Gamification, or the use of game mechanics in non-game applications, has made its way to stock trading.

Kapitall has launched an online stock-trading site that makes trading stocks a lot less intimidating for people who aren’t familiar with stock trading. The basic idea is that trading stocks should be no more difficult than playing a video game. And if you practice at it long enough, you can become much more skillful than a neophyte stock picker. This clever approach to training people how to do something hard is another sign that the influence of gaming is growing and that gamification — delivered as achievement, badge, and leaderboard services to enterprises — has only scratched the surface so far.

“Financial services brands are delivering complex services to active traders who have experience,” said Jarrett Lilien, the chief executive of New York-based Kapitall, in an interview with GamesBeat. “We feel that’s a little unfair to smaller investors. We tried to simplify it because too much information is overwhelming.”

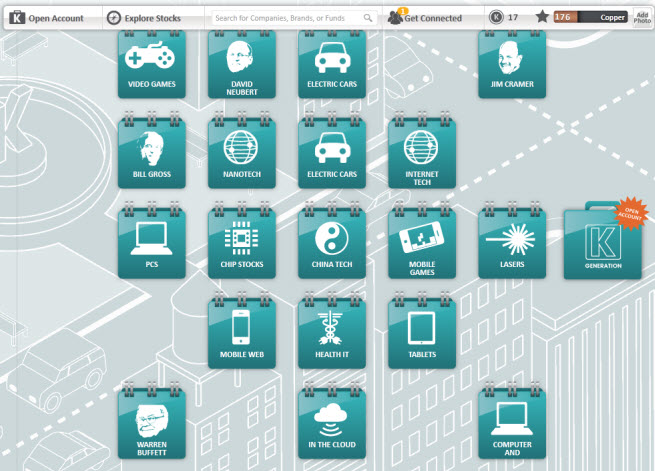

The user interface for Kapitall, pictured above, looks a lot more like a video game than an online brokerage account. That’s important for attracting people 35 and under, who are more likely to enjoy a game-like experience. Lilien said Kapitall draws a young set of customers, and roughly half are women.

When you first create an account, you play for free. You receive $25,000 in virtual money to get started picking stocks. When you aren’t trading with real money, you can do the experimentation it takes to understand how stocks move up and down over time. The first time I logged in, I went through a tutorial that showed me important numbers to notice like “price of profit.” That number is basically a forward price-earnings ratio, which divides a company’s stock price by its expected earnings per share 12 months from now. It is a measure of how good a deal a stock is. The lower the number, the better the opportunity to make money.

You can drag and drop icons onto a central work space dubbed a “playground,” where you can look at a lot of things at once. You can look at stocks on a superficial level or drill down on them. The tutorial also shows you how to compare different stocks with the press of a button. You can do so by using an “analyze” or “compare” tool. It’s easy to see analyst ratings at a glance, so you can see whether the bulk of analysts following the company recommend it or not. Purchasing a stock is similarly easy.

The second time I logged in, I found that my practice portfolio of $25,000 had turned into $24,996. But my return for that day was $9.63. A normal newbie investor would play around with the practice portfolio for a while and see if he or she had a knack for making money trading stocks. If they don’t, then they won’t lose any money. But if they can consistently make money over six months or a year, it might very well be profitable to convert the practice account into a real online brokerage account.

That’s where Kapitall makes money, and it gives you a series of missions to fulfill so that you can get more comfortable with trading. Some of the changes are intuitive. Rather than show a new investor a tile with a stock symbol, Kapitall has a tile with an icon on it. A stock ticker runs across the bottom of the page with real-time stock quotes. But the stock symbols are replaced with icons so that the company are more easily recognizable.

You can explore stocks by clicking on the icons of investment themes. Those icons include a portfolio of stocks that fit a particular investment strategy. If you want to invest in electric cars, you’ll see stocks like Tesla listed.

If I had any complaint about the way Kapitall looks, it’s that it doesn’t look enough like a game. But it has to balance the need to make its user interface flashy against the fact that a very different type of user will be playing this “game.” You can share your picks with others. But Gaspard de Dreuzy, who has the game experience on the team, said in an interview with GamesBeat that Kapitall is designed like a game, but it just doesn’t look like a game.

“Our market is likely going to skew toward women who are older,” de Dreuzy, chief innovation officer, said.

The video game experience comes from founder de Dreuzy, who started the company (under the name Stereo Scope) in 2008 with Serge Kreiker, Cordell ratzlaff, David Neubert and Sally Wood. Lilien, former president of E*Trade who has spent a career in stock trading, came on in August as chief executive and chairman. It launched its first iteration of its Kapitall web site in 2009 and it now has dozens of employees. One of its directors is Mike Haller, former senior vice president at video game publisher THQ, and an advisor is Bruce Shelley, a game veteran and co-creator of Age of Empires.

“The world doesn’t need another online broker,” said Lilien. “But there is an opportunity for one that brings a radical change to the usual model.”

“And to me, the user experience will be the next radical change,” de Dreuzy said. “We don’t really like the word ‘gamification’ because it suggests you do something on top of another site. In this case, we have built in the game technology from the ground up.

Real-world brokers are likely to give you a lot more attention. But if you want to sign up with Merrill Lynch, you’ll find that you have to put a lot of money down.

Their hope is to use gaming to change how people invest in the future.

So far, more than 100,000 people have logged in and created practice portfolios. Of those, 2,800 have created brokerage accounts. Over time, de Dreuzy said his company will add more features and applications. The way he sees it, the company has creating an operating system for gamifying online trading. And the applications will follow to make the users more and more engaged.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More