It looks like Twitter’s acquisition of social media firehose reseller Gnip could pay off big, once Gnip is fully accounted for in Twitter’s earnings statements.

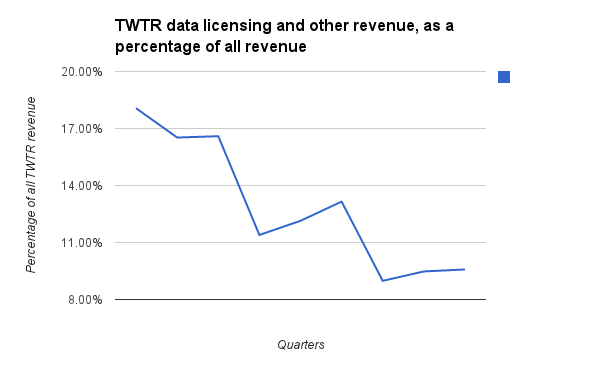

In reporting financials for the first quarter of this year, Twitter showed how its data-licensing business is not growing at the same rate of its advertising services. In fact, data licensing revenue as a percentage of total revenue has generally declined in the past couple of years, while the ad services revenue share has gone up.

And for yet another quarter, Twitter’s data-licensing revenue trailed year-over-year growth for advertising services.

All the while Gnip, which sells access to messages people send on Twitter and Facebook, has watched its revenue grow. Job postings claim “explosive growth.” Growth reportedly factored in to Gnip’s chief executive swap last year, too.

Compare that with Twitter, which posted around $24 million in data processing revenue, up from previous quarters but not delivering, say, a fifth of all revenue the way it did back in the first quarter of 2012. Instead, the share was roughly 9.5 percent.

Because Gnip has given part of its revenue to Twitter, that money shows up in Twitter’s current and previous earnings, but Gnip’s full revenue has not yet hit Twitter’s profit and loss tables. Once that happens after the acquisition closes, Twitter could see a nice splash.

So cutting out the middleman and buying Gnip could lead to a new wave of growth for data licensing, providing for less dependence on advertising — a potentially risky business — and more reliance on using tweets as a big data source.

More companies have been setting up big data projects. And as more companies decide they want to understand ideas people express on social networks like Twitter, the company’s ownership of that piece of the market could start paying off in a bigger way in the future.

Companies in many industries use social media sources through resellers like Gnip for business intelligence, sentiment analysis, customer relationship management applications, and marketers use them to better understand ad targeting on Twitter, Twitter chief executive Dick Costolo said in today’s earnings call.

“That was something we really needed to bring in house, because it’s so strategic to the future of the way we think about our data in service to those kinds of companies,” Costolo said.