In 2011, Marc Andreessen famously opined for the Wall Street Journal that “software is eating the world.” His observation has proven true in many sectors of the economy, and especially so in marketing.

B2B predictive analytics vendor 6Sense announced recently the close of a $20 million funding round, coming less than one year after the release of the company’s first product. Just a few weeks before, Infer, a vendor in the same space, touted its $25 million raise, revenue that has been doubling for each of the past six quarters, and a customer list that includes companies like Atlassian, Cloudera, New Relic, Tableau, and Zendesk.

The size and timing of the 6Sense and Infer announcements are indicative of the explosive growth happening in the market for customer data platforms (CDPs), a term coined by industry analyst David Raab.

Per Raab, CDPs “gather customer data from multiple sources, combine information related to the same individuals, perform predictive analytics on the resulting database, and use the results to guide marketing treatments across multiple channels.”

Simply put, CDPs are powerful in their ability to help enterprises create a comprehensive view of their prospects and customers. And, as new data sources and collection and analysis techniques come online, this view is increasingly accurate, insightful, and timely.

The new tools driving modern data-driven marketing

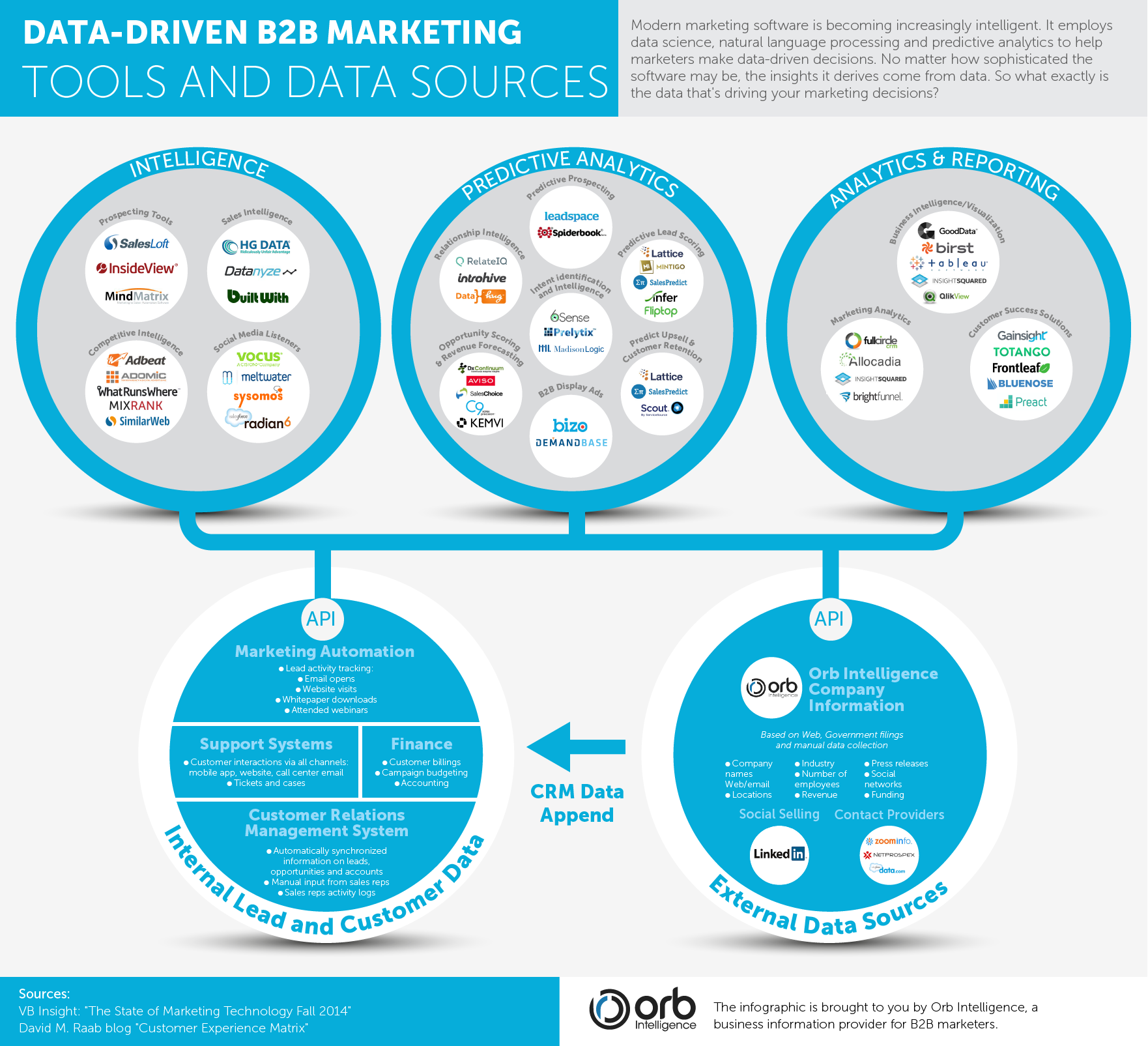

New research by my company, Orb Intelligence, published today in the form of an infographic, builds upon Raab’s work by calling out three major categories and 14 subcategories of customer data platforms, and by explicitly identifying the data sources that feed these platforms. They are:

