Bitcoin first cracked a $1 billion market cap on March 30, 2013. And by the following month, it had reached $1.504 billion. Meanwhile, the market for additional blockchain assets outside of bitcoin (“non-bitcoin blockchain assets”) was vastly smaller, totaling in at just $92 million on April 28, 2013.

Less than three years later — on March 21, 2016 — while the bitcoin market cap had grown 300% to $6.318 billion, non-BTC blockchain assets had grown a whopping 1,600% to $1.602 billion.

You can see the dramatic evolution of blockchain assets in terms of market capitalization and asset composition in some illustrations below.

Market cap over time — blockchain assets

Market cap over time — non-bitcoin blockchain assets

Ratio over time — non-BTC blockchain asset market cap / total blockchain asset market cap (%)

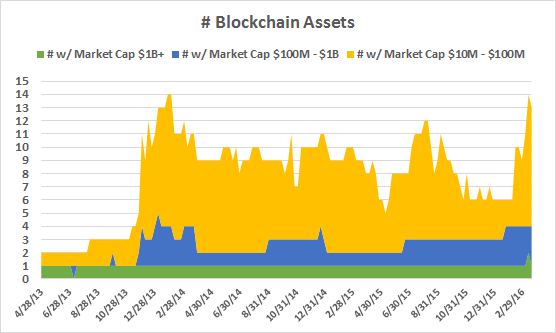

Number of assets over time — large blockchain assets

Composition over time — major non-BTC blockchain assets

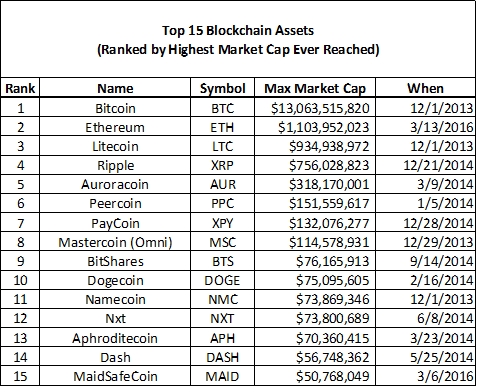

Ranking – top 15 blockchain assets (by largest market cap ever reached)

Ranking – top 15 blockchain assets (by largest current market cap)

The blockchain asset market currently sits in the following state as we move past Q1 2016:

- Bitcoin comprises just about 80% of the total blockchain asset market cap

- 15 blockchain assets have now exceeded a $50 million market cap (ever)

- 13 blockchain assets currently exceed a $10 million market cap

- Ether just broke a $1 billion market cap, making it the first non-BTC blockchain asset to ever break this mark. It now sits in the second place blockchain asset position (by current and all-time market cap).

A closer look at the larger blockchain players

Let’s explore some of these larger non-bitcoin blockchain assets a bit further. Here are the top five, ranked by current market cap, all over $30 million (data source: Coinmarketcap).

As you can see, three non-BTC blockchain assets have spiked over the $500 million market cap level: Litecoin in late 2013, Ripple in late 2014, and Ether in early 2016.

Litecoin is an open source fork of the bitcoin client that was released in October 2011 by Charlie Lee, a former Google engineer and MIT CS graduate who currently leads engineering at Coinbase. Some of Litecoin’s primary differences to bitcoin are: a decreased block time (“2.5 minutes, one quarter of bitcoin’s 10 minutes”), an increased total supply (“84 million, four times as many currency units as bitcoin”), and a different proof-of-work block hashing algorithm (“scrypt instead of SHA256”).

Ripple comes from from Ripple Labs, a San Francisco based startup (founded in 2012 with over $35 million in funding) that created an open payment network based on what it says is “the world’s first distributed exchange” and a “counterparty-free currency”. In addition to its development of the Ripple protocol and open-source software (for which it encourages developer contributions), it is actively “building a global financial settlement network” comprised of “international payment originators, financial institutions, market makers, and system integrators” to “provide a significantly superior alternative to the current system of cross-border settlement (which provides limited access, with settlement risk, two to four day transaction cycles, and high costs)”. As to the supply of Ripple, it’s “method of confirmation, called consensus, doesn’t need mining”, and thus Ripple has the following distribution of its native currency (source: https://ripple.com/xrp-portal/):

The company says that, “in theory, users of the Ripple Network could exchange anything of value (fiat currencies, digital currencies, gold, securities, etc.),” and much more. Some major ways if differs from bitcoin are that Ripple “can send and automatically exchange any currency”, “has no mining or direct monetary reward for running a server”, and uses “consensus instead of proof-of-work,” resulting in a totally different supply structure.

Ether is the built-in currency of open source blockchain app platform Ethereum. It was founded by Vitalik Buterin (a 22-year-old University of Waterloo dropout, Thiel Fellow, and Bitcoin Magazine cofounder) in late 2013 and is now developed by a team of developers for the Ethereum Foundation. Ethereum is a “decentralized platform that runs smart contracts on a custom built blockchain: applications that run exactly as programmed (without any possibility of downtime, censorship, fraud or third party interference).” You can find a snapshot of the current “State of the DApps” — de-centralized applications being built on Ethereum — here.

Regarding Ether’s issuance model, a white paper cites a few current and future expected methodologies: “Ether will be released in a currency sale at the price of 1000–2000 ether per BTC (a mechanism intended to fund the Ethereum organization and pay for development).” Initial sales of the currency resulted in over $18 million raised and the 5th place highest funded crowdfunding project ever in September 2014. Of the total amount sold, a ratio will be allocated to “the organization to compensate early contributors”, “a long-term reserve”, and “to miners per year forever.” The paper further claims, “in the future, it is likely that Ethereum will switch to a proof-of-stake model for security, reducing the issuance requirement to somewhere between zero and 0.05X per year.”

Now to the fourth- and fifth-ranked non-BTC blockchain assets, Dash, which spiked over $50 million in mid-2014 and MaidSafeCoin, which spiked above $50 million in early 2016.

Dash: was created in January 2014 as an open source project built and maintained by the Dash team. Dash claims to be a “privacy-centric digital currency with instant transactions. It is based on the bitcoin software, but it has a two tier network that improves it.” You can find further information on its features and specifications in its white paper.

MaidSafe is a company based in Scotland. It developed the SAFE (Secure Access For Everyone) Network from “the unused hard drive space, processing power, and data connection of its users”. You can find details on SafeCoin, some comparisons between bitcoin and SafeCoin, the distribution of SafeCoin, and more in its Wiki and white papers.

With the recent rise in value of these and other non-BTC blockchain assets, it’s clear that bitcoin may no longer be the only blockchain asset worth your interest. In fact, the growing blockchain ecosystem is full of exciting assets and sub-asset classes, and it’s something all investors should be looking at for purposes of portfolio diversification.

Disclaimer: All viewpoints are completely my own . Nothing presented represents the viewpoints, opinions, etc. of any corporation or organization and all data/charts/analyses are for illustrative and discussion purposes only and should not be construed or interpreted as fact, advice, recommendation, or anything of similar nature. I am biased on the investments covered and do hold positions in various blockchain assets.

Alex Sunnarborg is CFO and cofounder of Lawnmower.io, a mobile app for investing in bitcoin and blockchain technologies. Previously, he was a municipal investment banking analyst at Raymond James, and prior to that, he worked in wealth management.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More