[For a view on gaming investing myths, read this guest post from YetiZen CEO Sana Choudary. -Ed.]

In 2012, investors were excited about the game market’s march toward billions of new users with the rise of smartphones and tablets. But that excitement fizzled as Zynga’s fortunes wavered, and it reported weak earnings starting in August. Consequently, game investments rose dramatically for a while, and then they tapered off.

The data for this story comes from GamesBeat’s own original research into fundings during the year, with contributions from Sana Choudary of YetiZen, Tim Merel of Digi-Capital, Internet Deal Book, Signia Venture Partners, and Electronic Arts.

The upshot is that game investors have been spooked and they aren’t making as many deals as they once were. That means that higher-quality startups will receive funding, but copycat ideas aren’t necessarily going to. And as weak as the year was in investments, nobody is changing any forecasts about the march of gaming into the stratosphere in revenues and player numbers over time. So the industry is facing a confidence contradiction. Game companies are growing, but the money they’re raising isn’t.

The number of game investments rose to 188 deals, compared to 145 a year ago. But the value of the announced deals was $901.3 million, compared with $1.540 billion in 2011. That represents a 29 percent increase in the number of deals, but a 42 percent decline in dollars invested.

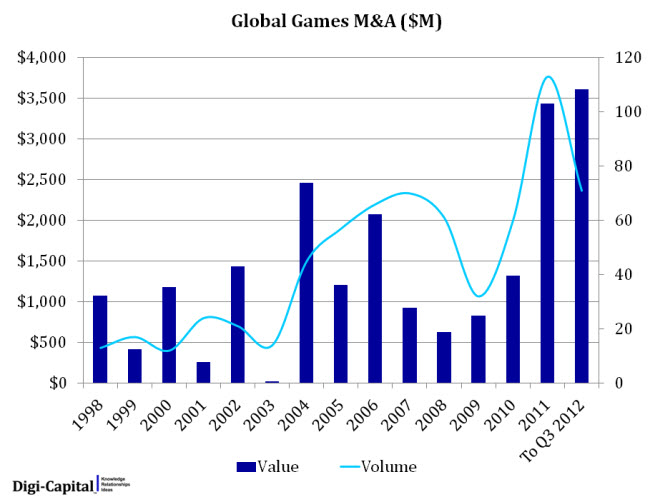

By comparison, the value of game acquisitions rose 23 percent in 2012 to $3.47 billion, compared to $2.87 billion a year earlier. The number of game acquisitions fell from 77 in 2011 to 58 in 2012. According to Avista Partners, the value of publicly traded video game companies is about $153 billion, but 78 percent of the value is in the top 10 companies, with China’s Tencent leading the list.

A big gap exists in investor thinking, according to analyst Peter Warman of Newzoo in a recent interview with GamesBeat. Fear kept investors from pouring money into a sector that was actually producing much better results in terms of cashing out through acquisitions. Since 1997, Avista Partners says that games have produced $44 billion in value for venture capitalists and private equity investors since 1997.

Tim Merel, the managing director at Digi-Capital, said that the collapse of social gaming investments in the wake of Zynga’s troubles accounts for almost all of the decline in the game investment deals. Investment capital continued to shift from traditional console games to social, mobile, and online games.

But the clear bright spot for the year was mobile gaming. Merel reported that mobile deals account for as many as 40 percent of the overall game deals. But a mobile game studio with 10 employees can produce a game and get it into the market. It doesn’t need the same kind of capital that earlier game startups required, so it makes sense that the average size of a game deal is getting smaller.

In 2012, the average size was $4.8 million, compared with $10.6 million a year earlier. Zynga’s crash in the stock market (it’s trading at 25 percent of its peak value) also deflated game investment valuations.

Another savior for many game companies was Kickstarter, the crowdfunding platform that raised $83.1 million for video games and board games from 520,000 backers (we’ve included Kickstarter deals in our list). Of that amount, $55 million went to 296 video game companies (we haven’t included most of those on our list). The average amount raised via crowdfunding was $186,000, as most projects raised money for games instead of trying to finance whole companies.

More than anything, Kickstarter changed the dependence of developers on major publishers for funding. Midsized game companies such as Double Fine Productions, which started a Kickstarter mania back in March, could turn directly to their fans for the first time to raise money to make games. The crowdfunding platform became an important place to test disruptive ideas such as the Oculus VR virtual reality goggles and the Ouya Android video game console for televisions.

Certain sectors saw a boom, as hardcore game companies such as Kabam and Kixeye saw huge demand for free-to-play hardcore games. And social casino games debuted by the dozens on Facebook and mobile game platforms. More disruptions are happening as game companies adopt new business models such as free-to-play games, where you play for free and pay small amounts for virtual goods. Gaming also has its own version of the war for talent as big companies acquire smaller ones. Green Throttle Games raised $6 million on the hope that its Android game controller and app could disrupt $60 console games on the television. Such trends serve as grist for the bigger investments.

Signia Ventures (which did eight deals in games in 2012) noted that about 80 percent of investments in 2012 were in North America, with a lot of excitement continuing in mobile gaming, analytics, distribution and the larger consumer mobile ecosystem.