- Intelligence. These tools help sales and marketing organizations gather key information on leads, prospects, competitors, and the market at large. Note that “intelligence” is used here in the sense of “intelligence agency,” as opposed to “artificial intelligence,” as these tools focus on classic information gathering, organizing, and disseminating tasks. Examples of companies in this space include Datanyze, iDataLabs, and SalesLoft. Subcategories include Prospecting Tools, Sales Intelligence, Competitive Intelligence, and Social Media Listeners.

- Predictive Analytics. Here is where intelligence means something more akin to “artificial intelligence.” CDP tools in this category apply advanced machine learning and analytic techniques to uncover patterns in data and infer recommendations for sales and marketing teams. 6Sense falls into this category, as do SalesPredict and Lattice Engines. Subcategories include Relationship Intelligence, Predictive Prospecting, Predictive Lead Scoring, Intent Identification and Intelligence, Opportunity Scoring & Revenue Forecasting, B2B Display Advertising, and Upsell & Retention Prediction.

- Analytics & Reporting. These tools allow users to aggregate data from multiple sources, perform analytics, and build reports. They don’t necessarily employ sophisticated machine learning; rather, they focus on grouping and filtering data in a way that is easily understood by business users, and presenting this information in the form of attractive charts and graphics. Companies like Birst, Looker, and GoodData fit here. In many ways, one can think of analytics and reporting tools as a window to the past, while predictive analytics is one into the future, inferred from historical data. Subcategories include Business Intelligence & Visualization, Marketing Analytics, and Customer Success Solutions.

We’re studying social media management tools (SMM)…

Add your voice and we’ll share the data with you.

The data that’s feeding the software that’s eating marketing

We’re probably pushing the metaphor too far here, but the point stands: It’s data that gives the CDP, and thus the marketer, its power.

Broadly speaking, customer data platforms integrate internally and externally sourced data, enriching the former with the latter through a process called data appending.

For each record or select records in internal systems such as the CRM, support, finance, or marketing automation system, external data is appended to internal records to help marketing and sales develop a richer profile of the customer or prospect.

External data on companies and individuals comes in a variety of forms and from a variety of sources, including the web, government filings, and manual data collection. Data providers like Orb Intelligence (in our case, focusing on company data) serve as a one-stop data shop for CDP vendors, agencies, and end users by aggregating data from multiple sources and presenting it via easily consumable APIs.

Data, customer data platforms, and the 360-degree customer view

The 50 CDP vendors identified in our infographic represent just a small sample of an exploding data-driven marketing universe. What’s driving the expanding number and capabilities of customer data platforms is data, and the power that a comprehensive customer view offers to sales and marketing organizations.

The notion of a 360-degree view of the customer is not a new one for marketers. However, if you compare the customer insight and visibility offered by the modern CDP with that offered by previous systems purporting to offer this benefit, you’d be generous to attribute to the latter more than 5 or 10 “degrees.”

In hindsight, marketers didn’t have such a complete view of the customer after all, and what limited view they did have took a tremendous effort to achieve.

Perhaps we’ll be saying the same thing about today’s CDP in five years. With a truly comprehensive view of the customer in place, it is inevitable that ever more powerful marketing applications will be built on top of it.

This is already happening, actually, within the CDP space itself. Lattice Engines and SalesPredict are two companies that started out in a single CDP category, offering tools for predictive lead scoring. Both have now expanded to providing predictive support for a larger segment of the full sales and marketing lifecycle: They now predictively score leads early in the funnel, score opportunities as these leads transition into possible sales deals, and predict churn once these deals become paying customers.

These companies are not just growing their product offerings — they’re eating marketing, one data-driven bite at a time.

Maria Grineva is a cofounder/scientist of Orb Intelligence, a company that provides business information for marketing software vendors and B2B marketing agencies.

Maria Grineva is a cofounder/scientist of Orb Intelligence, a company that provides business information for marketing software vendors and B2B marketing agencies.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More