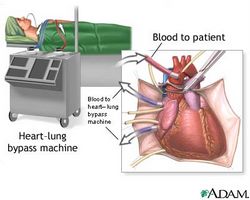

Turns out a few people have also been wondering whether a deflating private-equity bubble might also redirect capital to the life sciences. (That’s a graphic of the redirected blood flow during a heart-bypass operation over to the left.) Last month, for instance, Ogan Gurel — chairman of the life-sciences consulting firm Aesis Group and a prolific blogger in his own right — suggested that because the private-equity juggernaut is fueled by cheap credit (or low interest rates, essentially the same thing), a slowdown implies higher rates that might naturally make high-risk, high-return venture investments more attractive.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":27372,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"B"}']That’s because it’s relatively easy to make money from mundane investments with low-to-middling returns when it doesn’t cost you much to get into the game with debt funding, but much harder when the capital itself is more expensive. In turn, that means savvy investors are going to look harder for bigger payoffs, even at the expense of taking on more up-front risk. (Of course, the recent aftershocks rippling out of the subprime mortgage market make clear that there was plenty of risk in the private-equity strategy as well — it’s just that everyone was perfectly happy to pretend it wasn’t there until it couldn’t be denied any more.)

As to the specific implications in the life sciences, Ogan writes:

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

First of all, life sciences VC funding has – as a proportion of overall VC funding – has been markedly increasing. Life Sciences (Biotech and Medical Devices together) accounted for 36% of total first-quarter 2007 VC dollars. Medical device investing, in particular has skyrocketed to an all-time high of $1.08 billion going into 96 deals representing a 60% increase over fourth-quarter 2006 results. Biotechnology was the largest sector with $1.B actually displacing software investments which has traditionally been the largest sector according to the NVCA and Pipal Research.

Second, if my hypothesis is correct, then higher anticipated interest rates will – ceteris paribus as the economists say – stimulate investors to allocate funds towards higher potential return, higher risk investments which means that venture capital will benefit just as it did during the late 1970s and potentially during the latter part of the 1990s as well.

If we combine the two premises that (1) the life sciences share of VC funding is intrinsically increasing and that (2) venture capital will see growth relative to other investment strategies, then the future is bright for life sciences funding in the foreseeable future.

As you’ll see if you read the comments of his piece, I’m somewhat skeptical that the relationship between interest rates and venture returns is as cut-and-dried as Ogan makes it sound. On the other hand, I don’t have any trouble believing that the relative attractiveness of high-risk, high-return investments should rise as the seemingly easy money available in private equity goes away. Heck, perhaps investors might even show renewed interest in the all-but-moribund biotech-IPO market.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More