Investors probably shied away from the sector because of the almost total absence of initial public offerings. China’s YY and Zattikka staged a couple of small IPOs, but no one grabbed the attention or the investment dollars like Zynga and Nexon did in 2011, when both companies raised $1 billion each. Zynga raised $515 million in a secondary offering not long before its stock collapsed. And Tencent completed a $598 million fixed income offering. If the IPOs return, you can bet that the investors will as well. But perhaps the only trend to count on is further consolidation with a continued acquisition boom.

Here’s a cautionary note about these numbers. If we knew the value of every deal, the numbers would be much higher this year. We’d love to know how much money Tencent invested in Epic Games, but we don’t. But we have the same problem every year as the majority of the dealmakers keep their values secret.

Here’s a look at the deals of the year below. We’ve organized them by dollar value of the transactions. For those deals where the value is unknown, we have listed them in reverse chronological order. We have linked to our own VentureBeat/GamesBeat stories where we covered them. For deals we didn’t cover, we have linked to other publications or press releases.

Major VC firms such as Accel Partners, Sequoia Capital, DCM, Kleiner Perkins Caufield & Byers, Andreessen Horowitz, and others all poured money into big game companies this year. Google Ventures continued its role as an active strategic investor. Check out the GamesBeat game investments list in the following pages.

GAME FUNDINGS

GAME FUNDINGS

1. Cygames — Japan’s DeNA invests $92 million in Cygames, taking a 20 percent stake in the company that created the hit role-playing game Rage of Bahamut. Investors: DeNA. Nov. 7.

2. Trion Worlds — The maker online games raises $85 million to expand Red Door, its platform for launching massively multiplayer online games. Investors: Ontario Teachers’ Pension Plan and Bertelsmann Digital Media Investments, a division of media firm Bertelsmann. Jan. 19.

3. Trial Pay — TrialPay raises $40 million for its alternative payments business. Investors: Visa, Greylock Partners, T. Rowe Price, DAG Ventures, DFJ Growth and QuestMark Partners, with existing investors. Jan. 31.

5. Lumosity — Lumosity raises $31.5 million for cognitive games. The company’s brain games can help patients with cognitive risks. Investors: Discovery Communications, Menlo Ventures, FirstMark Capital, Harrison Metal, and Norwest Venture Partners. Aug. 22.

6. Badgeville — Badgeville takes in $25 million to gamify corporations, or increase the engagement of customers and employees using game-like tactics. Investors: InterWest Partners, with participation by prior investors. May 30.

7. Flurry — In a whopper for analytics, Flurry raises $25 million to provide intelligence for the mobile app industry. Flurry enables app makers to know who is using its apps and what it can do to get them to buy virtual items in the game. Investors: Crosslink Capital, Menlo Ventures, Draper Fisher Jurvetson, InterWest Partners, Union Square Ventures, First Round Capital, and Draper Richards. Nov. 2.

9. D.cn — D.cn raises $20 million for its Chinese mobile games platform. The company operates a big mobile game downloading site and gamer community. Investors: SAIF Partners and Qiming & Grains Valley Capital. April 18.

10. Virgin Gaming — Virgin Gaming raises $19.8 million in convertible debentures for its hosted online game tournaments, leagues, and ladders. Investors: Difference Capital Funding. June 5.

10. Virgin Gaming — Virgin Gaming raises $19.8 million in convertible debentures for its hosted online game tournaments, leagues, and ladders. Investors: Difference Capital Funding. June 5.

11. Meteor Entertainment — The publisher of Hawken raises $18 million for its hardcore free-to-play mech shooter game. Investors: First Mark Capital, Benchmark Capital, Rustic Canyon Ventures, and KongZhong. Oct. 29.

12. Discovery Bay Games — Discovery Bay Games raises $15 million from Logitech for iOS game peripherals. Investors: Logitech and Trilogy Equity Partners. Aug. 21.

13. Twitch — Livestreaming startup Twitch raises $15 million for eSports webcasts. Investors: Bessemer Venture Partners, Alsop Louie Partners, and Draper Associates. Sept. 19.

14. Dragonplay — Israel’s Dragonplay gets $14 million for free-to-play mobile social games. Investors: Accel Partners, Entrée Capital, and Founder Collective. April 2.

15. Major League Gaming — Aiming to be the broadcaster of live game tournaments and streamed eSports videos, MLG raises $13 million. Investors: unnamed. March 13.

16. Game Closure — Game Closure raises $12 million for HTML5 cross-platform games. Investors: Highland Capital, Greylock, Benchmark, CRV, and General Catalyst. Feb. 23.

17. FunPlus — China’s FunPlus announces $12 million in funding for its social games on Facebook. Investors: GSR Ventures. March 1.

Breaktime Studios — Breaktime Studios gets $11.5 million for free-to-play games. Investors: Azure Capital and others. March 14.

18. CrowdStar — The maker of social games for Facebook and mobile raises $11.5 million. But the firm cuts its Facebook team loose to focus on mobile. Investors: Time Warner, Intel Capital, YouWeb, The9, and NV investments. May 2.

