a tall, slab-sided urban subcompact car with 80 miles of range?

Nissan Leaf ‘Advanced R&D Electric Vehicle’ shown at company annual meeting, Yokohama, Jun 2015

Is Nissan CEO Carlos Ghosn wondering how his upcoming longer-range Leaf, presently the world’s best-selling electric car (with more than 200,000 sold since 2011), will fare in the eyes of buyers willing to put down cash years in advance for a Tesla?

At GM: How can Tesla get 300,000 people to put down $1,000 apiece for a car that won’t appear for two years when we still have to fight with our dealers to get them to understand, stock, and sell our well-reviewed Volt and the upcoming 200-mile, $37,500 Bolt EV hatchback that will beat the Model 3 to market by at least a year, perhaps two or three?

All of those companies, which often speak about the ultimate decision-making power of the market and providing the cars that buyers are willing to pay for, are likely to do some hard thinking about the mix of qualities that make the Model 3 and Tesla Motors attractive enough for that many people to risk a four-figure sum on faith in a car they don’t know that much about.

2017 Chevrolet Bolt EV pre-production vehicles at Orion Township Assembly Plant, March 2016

Sexy, fast, affordable

Except, of course, for those carmakers, fewer and fewer in number, who continue to dismiss Tesla as an unsustainable and short-term phenomenon that will inevitably crash and burn.

But it seems a little clearer today that a reasonably priced battery-electric car, with 200 miles of range or more, can find buyers if it’s good-looking and performs well.

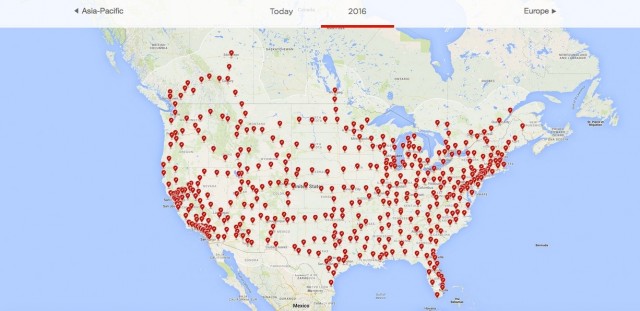

Perhaps the final piece of the puzzle is that the fast, good-looking, affordable 200-mile electric car is also accompanied by a free, fast-growing nationwide network of DC fast-charging sites.

Because today, that’s an asset that only Tesla can tout.

Tesla Motors Supercharger network in the U.S. – projected 2016 installations

And fast charging too

Nissan’s efforts to spread CHAdeMO fast charging beyond its dealers into other public sites appear to have stalled, while GM has said specifically it will not fund any DC fast-charging capabilities.

So far, only Audi and Porsche among future electric-car entrants appear to have recognized the importance of a fast-charging capabilities modeled after the Supercharger network, and their cars won’t arrive for two or three more years.

It may be a week of pondering among the car companies of the world.

And we’re betting there are some quiet office pools being established on where that Thursday evening number to be tweeted by Musk will come in too.

This post first appeared on Green Car Reports.