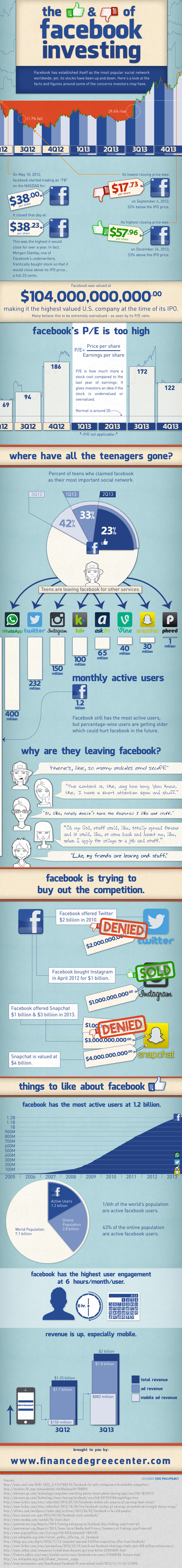

Since Facebook’s blockbuster $16 billion IPO in 2012, the social network has seen its share of highs and lows.

The company had an impressive $2 billion in revenue in the third quarter of 2013, beating analyst expectations of $1.91 billion. It’s gained nearly a half billion monthly active users on mobile over the last two years, and overall engagement remains exceptionally high at six hours per month per user.

But not everything is rosy in Facebook-land. On a late October earnings call, Facebook’s chief financial officer admitted that the number of younger teen users declined in the third quarter of 2013, which quickly wiped $18 billion off the company’s market valuation. The stock has since crept back to the $57-a-share mark, but declining teen interest remains a worrisome stat for Facebook investors — as does the platform’s high price-per-share to earnings-per-share ratio, which suggests that the stock may be overvalued.

The infographic below from Finance Degree Center offers a broad view of where the social network stands, highlighting some of the pros and cons of investing in Facebook today.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c5457c1d-1f37-48c2-b438-a1b0eeb2d16b)