19. Kiip — Mobile rewards firm Kiip raises $11 million to expand beyond in-game rewards. Investors: Relay Ventures, True Ventures, and Hummer Winbland. July 17.

20. NaturalMotion — Publisher of CSR Racing and My Horse raises $11 million. Investor: Benchmark Capital. June 21.

21. EverFi — EverFi raises $10 million to offer a gamified software-as-a-service education platform. Investors: Jeff Bezos, Evan Williams, Rethink Education, New Enterprise Associates, Tomorrow Ventures, Allen and Company, and Michael Chasen. Aug. 14.

21. EverFi — EverFi raises $10 million to offer a gamified software-as-a-service education platform. Investors: Jeff Bezos, Evan Williams, Rethink Education, New Enterprise Associates, Tomorrow Ventures, Allen and Company, and Michael Chasen. Aug. 14.

22. Gamevil — Gamevil invests $10 million in third-party partner fund. Gamevil said it distributed all of the money to game developers. Investors: Gamevil. July 5.

23. Fiksu — Mobile app marketing platform Fiksu raises $10 million. Investors: Qualcomm and Charles River Ventures. July 3.

24. Meteor Entertainment — Meteor raises $10 million to create a platform for publishing digital titles like Hawken (pictured right). Investors: Benchmark Capital and First Mark Capital. Feb. 27.

25. Mogl — Mogl raises $10 million for gamified restaurant and bar rewards. Investors: Sigma Partners, Avalon Ventures, and Austin Ventures. Jan. 31.

26. Ouya — Ouya raises $8.6 million on Kickstarter for Android-based game console for the TV. Ouya surprised everyone by raising a record amount via crowdfunding. Investors: Kickstarter contributors. Aug. 8.

27. Scopely — Scopely scoops up a big seed round of $8.5 million for a mobile gaming platform. Investors: Anthem Venture Partners, The Chernin Group (headed by media executive Peter Chernin), Greycroft Venture Partners, and New Enterprise Associates. Sept. 8.

28. Jibe — Jibe raises $8.3 million to build rich real-time communications in games and apps. Investors: Vodafone Ventures, the U.S. investment arm of Vodafone Group, and Tokyo-based game creator MTI. Dec. 11.

29. PlayHaven — PlayHaven gets $8 million to fuel international expansion for its mobile gaming ad network. Investors: GGV Capital, E.ventures, and Tandem Entrepreneurs. Nov. 13.

30. Machine Zone — Machine Zone, formerly known as Addmired, raises $8 million for its free-to-play iOS games such as iMob 2. Investors: Menlo Ventures. March 27.

32. Social Point — Barcelona’s Social Point raises $7.4 million for social and mobile games such as Social Empires. Investors: Idinvest Partners, BBVA, and Nauta Capital. July 11.

33. Cloud Imperium Games — Chris Roberts, creator of Wing Commander, spent a decade in films and returned to games with $7.3 million raised via crowdfunding to make Star Citizen sci-fi game. About $2.1 million of the amount came from Kickstarter. Investors: Kickstarter fans and other crowdfunding donors. Nov. 19.

33. Cloud Imperium Games — Chris Roberts, creator of Wing Commander, spent a decade in films and returned to games with $7.3 million raised via crowdfunding to make Star Citizen sci-fi game. About $2.1 million of the amount came from Kickstarter. Investors: Kickstarter fans and other crowdfunding donors. Nov. 19.

34. Session M — Boston’s Session M raises $6.5 million to improve engagement in mobile games and apps. Investors: Highland Capital Partners and Kleiner Perkins Caufield & Byers. May 20.

35. MindSnacks — Educational game start-up MindSnacks raises $6.5 million. Investors: Sequoia Capital. Aug. 2.

36. Portalarium — Richard Garriott, creator of Ultima Online and Tabula Rasa, is back with the social gaming company Portalarium. He raised $7 million to fund his first big title, Ultimate Collector (pictured right). Investors: 8 Capital, FF Angel, BHV Venture Capital, and Garriott himself. July 10.

37. Swrve — They can’t spell. But Swrve managed to raise $6.25 million for mobile and social analytics, such as testing which feature is more popular in a social game. Investors: Atlantic Bridge Partners and Intel Capital. Nov. 12.

38. MoMinis — Israel’s MoMinis raises $6 million for mega Android game portal, PlayScape, with a huge number of titles. Investors: Gemini Israel Ventures. Dec. 9.

39. Green Throttle Games — Guitar Hero co-creator Charles Huang started Green Throttle Games to create a game controller and app that allows players to take Android games to the TV. He raised $6 million. Investors: Trinity Ventures and DCM. Dec. 4.

39. Green Throttle Games — Guitar Hero co-creator Charles Huang started Green Throttle Games to create a game controller and app that allows players to take Android games to the TV. He raised $6 million. Investors: Trinity Ventures and DCM. Dec. 4.

40. U4iA — U4iA raises $5.6 million for hardcore games on browsers. Investors: not disclosed. April 17.

41. Thatgamecompany — Jenova Chen’s Thatgamecompany raises $5.5 million to platforms with wider audiences. Chen’s company created hit games Flower and Journey. Investors: Benchmark Capital. June 14.

