In the video game market, billions of dollars in revenue and profits are up for grabs with the launch of each new generation of technology. In this current console war, which got underway with the launch of the Xbox 360 in 2005, the results are pretty even.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":188741,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"D"}']Nintendo comes out on top in terms of raw numbers. Certainly, it could pull further ahead and gain a complete victory. But if you factor in other considerations, and if Microsoft and Sony continue to make gains, this race could turn out to be a three-way tie when all is said and done.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

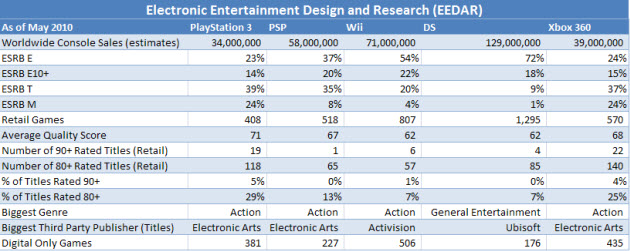

Add to this the fact that Nintendo dominates the portable handheld game player market, with more than 129 million units sold compared with Sony’s 58 million PlayStation Portables sold (and zero from Microsoft, which doesn’t participate in the lucrative handheld game market, unless you count Zune music players).

But there are other factors that balance out the competition, as the chart above from Electronic Entertainment Design and Research shows. Microsoft says it has the best tie ratio, or number of games sold per console, according to data from NPD Group. Sony, meanwhile, has the most complete portfolio of game devices, selling the PS 3, PS 2 and PSP. Sony also has the best-rated games.

There are three profitable video game console makers today. That is a unique and remarkable achievement, considering that the recession has taken its toll on game sales. In past console cycles, there was usually a weak player that ruined the market for everyone. Microsoft, for instance, lost billions of dollars when it launched the Xbox against Sony’s PS 2 and Nintendo’s GameCube. And before that, Sega and 3DO were the weak hardware companies. These weaker companies often tried to recover by cratering prices, forcing everyone to cut prices beyond where they should have. There wasn’t enough money to reinvest in good games, making both the industry and gamers suffer.

Today, each player is on a stable financial footing. And they are all benefiting from a market expansion. Today, the average game player is 35 years old, according to the Entertainment Software Association. About 40 percent of all players are women. About 68 percent of American households play video games. All of those numbers are improvements upon the previous game cycle.

This expansion of the video game market has helped everyone. Nintendo’s Wii can be credited for recruiting many more non-gamers into the market, while Sony and Microsoft have been slugging it out for the hardcore gamers. But those non-gamers don’t buy nearly as many games as hardcore gamers do. That’s why Sony and Microsoft have done so well with hardcore game sales.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":188741,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"D"}']

If you have to point to the one company that’s in the best position, it would be Nintendo. The company did the best job reading the state of the market. Gamers, Nintendo correctly assessed, were getting bored with traditional game improvements that stressed only better graphics. The company’s motion-sensing Wii turned the industry on its head. The Wii didn’t even take advantage of high-definition TVs as the other consoles did. It was simply more innovative and found a way to expand the overall market, rather than just steal market share from its rivals.

Nintendo may need to refresh its console sooner, given the fact that it ought to upgrade for HD, which is now pervasive. On the other hand, the Wii is still the top seller, and Nintendo has been great about patching up the Wii’s weaknesses, like when it added a gyroscope accessory, the Wii MotionPlus, to make the Wii controller more accurate.

The Wii came out at the mass market price of $249, while Microsoft and Sony debuted at $399 and $599, respectively. And Nintendo was able to go for almost three years without a price cut. Now at $199, the Wii is still the price leader. There is plenty of room for Nintendo to cut hardware prices, and the company has lots of game franchises to keep feeding to hungry gamers. Nintendo’s Wii Sports and Wii Fit games have done wonders for creating new gamers.

Meanwhile, Nintendo should turn its attention to the new age of apps to deal with the threat from Apple, whose 99 cent or free games are undercutting demand for $20 or $30 portable games. Nintendo will talk about its new 3DS handheld at E3; it has a 3D screen that is viewable without 3D glasses.

[aditude-amp id="medium2" targeting='{"env":"staging","page_type":"article","post_id":188741,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"D"}']

In the end, software has always been Nintendo’s advantage. Shigeru Miyamoto, the master game designer at Nintendo, always has something new up his sleeve. A year ago, Nintendo demoed its heartbeat sensor for the Wii. At this show, the company will unveil the game behind that sensor. Nintendo will also probably talk about the next Legend of Zelda game for the Wii console. That was has been hinted at, and it has been in the works for a long time.

Let’s hope that Miyamoto’s magic will keep dazzling us. Because if Nintendo doesn’t do something innovative soon, it may be in for a decline. When you’re at the top, the only way you can go is down.

If I have been critical of Nintendo in this generation, it has been that the company has been too profitable. That is, it is milking the Wii advantage for all it can get. It has not aggressively cut prices, largely because its prices are already lower than its rivals. But this profit-friendly strategy is not consumer friendly, and Nintendo’s strategy of maximizing profits might come back to haunt it, as the sands are always shifting in some way.

