Tales of the tech unicorn’s impending demise might be somewhat exaggerated. Spoke Intelligence and VB Profiles released a report recently that counted more than 208 of the mythical creatures, not to mention an additional 21 of the even more rarely spotted decacorns — startups with a valuation in excess of $10 billion.

Almost half of them live in California.

Almost half of them live in California.

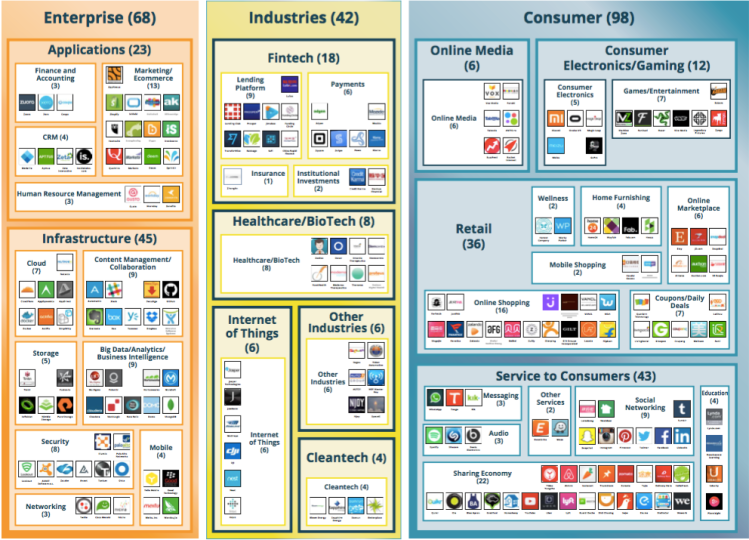

Ninety-eight of the unicorns are in the consumer space, especially in retail and the sharing (or “collaborative”) economy. Examples of unicorns in retail include the online marketplace Etsy and Alibaba, the massive Chinese commerce platform. In the collaborative economy, you’ll recognize names like Airbnb and Lyft. Another 112 unicorns can be found in enterprise technology infrastructure or vertical industries, such as fintech, healthtech, cleantech, and the current growth darling, IoT (Internet of Things).

“Unicorns are everywhere across the technology landscape,” said Spoke CEO Phillipe Cases.

Examples in IoT include Nest (acquired by Google), DJI (the drone company), and Jasper Technologies, which builds technology for self-driving cars.

Where the unicorns live

All told, 101 unicorns are headquartered in California. Another 23 are in New York, with a few handfuls scattered in states such as Massachusetts, Texas, and Illinois. Europe, as a whole, only has 13 — split between Germany, the UK, and a few other countries — which leaves China as the other heavyweight contender.

No fewer than 33 unicorns make their home in the most populous nation on the planet.

Interestingly, Europe ranks low both in terms of absolute number of unicorns and value creation. While the average global unicorn has returned 7X its invested capital in current valuation, Europe — which has not produced a single decacorn — sees returns of less than 4.5X.

Slowly, however, the world seems to be getting flatter in terms of investment and startups, just as it is with information and communication.

2015: the year of the unicorn

2015 was clearly a big year for the unicorn, with 81 new entrants joining the club, including one decacorn. It’s interesting to see that about 40 percent of the 2015 unicorns are based outside of the U.S. That number for all unicorns is around 30 percent … meaning that extremely high-value startups are becoming more global.

It’s worth noting that Spoke uses a fairly liberal definition of the term “unicorn,” counting any company valued at more than $1 billion and founded less than 25 years ago. That’s a long stretch of time, but 75 percent of those companies listed were founded in the last decade.

“It takes time to create a unicorn — the median length is six years — and even more time to exit,” Cases said. “Seventy-five percent of unicorns have not exited yet, and for the 52 who have, half got acquired and half went through an IPO.”

Spoke’s data showcases the ingredients it takes to become a unicorn (in addition to a great idea, stellar execution, and good timing). Not only does the average unicorn take six years to build, it requires $95 million in funding to reach that exalted status. Six years is fast by historical standards, but it’s hardly overnight.

It’s also worth throwing a few caveats into the discussion.

The 2015 investment environment featured ridiculously low interest rates, massive amounts of institutional capital, and investor-friendly exit preference agreements that made massive new funding rounds almost more like loans than venture capital. All of this contributed to sky-high valuations that, in some cases, are simply not supportable.

So it’s worth exercising a little caution when talking about tech unicorns, especially as 2016 valuations may be tightening up.

Above: Industries where the decacorns live

On the other hand, dismissing them entirely isn’t wise, either. There is something fundamentally different happening here, something worth paying attention to: the rapid rise of mobile-fueled tech companies that are growing big more quickly than we’ve ever seen before.

One thing is clear, looking at the numbers: Big bets can offer bigger returns on investors’ capital.

While the unicorns, as a club, are already massive outliers in the investment world, having so far returned 7X on invested capital, decacorns have returned measurably more: 10X.

Who’s investing in unicorns?

This is where the world’s top investment firms — almost all U.S.-based — make their money. Top firms include Sequoia, with 37 unicorn and decacorn investments, Accel Partners, with 29, and Andreessen Horowitz, with 28.

“Investing at unicorn valuation is risky, as 30 percent of exits are done below the unicorn valuation marks,” Cases warned. “However, with a portfolio approach, returns are stellar at more than 78 percent per year.”

Late-stage investors, however, tend to be big, old, institutional capital firms with names like Goldman Sachs, T. Rowe Price, Wellington Management, and Insight Venture Partners. The ranks of investing companies are dominated by giants like Google, SoftBank, and Alibaba.

A high-resolution version of the infographic is available here.

(Disclosure: VB Profiles is a cooperative effort between VentureBeat and Spoke Intelligence.)