42. Beintoo — Beintoo raises $5 million for gamification platform. It has a loyalty rewards and monetization platform for mobile games, apps and web sites. Investor: Innogest Capital. June 22.

43. BigDoor — BigDoor raises $5 million for white label gamification platform, allowing non-game publishers to gamify their web sites with game-like mechanics that improve user engagement. Investor: Foundry Group. April 3.

44. Ignite Game Technologies — Ignite Game Technologies raises $5 million for Simraceway online racing game and cool racing simulation hardware. Investors: Steve Bellotti, Bill Budinger Jr., and Dave Marrs. Feb. 7.

45. Infinite Game Publishing — Aiming to revive an old franchise, Infinite Game Publishing raises $5 million via crowdfunding for MechWarrior Online. Investors: Fans. Oct. 17.

46. Pocket Change — Pocket Change raises $5 million for virtual currency platform for Android games. Investor: Google Ventures. July 11.

47. Tapjoy — Tapjoy invests $5 million in 130 game companies. Investor: Tapjoy. Jan. 25.

48. Red Robot Labs — Shooting to be first in location-based smartphone games, Red Robot Labs raises $5 million as part of a bid to take its location platform and Life is Crime Game into Asia. Investor: Next Media in Taiwan. March 21.

49. MoMinis — MoMinis lands $4.5 million to expand its mega portal on Android. MoMinis created PlayScape as a portal to hundreds of curated games. Investors: BRM Group and Mitsui Ventures. April 18.

50. Mindshapes — Mindshapes raises $4 million to build interactive learning apps for children. Investors: Index Ventures and Richmond Park Partners. May 29.

51. Outplay — After its Word Trick social mobile game takes off, Outplay raises $4 million. Investors: Pentech and Scottish Investment Bank. Nov. 16.

52. Playdemic — Playdemic takes $4 million to launch more cross-platform games like its successful Gourmet Ranch title. Investors: Family of IBM founder Thomas Watson. Aug. 21.

53. Applifier — Hoping to get more games discovered, Applifier raises $4 million as it launches its Everplay (pictured right) game replay service on mobile. Investors: Lifeline Ventures, MHS Capital, and PROFounders. Dec. 12.

54. Recce — Recce nabs $4 million M for interactive map gaming platform Investor: New Enterprise Associates. July 13.

55. Obsidian — Obsidian raises $3.9 million via crowdfunding on Kickstarter for Project Eternity title. Investors: More than 73,986 fans on Kickstarter. Oct. 16.

56. Playnery — South Korea’s Playnery grabs $3.7 million for social mobile games. Investors: SoftBank Ventures, Qualcomm Ventures, and Stonebridge Capital. Nov. 12.

57. Quipper — Quipper gets $3.6 million for e-learning games. Investors: Globis, Atomico, and Benesse. May 29.

58. Iddiction — Headed by former Outfit7 chief Andrej Nabergoj, Iddiction raises $3.5 million for its App-o-day game discovery site.

58. Iddiction — Headed by former Outfit7 chief Andrej Nabergoj, Iddiction raises $3.5 million for its App-o-day game discovery site.

59. LuckyLabs — LuckyLabs raises $3.5 million for Boston game studio. Investors: Atlas Ventures, Jeff Robinov, and Jerry Colonna.609.

60. Playdek — Playdek raises $3.41 million for digital tabletop games. Investor: Greycroft Partners. (No date available).

61. Double Fine Productions — Tim Schafer’s zany antics enabled him to draw a ton of attention to his Kickstarter project and raise $3.3 million for Double Fine’s next adventure game. Investors: Kickstarter fans. March 13.

62. Tap.me — Tap.me lands $3.2 million for in-game mobile ad network. Investors: Hyde Park Ventures, I2A Fund, Western Technology Investment, Great Oaks Venture Capital, FireStarter Fund, and Hyde Park Angels. March 12.

63. MunkyFun — MunkyFun raises $3.1 million for high-end mobile games. Investors: unnamed. Nov. 20.

64. Preplay — Preplay scores $3.1 millon for raises $3.1 million for games that let players predict the outcome of live TV shows. Investors: Gary Vaynerchuk, Matt Higgins, and other angels. July 10.

65. PixyKids gets $3 million for social media platform for kids. Investors: ATA Ventures and others. March 15.

66. Xfire — Xfire raises $3 million for gamer social network. Investor: IDG Capital. May 21.

67. inXile Entertainment — Brian Fargo’s inXile Entertainment raises $2.9 million for Wasteland 2 on Kickstarter. Investors: Kickstarter fans. April 17.

68. Plumbee — Plumbee raises $2.8 million for social casino games. Investor: Idinvest Partners. March 22.

69. Flaregames — Started by Gameforge founder Klaas Kersting, Flaregames raises $2.63 million for social and mobile games. Investor: Accel Partners. April 4.

70. Jawfish Games — Jawfish Games raises $2.6 million for online gaming tournament platform. Investor: Founders Fund. July 23.

