This is a guest post by Indy Guha, an investor at Bain Capital Ventures

This week at Dreamforce, cloud applications businesses will come together to celebrate product announcements, impressive growth, partnerships and much more. That momentum is also reflected in all-time-high valuations, with Software-as-a-Service (SaaS) companies trading at an average of 12 times last-twelve-months revenue.

Unfortunately, high valuations come with equally high growth expectations. The expectation that you need to keep landing huge customers, and growing revenues, is omnipresent. Chief marketing officers and sales officers are feeling the pressure. I often hear this concern from CMOs: “My boss wants a plan for 60 percent growth next year… off a big number. Where are we going to find that many leads?”

At my firm, I developed a marketing and sales tech toolkit dubbed the “Revenue Pit-Crew” to address this issue. More on that to come.

How did we get here?

The cloud services market will hit $131 billion this year and is growing just over 18 percent annually, according to a Gartner research report. Specifically, cloud applications are an estimated $20 billion market, growing at 19 percent annually, due to their speed of deployment and customer time-to-value.

Over the last 2 years, investors saw these growth projections and opened their check books. Consequently, as Tomasz Tunguz notes in this thorough analysis, SaaS valuations have grown 200 to 400 percent, despite unchanged customer unit economics.

CMOs and sales are therefore under pressure to deliver both the top-line growth investors are expecting and better unit economics. That means lowering customer acquisition cost (CAC), increasing customer-lifetime-value (CLTV), and all the other key SaaS metrics that Wall Street will care about.

No pressure or anything, CMOs.

Consequently, as these teams strive for efficient growth at large scale, marketing and sales leads will become major buyers of technology.

The “Revenue Pit-Crew” to the rescue

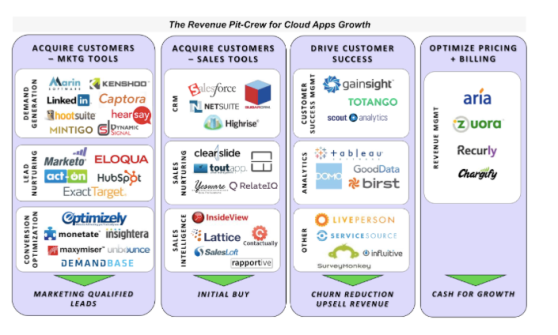

Sophisticated go-to-market teams already rely on technology partners — what I call the “Revenue Pit-Crew,” who can help keep their growth engine humming.

These partners help other cloud apps maximize growth and profitability across the revenue value chain, whether it’s cheaper acquisition, maximizing up-sells or more efficient billing. Below, I’ve charted out a core set of tools that come up most often in conversations with sales and marketing leaders.

Some of these categories, like “Lead Nurturing,” are well established. However, the growth of cloud apps and subscription business models presents new pain points and therefore new categories, such as “Customer Success Management” and “Recurring Revenue Management.”

For example, with on-premise, perpetual software, account management was a cost center. Today, customers can leave you at each renewal cycle, making proactive account management and customer success a strategic priority. Solutions like Gainsight and Totango help clients:

- Aggregate every source of customer data

- Visualize that data into account health scorecards

- Identify clear actions and trigger alerts for the account management team (in an increasingly competitive cloud apps landscape, maximizing up-sells and retention is an easier path to growth than getting new customers)

Similarly, prior to cloud apps, very few industries, such as telecoms and insurance, needed to deal with recurring revenue management. Managing all the permutations and combinations of different pricing tiers, charge models, billing frequency and product bundles is incredibly complex. And doing so without hurting cash collection is key to funding growth. That’s why solutions like Aria and Zuora are mission-critical.

As pricing models for cloud apps continue to evolve, this category will become even more inportant.

Editor’s note: Our upcoming DataBeat conference, Dec. 4-Dec. 5 in Redwood City, will focus on the most compelling opportunities for businesses in the area of big data analytics and beyond. Register today!

[Disclosure: Aria and Gainsight are Bain Capital portfolio companies]

Gearing up for growth

The need for a Revenue Pit-Crew is just beginning. As mainstream businesses like Adobe Creative Suite and Target’s baby products category move to subscription models, the need for these solutions will only get broader.

How will they manage that growth? What solutions will these companies turn to? Here’s a public hackpad to help all of us track and revisit this discussion.

Indy Guha joined Bain Capital Ventures in 2007 and invests in early and growth-stage Software-as-a-Service companies companies. His “major” is marketing tech and he’s excited to have backed companies like BloomReach, Optimizely, Gainsight, Captora and other great Bay Area teams.

Indy Guha joined Bain Capital Ventures in 2007 and invests in early and growth-stage Software-as-a-Service companies companies. His “major” is marketing tech and he’s excited to have backed companies like BloomReach, Optimizely, Gainsight, Captora and other great Bay Area teams.

Previously, Indy was a strategy consultant at the Monitor Group, specializing in serving technology clients. Indy holds a BS in Finance and BA in International Relations from the University of Pennsylvania. He received his MBA from Harvard Business School.

Follow him on Twitter @indyguha

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=9519f225-1383-49ea-becb-df854cf335b0)