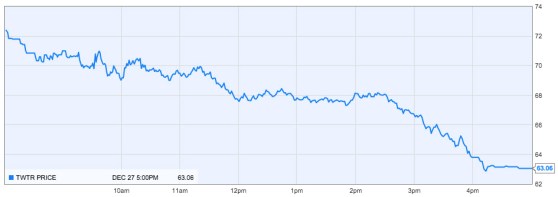

Twitter had a very merry Christmas week, with five days of consecutive stock market gains by Thursday’s close. But today, Twitter’s stock dropped more than 13 percent, slashing the microblogging site’s market capitalization from nearly $40 billion to about $36 billion.

Still, at $63.06 during after-hours trading — down this week’s high of more than $70 — the stock is nearly threefold its November IPO price of $26.

The stock has gotten a boost from positive media coverage, including the extension of “promoted accounts” ads to mobile users’ streams, but many analysts think the company’s current valuation isn’t justified.

“We think all of these announcements are positive, but expected, and they don’t fully explain the recent stock run,” Robert Peck, an analyst at SunTrust Robinson, wrote in a note to investors early last week. “The company is still in a very nascent stage of its life cycle.”

While investors are largely bullish on Twitter’s potential in online advertising, the company remains unprofitable, and there’s a massive disparity between its revenues and its valuation. Blake Harper, an analyst at Wunderlich Securities, said in a note Tuesday that the stock has “graduated to cult status.”

“We don’t believe the current valuation justifies the risk,” said Harper.

Above: Twitter’s stock dropped more than 13 percent on Friday, Dec. 27