71. Adicttiz — France’s Adictiz raises $2.54 million for web and mobile games. Investor: Omnes Capital. Nov. 13.

72. Artillery — Artillery raises $2.5 million to make high-end browser-based games. Investors: First Round Capital, Signia Ventures, Chris Sacca’s Lowercase Capital, General Catalyst, Andreessen Horowitz, longtime former Googler Ben Ling, Greylock’s Ali Rosenthal, Bubba Murarka, Tim Ferriss, Crunchfund, and Kevin Colleran. Aug. 3.

73. MS Paint Adventures — Andrew Hussie’s comic-style Homestuck Adventure game raises $2.4 million on Kickstarter. Investors: Kickstarter fans. Oct. 4.

74. Oculus VR — Oculus VR is bringing back virtual reality with its Oculus Rift googles. The company raises $2.4 million on Kickstarter. Investors: Kickstarter fans. Sept. 1.

75. Frontier Developments — Frontier Developments raises $2.4 million for Elite Dangerous game on Kickstarter. Investors: Kickstarter fans. Jan. 4.

76. Uber Entertainment — Uber Entertainment gets $2.2 million for Planetary Annihilation game on Kickstarter. Investors: Kickstarter fans. Sept. 4.

77. Wedgebuster — Wedgebuster raises $2.2 million for sports mobile games. Investors: 37 Technology Ventures, Park Lane, Drew Brees, Rob Dyrdek and others. Sept. 25.

78. Fight My Monster — Fight My Monster raises $2.1 million fro free-to-play trading card games. Greycroft Partners, eVenture Capital Partners, and angels. Feb. 16.

79. Koolbit — Koolbit scores $2 million for social casino games.

79. Koolbit — Koolbit scores $2 million for social casino games.

80. Seismic games — Seismic Games raises $2 million for next-generation social games. Investors: DFJ Frontier and venture capitalist Tom Matlack. Jan. 4.

81. Scalify — Australia’s Scalify raises $2 million to improve networking performance in online game worlds. Investor: Starfish Ventures. May 6.

82. Grand Cru — Helsinki’s Grand Cru raises $2 for kids online game Supernauts. Investors: Rick Thompson, Idinvest Partners, Nicolas Beraud, Anil Hansjee, and Henric Suuronen.

83. Stray Boots — Stray Boots raises $2 million for gamified urban city tours. Investors: Correlation Ventures, Milestone Venture Partners, Great Oaks, and angels. Nov. 27.

84. Wemo Media — Wemo Media grabs $2 million for TheBlu animated ocean world. Investors: Not disclosed. Jan. 9.

85. Yodo1 — Yodo1 raises $2 million to distribute Western-made games in China. Investor: ChangYou Fund. June 28.

86. Corona Labs — Corona Labs raises $2 million fo fund its cross-platform game development plaform. Investors: Merus Capital and Western Technology Investment. Nov. 13.

87. PlaySpace — PlaySpace raises $1.9 million for Spanish and Portuguese social games. Investor: Faraday Ventures. Sept. 5.

88. ApsIndep — AppsIndep raises $1.8 million for online games. Investor: TMT Investments. Nov. 12.

89. Funium — Funium gets $1.8 million for Family Village heritage game. Investors: Family Odyssey and angel investors. Aug. 7.

90. Harebrained Schemes — Jordan Weisman’s Harebrained Schemes raises $1.8 million for Shadowrun Returns on Kickstarter. Investors: Kickstarter fans. April 29.

91. Eelusion — Berlin’s Eelusion raises $1.7 million to make Eevoo “geo-social game.” Investors: not disclosed. May 8.

92. Grantoo — Grantoo raises $1.7 million to help students pay tuition by playing social games. Investors: Angyal Capital, Olivier Douce, Olivier Legrain, Daniel Hechter, Jacques Berrebi and Pierre Lavail. Oct. 10.

93. Tequila Mobile — Poland’s Tequila Mobile raises $1.7 million to expand business of distributing games through mobile app stores. Investors: Not disclosed. Jan. 3.

94. Serious Paradoy — Serious Parody scores $1.6 million for mobile games such as Wrestling Manager. Investors: Scottish Enterprise and undisclosed investors. May 16.

95. Kamcord — Kamcord raises $1.5 million for mobile game recording. Investors: Andreessen Horowitz, Google Ventures, Tencent, Marissa Mayer, and Alexis Ohanian. Dec. 19.

96. Kihon Games — Arizona’s Kihon Games raises $1.5 million for mobile games. Investors: Signia Venture Partners. July 3.

97. Playsino — Brock Pierce’s Playsino raises $1.5 million for social casino games. Investors: IDM Venture Capital, Pacific Capital Group, Siemer Ventures, Jordan Simons, Wicks Walker, Tomorrow Ventures, Jim Armstrong and Michael Huskins. April 20.

98. Execution Labs — Starting an incubator focused on games, Execution Labs raises $1.4 million to fund and train game companies in Canada. Investors: BDC Venture Capital, Real Ventures, White Star Capital, Jimmy Foo, and Richard Wu. Nov. 8.

99. Ovelin — Finland’s Ovelin raises $1.4 million for interactive, gamified app on the iPad that teaches kids how to play a guitar. Investor: True Ventures. Feb. 8.

