In an era where generative AI and deepfakes dominate headlines, a quieter but potentially more transformative AI revolution is taking place in consumer advocacy. Companies like Pine AI are deploying sophisticated autonomous agents that negotiate with corporations on behalf of consumers, creating both unprecedented opportunities and complex ethical challenges for the marketplace.

The rise of algorithmic consumer advocates

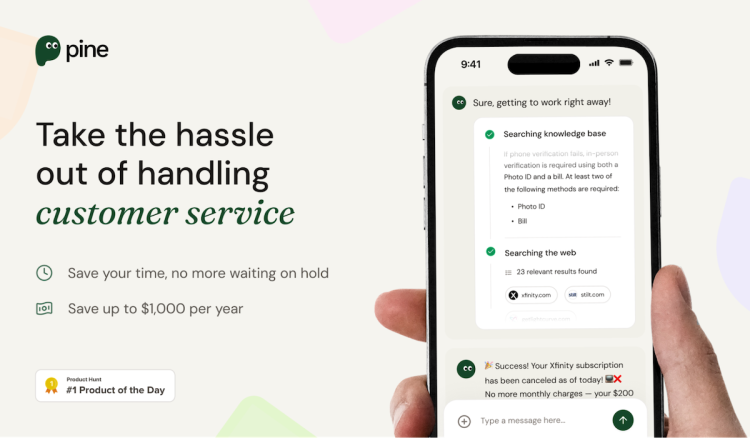

While media attention focuses on flashier AI applications, Pine AI has been pioneering what industry insiders call “algorithmic consumer advocacy” – using advanced AI systems to handle negotiations ranging from routine bill disputes to complex insurance claim appeals without human intervention.

Pine AI’s system consists of three specialized agents working in concert: a customer-facing agent that communicates with users, a planning agent that researches and develops negotiation strategies, and a tool agent that interfaces directly with businesses through phone calls, emails, and web interfaces. This technology helps level the playing field for consumers by making specialized negotiation expertise widely accessible.

Beyond bill negotiations: the expanding use cases

While bill negotiation creates the most immediate value, Pine AI‘s technology extends far beyond this single application. Users are increasingly delegating tasks such as reporting service outages, making restaurant reservations, arranging home service installations, negotiating credit card interest rates, and comparison shopping.

For investors and startups, this signals an expanding addressable market. The technology is evolving from single-purpose bill negotiation tools to comprehensive consumer assistance platforms that could potentially disrupt traditional customer service models across multiple industries.

The corporate countermeasure: an algorithmic arms race

This consumer-side innovation hasn’t gone unnoticed in corporate boardrooms. Major telecommunications providers and insurance companies have invested significantly in counter-AI technologies over the past 18 months.

These defensive measures include sophisticated neural networks designed to identify AI callers and surprisingly low-tech solutions like requiring verbal confirmation of personal anecdotes before proceeding with discount requests.

For startups entering this space, this escalating technological arms race represents both a challenge and an opportunity. Companies that can stay ahead of corporate countermeasures while delivering measurable consumer savings will likely find a receptive market, though the cost of continuous AI development may create significant barriers to entry.

The human element: capabilities and limitations

Behind the efficiency gains lies a more fundamental question that affects product development strategies: what aspects of human advocacy are lost in automation?

Research from Harvard Business School suggests human negotiators often achieve outcomes that transcend purely transactional results – securing policy changes that benefit future customers, extracting meaningful apologies for service failures, or building relationships that yield long-term benefits. This presents both a limitation for current AI systems and a potential differentiation opportunity for companies developing next-generation consumer advocacy technology.

Market trajectory and investment implications

Despite these concerns, market analysts project that by 2027, adoption of AI-powered automation services will continue to grow significantly among American households. This adoption curve suggests the market is still in the early stages of formation, with significant growth potential for well-positioned companies.

For investors, this presents intriguing possibilities. The technology could follow multiple paths to market – either through specialized providers like Pine AI or as features embedded in banking and financial management applications. This latter path could make consumer advocacy AI an acquisition target for larger fintech platforms looking to expand their value proposition.

The path forward: balancing automation and control

The challenge for the industry is developing approaches that harness the efficiency of automation while preserving meaningful human control over advocacy priorities and decisions.

For startups in this space, addressing these concerns could become a significant competitive differentiator. Companies that develop transparent AI systems that keep humans appropriately involved in decision-making may gain advantages in consumer trust and regulatory compliance compared to “black box” alternatives.

The transformation of consumer advocacy through AI appears irreversible, with significant implications for startups, established companies, and investors. The winners in this emerging market will likely be those who recognize that the technology’s potential extends far beyond mere cost savings – it could fundamentally reshape the balance of power between consumers and corporations in ways we’re only beginning to understand.

Investing involves risk and your investment may lose value. Past performance gives no indication of future results. These statements do not constitute and cannot replace investment advice.

VentureBeat newsroom and editorial staff were not involved in the creation of this content.