[aditude-amp id="medium3" targeting='{"env":"staging","page_type":"article","post_id":188741,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"D"}']

Microsoft’s bragging point is to look at how far it has come. When it originally started planning the original Xbox, it was in a state of panic about the prospects for the PlayStation 2, which threatened to take over computing in the home. When it launched the Xbox in late 2001, Sony had already sold 25 million PS 2s. It lost about $4 billion on sales of 25 million Xbox consoles. And while Microsoft beat out Nintendo’s GameCube, Sony outsold it 5-1 (in the time frame that mattered most).

Today, with 39 million Xbox 360s sold, Microsoft is a solid No. 2. It has sold lots of games per console and has cemented its place in gaming with titles such as Halo, Gears of War, Forza Motorsport, and many more from third-party game companies. Those third parties often use the Xbox 360 as their primary development platform.

Microsoft shot itself in the foot with its quality problems that led to a $1.05 billion write-off for the cost of replacing defective Xbox 360s. One survey showed that 24 percent of consoles failed after two years. That tarnished the brand name, but Microsoft has recovered from those problems now.

[aditude-amp id="medium4" targeting='{"env":"staging","page_type":"article","post_id":188741,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"D"}']

Microsoft’s biggest hope for a big gain is Project Natal, which goes a step further with motion-sensing than the Nintendo Wii. Natal combines technologies such as body movement detection, facial recognition, and voice recognition. Games that utilize can let gamers use natural motions and voice commands to control games. That’s great for the people who would never pick up a controller, and it might just expand the video game market. I’m worried that the device might be too expensive or that the technology might not detect gestures fast enough.

There’s also a rumor that Microsoft will show off a new slim version of the Xbox 360, one that uses a chip that combines graphics and a processor in a single chip. This could lower the system’s cost and position Microsoft to lower its prices further. It will also counteract Sony’s popular PS 3 Slim. We’ll find out more about these possibilities at E3.

If you look back on its history, Microsoft has made tremendous progress. But if you only want to look at Microsoft’s bright side, don’t compare it to Nintendo’s progress, because that’s what shows what you can really do if you think smarter than the competitors.

[aditude-amp id="medium5" targeting='{"env":"staging","page_type":"article","post_id":188741,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,games,","session":"D"}']

Sony got off to a slow start in 2006 because of the $600 price tag on the PS 3. But it got back in the running last year when it sliced the price to $299 for its mainstream model and launched a slimmer version dubbed the PS 3 Slim.

Sony made a lot of mistakes, but the company believes that its focus on long-term goals, such as the establishment of the Blu-ray high-definition video standard, paid off. The decision to add Blu-ray forced Sony to delay a 2005 launch until 2006, putting it behind Microsoft. And the extra costs of the console hurt Sony’s ability to match the prices of its rivals. Now, lots of buyers are citing the free Blu-ray player that comes with the PS 3 as a reason for the purchase.

But the missteps caused a big reversal in fortune, with Sony falling from the dominant position with 70 percent-plus market share in PS 2 generation to 23 percent today. By any measure, that’s a huge business disaster. Sony’s PlayStation Portable business is also hurting. Nintendo has outsold it by more than 2 to 1. And the PSPgo, which was Sony’s answer to Apple’s downloadable apps, was over-priced when it launched last October. The PSPgo has landed with a thud, prompting new rumors of a PSP 2. But whatever Sony does in handhelds, it still has a better business than Microsoft, which has no handheld business at all.

As the chart at the top shows, many of Sony’s exclusive games have been highly rated. Some games such as Uncharted 2: Among Thieves just aren’t possible on the other platforms. If that were the only thing that mattered, then Sony could keep on gaining ground. But this is the age of mass market gaming, not just pretty graphics. And Sony has lost many exclusive games that it once commanded, such as Grand Theft Auto and Final Fantasy.

Sony’s pretty games have enabled it to turn around its financial performance and move back into profitability after a few bad years. Sony’s major bet for the fall is the Sony Move, a wand-like motion-sensing controller that will allow for precise control of games. It’s like Natal, but less ambitious. Sony says Move’s big benefit is its precision.

Sony is also latching on to the fact that the PS 3 can accommodate 3D viewable images on TVs. The parent company is making a big push to sell 3D TVs, but I don’t think it adds to the gaming experience, based on what I’ve seen so far with demos of games such as Killzone 3. Lastly, there’s a rumor Sony will begin charging for a premium version of its PlayStation Network online service. It’s about time for that, given Microsoft’s success with Xbox Live’s premium service.

Sony still has a lot to prove, but it has been on the mend and it has a fighting chance for second place.

Conclusion: There’s too much at stake to surrender

In summary, each competitor has something to crow about. The good thing is this isn’t a grueling war where nobody wins, as in World War I. With three profitable companies, everyone stands to gain, and gamers will benefit from the competition. And with all of the attention that gaming is getting these days, don’t be surprised if more players will join the fray in a war that crosses all platform barriers. After all, games are the No. 1 apps in mobile games, and both Apple and Google are committed to dominating the market for mobile devices. Whoever wins the video game war is going to own a very precious relationship with some of the most engaged customers on earth. With so much at stake, one thing is for sure. No one is going to surrender just yet.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More