100. Le Groupe Interaction — Le Groupe Interaction gets $1.35 million for interactive games. Investors: NCI Gestion. Oct. 18.

101. Lookout Gaming — Lookout Gaming grabs $1.25 million for game monetization product. Investors: Atlas Venture and Nextview Ventures. Nov. 19.

102. Digit Games Studios — Digit Games Studios scoops up $1.25 million to establish indie game studio in Ireland. Investors: ACT, Delta, and Enterprise Ireland. June 27.

103. Pixowl — Pixowl raises $1.2 million for story-based and character-driven mobile games. Investors. Sept. 27.

104. Phoenix Guild — Jason Citron, founder of OpenFeint, wanted to get back to making games. So he started Phoenix Guild to make games for the “post-PC era.” Citron raised $1.1 million. Investors: YouWeb, Accel and General Partners. July 10.

105. LevelEleven — Detroit-based LevelEleven raises $1 million for gamification of the sales process. Investors: Detroit Venture Partners and ePrize. Oct. 30.

106. BitRhymes — BitRhymes raises $1 million for casino games such as the hit game Bing Bash. Investors: Mark Jung, Yucheng Chiang, Dan Cooperman, and Doug Bergeron. April 16.

107. Eruptive Games — Eruptive Games raises $1 million for action-adventure social games such as Citizen Grim. Investors: Kevin Colleran, Kai Huang, Nadeem Kassam, and Plarium. July 9.

108. Grow Mobile — Grow Mobile raises $1 million for mobile game and app marketing and data management. Investors: Signia Venture Partners and Bessemer Venture Partners. Sept. 7.

109. Playerize — Playerize secures $1 million to recruit more players for social games. Investors: Real Ventures, Rho Ventures, Mike Edwards, David Chamandy, Martin-Luc Archambault, Dan Robichaud, and Jason Bailey. Jan 4.

110. Pug Pharm Productions — Canada’s Pug Pharm Productions nabs $1 million for gamification engine. Investor: Goal Holdings. Oct. 30.

120. Revolution Software — Revolution Software raises $771,560 on Kickstarter for Broken Sword: The Serpent’s Curse. Investors: Kickstarter fans. Sept. 22.

121. Zipline Games — Zipline Games raises $750,000 for Moai game development platform. Investors: Founders Co-Op, Benaroya Capital, Pioneer Venture Partners, and Groundspeak. July 6.

122. Brass Monkey — Brass Monkey raises $750,000 to enable gamers to turn their smartphones into game controllers. Investors: Jeremie Berrebi, David Beyer, Nicole Stata, and others. Jan. 18.

123. Plyve — Plyfe nabs $750,000 for platform that lets brands to promote themselves through games and rewards. Investors: Crosscut Ventures. Nov. 29.113. Stoic — Stoic raises $723,886 for the Viking strategy game Banner Saga on Kickstarter. Investors: Kickstarter fans. April 20.

124. TribePlay — China’s TribePlay raises $750,000 for Dr. Panda kids’ games. Investor: Unnamed Dutch and Asian investors. Dec. 4.

125. Sauropod Studio — Sauropod Studio scores $702,516 for Castle Story on Kickstarter. Investors: Kickstarter fans. Aug. 26.

125. Sauropod Studio — Sauropod Studio scores $702,516 for Castle Story on Kickstarter. Investors: Kickstarter fans. Aug. 26.

126. Replay Games — Replay Games gets $673,602 for Leisure Suit Larry Remake on Kickstarter. Investors: Kickstarter fans. May 2.

127.Mavenhut — Mavenhut raises $650,000 for social gaming studio in Ireland. Investor: SOSventures. Nov. 16.

128. UpTap — UpTap raises $645,000 for tablet games. Investors: Seattle area angels. Sept. 27.

129. Stainless Games — Stainless Games raises $625,143 on Kickstarter for Carmageddon: Reincarnation. Investors: Kickstarter fans. June 6.

130. Chris Jones and Aaron Conners — Tex Murphy Project Fedora scores $598,104 on Kickstarter. Investors: Kickstarter fans. June 16.

131. Winterkewl Games — Winterkewl Games raises $567,665 on Kickstarter for sandbox adventure game Yogventures. Investors: Kickstarter fans. May 6.

132. Cliffhanger Productions — Cliffhanger Productions raises $558,863 on Kickstarter for Shadowrun Online. Investors: Kickstarter fans. Aug. 14.

133. Camouflaj — Camouflaj raises $555,662 on Kickstarter for Republique game. Investors: Kickstarter fans. May 11.

134. Tap Lab — Tap Lab raises $550,000 to fund location-based mobile games. Investors: Alex Rigopoulos, Eran Egozy, Don Dodge, Mike Dornbrook, and other angels. April 3.

135. We Want To Know — French-Norwegian game developer We Want To Know raises $550,000 to make math fun for kids. Investor: Jon von Tetzchner. Dec. 12.

136. Two Guys From Andromeda —Two Guys From Andromeda raises $539,767 on Kickstarter for SpaceVenture. Investors: Kickstarter fans. June 12.

137. Crate Entertainment — Crate Entertainment pulls in $537,515 on Kickstarter for Grim Dawn action role-playing game. Investors: Kickstarter fans. May 18.

