The next generation of online payments: As brands retool to meet consumers’ growing demand for convenience and security, we explore the future of online payments in this timely series brought to you by Braintree. Check out the whole series here.

The next generation of online payments: As brands retool to meet consumers’ growing demand for convenience and security, we explore the future of online payments in this timely series brought to you by Braintree. Check out the whole series here.

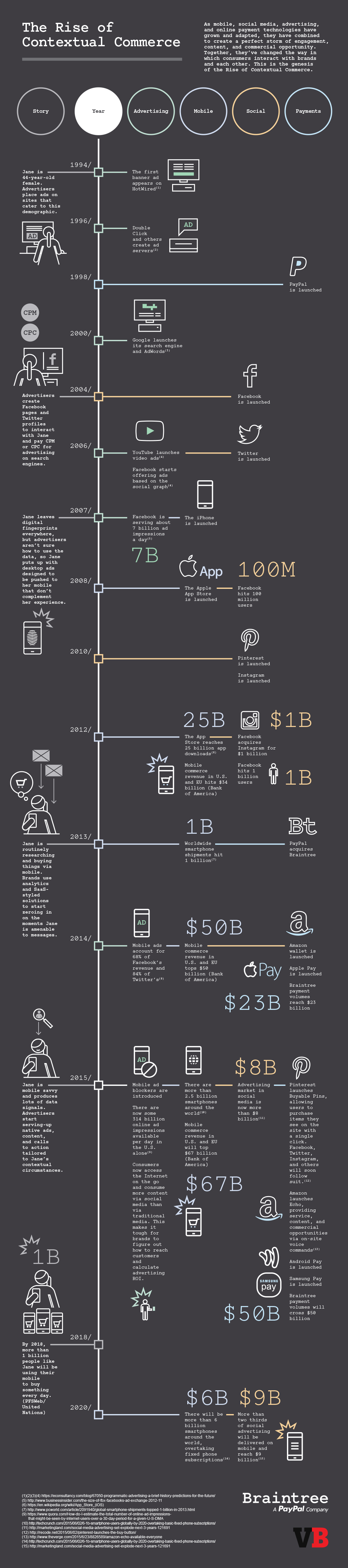

The rise of contextual commerce – using data from devices, apps, and websites to provide customers with the ability to make purchases and payments wherever they happen to be online – is all about the confluence of evolving technologies, markets, and consumer trends.

As mobile, social media, advertising, and online payment technologies have grown and adapted, they have combined to create a perfect storm of engagement, content, and commercial opportunity that has changed the way in which consumers interact with brands and each other.

The first signs of the gathering storm of contextual commerce can be traced back to 1994, when HotWired introduced the first-ever banner ad to the World Wide Web. The idea then, as now, was simple: present people with a relevant call-to-action that leads to a good outcome for the sponsoring brand. A few short years later – after DoubleClick introduced ad servers, but before Google became a verb and Ad Words were at marketer’s fingertips – PayPal was launched and a whole new way to buy and sell online was created.

Social media was the next major fountainhead. Facebook, Twitter and YouTube all launched between 2004 and 2006, giving millions (and eventually billions) of us a bottomless pool of digital content to gather around, discuss, and share. By 2007, Facebook was already serving about 7 billion ad impressions per day, and each time we interacted, we left a digital fingerprint that could be used by brands to understand who we were, what we ‘liked,’ and the people and things that influenced our behavior.

It was also in 2007 that the iPhone was introduced, and the tsunami that we now call m-commerce began to form. The App Store was launched just a year later, and by 2012, more than 25 billion apps had been downloaded. To this day, the most popular apps worldwide are from large social media networks, which, by now, have trillions of data points that run much deeper than what we like, and extend to our buying habits and how, when, and where we use our mobile devices.

By 2013, more than 1 billion smartphones had been shipped, Facebook had 1 billion users with 68% of its revenue coming from mobile ads, and m-commerce revenue in the U.S. and EU alone topped more than $50 billion. Amazon and Apple would soon launch their own digital wallet offerings, but it was PayPal that carved out the most ubiquitous market position with its acquisition of Braintree, which enables secure mobile payments across a variety of payments platforms, rather than limiting consumers and merchandisers to individual walled gardens.

Underlying the swelling confluence of mobile, social, and payments technologies was an extraordinary amount of data, long believed by advertisers and data scientists alike to contain untold commercial opportunity, if only it could be analyzed and meaningful insights extracted. As 2015 began, it became clear that a tipping point was at hand.

Investment in marketing analytics technologies by then had reached more than $45 billion annually, and was still growing. By 2015, investment on analytics tech was three times higher than any other Martech segment. This dovetailed with other stunning indicators of a content-thirsty world gathering at the confluence of mobile (2.5 billion smartphones now shipped), social (Pinterest introduces Buyable Pins), advertising (there are now more than 318 billion daily ad impressions in the U.S. alone), and payments tech (in 2015, Braintree’s annualized payment volume will cross $50 billion).

We, as a species, are mobile social creatures. We consume, feed, and share content voraciously. We influence and we are influenced by these technologies. Advertisers have greater tools than ever to find and engage us using creative, context-aware native ads to move us further along the path to purchase intent. Buy Now buttons and deceptively simple payment technologies make it easy for merchandisers of all types to get us to say “yes” and make a purchase.

By 2020, there will be more than 6 billion smart phones on Planet Earth, and more than two-thirds of all social advertising will be delivered via mobile. M-commerce will have grown from being a small part of the e-commerce universe to accounting for over 50% of all digital transactions globally. And the context of how we live, engage, and transact throughout the remainder of our days will have changed forever.

Sponsored posts are content that has been produced by a company that is either paying for the post or has a business relationship with VentureBeat, and they’re always clearly marked. The content of news stories produced by our editorial team is never influenced by advertisers or sponsors in any way. For more information, contact sales@venturebeat.com.