138. Penny Arcade — Penny Arcade raises $528,144 on Kickstarter to become independent from advertising. Investors: Kickstarter fans. Aug. 15.

139. Subutai — Subutai scores $526,125 for Clang on Kickstarter. Investors: Kickstarter fans. July 9.

Interactive Project — Italy’s Interactive Project garners $510,000 for racing title. Investors: LVenture. Nov. 14.

140. Game Genome Project — Game Genome Project raises $500,000 to make game discovery better. Investors: Anu Nigam and Roberto Fonti. Sept. 25.

140. Game Genome Project — Game Genome Project raises $500,000 to make game discovery better. Investors: Anu Nigam and Roberto Fonti. Sept. 25.

141. MadRat Games — MadRat Games gets $500,000 for games in Indian market. Investor: Blume Ventures and First Light Ventures. Dec. 10.

142. TinyTap — TinyTap raises $500,000 for children’s educational games. Investors: Israel’s Inimiti. Nov. 12.

143. Duxter — Duxter raises $500,000 for gamer social network. Investors: not disclosed. Nov. 6.

144. Pinkerton Road Studio — Jane Jensen’s Pinkerton Road Studio raises $435,316 on Kickstarter. The creator of Gabriel Knight (Jensen, pictured right) is creating a new adventure game called Moebius. Investors: Kickstarter fans. May 8.

145. Spitball Entertainment — Spitball Entertainment raises $300,000 for celebrity musician game. Investors: Not disclosed. March 16.

146. Quelle Histoire — Quelle Histoire raises $269,700 for history games. Investors: Paris Business Angels. Oct. 29.

147. Refract Studios — Refract Studios raises $161,981 on Kickstarter for Distance arcade racer. Investors: Kickstarter fans. Nov. 16.

148. Big Robot — Big Robot raises $145,358 on Kickstarter for Sir, You Are Being Hunted. Investors: Kickstarter fans. Dec. 2.

149. Infantium — Spain’s Infantium gets $134,850 for learning games for young kids. Investors: Grupo ITnet, SeedRocket Business Angels, and Enisa. Oct. 25.

150. David Hellman and Tevis Thompson — Two-man team raises $69,581 for Second Quest game on Kickstarter. Investors: Kickstarter fans. Nov. 16.

151. Softgames — Softgames gets $70,000 for HTML5 gaming platform. Investors: not disclosed. Oct. 26.

No amounts known

The following investments do not have disclosed amounts. We have put them in reverse chronological order. (If you know the number, let us know).

152. Mangatar — Italy’s Mangatar raises seed funding for Dengen Chronicles game. Investor: dPixel. Dec. 29.

153. Infernum Productions — Infernum Productions raises round for free-to-play games such as Brick Force. Investors: Koch Media/Deep Silver. Dec. 18.

154. Kabam — Kabam raises round for hardcore free-to-play social and mobile games. Investors: Warner Bros. and MGM. Dec. 11.

155. Storybricks — Storybricks raises round and pivots to creating artificial intelligence for online games. Investors: Alex Khein, Kima Ventures, Playfair Capital, and Andy McLoughlin. Dec. 5.

156. HitFox — HitFox raises round and expands globally with four new game distribution businesses. Investors: Team Europe Ventures, HV Holtzbrinck Ventures, Tengelmann Ventures, Hasso Plattner Ventures, Kite Ventures, and Digital Pioneers. Dec. 4.

157. Boomlagoon — Former Angry Birds developers secure funding for new game studio. Investors: Jari Ovaskainen and London Venture Partners. Nov. 28.140. Gogamingo — Gogamingo raises funds for cross-platform tournament system. Investors: not disclosed. Nov. 15.

158. Tista Games — Tista Games raises round for episodic games for hardcore gamers. Investor: Piedmont RIA (Militello Capital). Nov. 6.

145. Kidaptive — Kidaptive raises money for educational iPad apps that are disguised as games. Investors: Menlo Ventures, Crunchfund, Veddis Ventures, S-Cubed Capital, Krantz Holdings, VKRM Ventures, iCamp, and Prana Holdings. Oct. 12.

145. Kidaptive — Kidaptive raises money for educational iPad apps that are disguised as games. Investors: Menlo Ventures, Crunchfund, Veddis Ventures, S-Cubed Capital, Krantz Holdings, VKRM Ventures, iCamp, and Prana Holdings. Oct. 12.Oct. 9.

165. JumpStart — Formerly Knowledge Adventure, JumpStart rebranded and raises a round of funding to make educational games. Investors: Azure Capital Partners, TeleSoft Partners, and other investors. Oct. 4.148. LionWorks — Guatemala’s LionWorks raises funds to make Latin American games. Investors: PeopleFund. Oct. 3.

166. BitGym — BitGym raises funds to create motion-sensing games for mobile devices. Investors: Sam Altman, Zen Chu, and William Lohse. Sept. 30.

167. CiiNow — CiiNow raises round for software that reduces the costs and complexities of cloud-gaming services. Investor: Advanced Micro Devices. Sept. 11.

168. MediaSpike — MediaSpike raises round for in-game ads. Headed by Facebook gaming pioneer Blake Commagere, MediaSpike embeds product placements in social games. Investors: Raptor Capital, CMEA, 500 Startups, Venture51, EchoVC, and HNK Ventures. Sept. 7.

169. RocketPlay — RocketPlay blasts off with funding for sports casino games on Zynga’s platform. The company has raised “less than $10 million.” Investors: Pitango Venture Capital. Sept. 5.

169. RocketPlay — RocketPlay blasts off with funding for sports casino games on Zynga’s platform. The company has raised “less than $10 million.” Investors: Pitango Venture Capital. Sept. 5.

170. OHK Labs — OHK Labs scores money to launch SportsPicker Challenge sports-betting game. Company raised at least $250,000. Investors: not disclosed. Sept. 5.

171. Fingerprint Digital — Fingerprint Digital raises money so it can give kids something to play when they steal your iPhone. Investor: Corus Entertainment. Sept. 5.

172. PointMMO — PointMMO raises millions for massively multiplayer online gaming portal. Investors: not disclosed. Aug. 30.

171. SkyVu — Battle Bears creator SkyVu raises venture round to beef up its game brands. Investors: Lightbank, Nextview Ventures, Great Oaks Venture Capital, Michael Chang, and the Nebraska Angels. Aug. 14.

173. Innovative Leisure — Innovative Leisure scores a seed round to make arcade-style mobile games using Atari’s famous game designers. The company is headed by Xbox co-creator Seamus Blackley and Van Burnham. Investor: Hummer Winblad. Aug. 6.

174. Xyologic — Xyologic gets funding for game and app search engine on Android. Investors: Klaas Kersting, Signia Venture Partners, and Eric Wahlforss. Aug. 2.

175. Diversion — Los Angeles social gaming firm Diversion raises funds. Investors: Shawn Fanning, Michael Eisner, TomorrowVentures, Hearst Corp., The Tornante Company. July 22.

176. PeopleFun — PeopleFun gets funding for mobile games. Headed by former Ensemble Studios founder Tony Goodman, the team is keeping mum about its titles. Investors: Self-funded. July 17.

176. PeopleFun — PeopleFun gets funding for mobile games. Headed by former Ensemble Studios founder Tony Goodman, the team is keeping mum about its titles. Investors: Self-funded. July 17.

177. Jump Games — Tom Hanks moves into the game business by funding Jump Games. Investor: Tom Hanks. July 17.

178. Forgame Tech — China’s Forgame Tech raises a round of private equity for web games. Investors: TA Associates, Qiming Venture Partners, Ignition Capital Partners. July 11.

179. Betable — Betable raises seed round for platform that converts social casino games into real-money online gambling games. Investors: Greylock Discovery Fund, FF Angel LLC, True Ventures, Dave Morin, Yuri Milner, CrunchFund, Marc Abramowitz, Scott Belsky, Auren Hoffman, Sean Knapp, Howard Lindzon, Matt Ocko, Joshua Schacter, and Arjun Sethi. July 9.

180. Epic Games — Epic Games, maker of Unreal and Gears of War, raises strategic investment. Investor: Tencent. June 19.

181. Cmune — Cmune raises a round for first-person shooter games on social networks. Investor: Atomico. May 10.

182. IUGO Mobile Entertainment — IUGO Mobile Entertainment raises a round to make mobile games. Investor: Gree. April 19.

183. Aeria Games — Aeria Games gets strategic investment for hardcore free-to-play online games. Investor: Sony’s So-net Entertainment. April 18.

184. Spaceport.io — Spaceport.io raises money for cross-platform gaming. Investors: BBC Worldwide and YouWeb. April 11.

185. Transmension — Transmension raises funding for games for smart TVs. Investor: Intel. April 10.

186. Lifo Interactive — South Korea’s Lifo Interactive raises funds for social games. Investor: Intel Capital. March 10.

187. Dramagame — Dramagame (formerly Tribe Studios) raises a round for an acting game. Investors: Rauli Arjatsalo, Mikko Elomaa, Ville Skogberg and Kontro & Peuru Consulting Group. March 8.

188. Chuck Studios — Chuck Studios raises seed funds to move into social gaming. Investors: Bartle Bogle Hegarty, BBH Asia Pacific, and Perfetti Van Melle. Feb. 19.

189. Bionic Panda Studios — Charles Hudson’s Bionic Panda Studios raises funding for Android mobile games. Investors: Google Ventures, SoftTech VC, Norwest Venture Partners, 500 Startups, Craig Sherman, Kal Vepuri. Jan. 17.

![]() We’re holding our third annual VentureBeat Mobile Summit conference this April 1-2 in Sausalito, Calif. The invitation-only event gathers the top 180 executives from all segments of the mobile ecosystem to develop a blueprint for the industry’s growth in the coming year. For more information and to request an invitation, click here.

We’re holding our third annual VentureBeat Mobile Summit conference this April 1-2 in Sausalito, Calif. The invitation-only event gathers the top 180 executives from all segments of the mobile ecosystem to develop a blueprint for the industry’s growth in the coming year. For more information and to request an invitation, click here.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More