Car service Uber, which started just 18 months ago, debuts in Washington D.C. today, hot on the heels of its recently-closed Series B funding round and its official global expansion, which started with Paris earlier this month and will continue at a pace of two cities a month in 2012.

I’ve studied the company and the market opportunity from various angles before, then I finally got to try the service in San Francisco, coming away very satisfied. (You can read more about that experience here.)

I also had a chance to speak with CEO Travis Kalanick for more details on this month’s launches in Paris and Washington, and what we can look forward to from his company in 2012.

What is Uber?

Uber is an on-demand car service that lets customers request town car sedans that show up within 10 minutes. The service is fueled in no small part by the shortsighted politics that empower taxicab unions.

In cities around the world, these labor groups lobby for burdensome medallion regimes or other regulations that lead to a massive undersupply of cabs. Kalanick says that for some cities, there’s a shortage of taxicabs by a factor of about five or six times. The end result is a huge business opportunity for Uber.

Uber started in San Francisco in June 2010 and has expanded by one city per month since May 2011; it now operates in seven cities.

The service is all about leveraging technology to skirt around the politics. It takes advantage of GPS, increasing smartphone use, easier mobile payments, sophisticated demand-prediction algorithms and efficient, numbers-driven dispatch operations.

Kalanick, who is a self-proclaimed numbers geek, touts the incredible amount of math that underlies the system. To ensure that cars show up in 5 minutes, complex algorithms are used to first determine how much supply is needed, and then to position that supply (the actual cars) where it’s needed most.

Algorithms also help determine pricing, which is usually fixed, although the service has experimented with dynamic pricing. Over Halloween, for example, five cities across the U.S. featured Uber service where the pricing would automatically adjust depending on demand. This was, to Kalanick’s knowledge, never performed in the history of in-city consumer transportation. Dynamic pricing will again be rolled out for New Years Eve, but there are currently no plans for weekends or other peak times.

A well-funded enterprise

The promise of using math and technology to make the marketplace between drivers and riders efficient and convenient is exactly the type of startup investment the top tier of venture firms is looking for. This is why venture capitalists like Shervin Pishevar of Menlo Ventures led the latest funding round, the fourth capital infusion for Uber that has so far raised $44 million in total.

After Kalanick and co-founder Garrett Camp put in their own $200,000 as seed money, the company raised a $1.25m angel round led by First Round Capital, an $11m Series A round led by Benchmark Capital, Founder Collective and First Round Capital, as well as the most recent $32m Series B with Menlo Ventures, Jeff Bezos, Goldman Sachs and Benchmark again. The Series B is extendable up to $39m with the opening of a second tranche if need be.

When he announced the funding at the Le Web conference in Paris last week, Kalanick said, “Uber’s in it for the long haul, the goal is an IPO.” This justifies Goldman’s investment in the Series B: the investment bank is now a stakeholder in the company’s success at an early stage, and will no doubt play a role in its public exit.

The capital will be funneled into Uber’s global expansion, which aims to be in about 25 more cities by the end of 2012 and an additional 25 shortly after. A good chunk of the money will go into establishing 3-person operations teams in each new city, maintaining and enhancing quality in existing cities, and squashing any clones and copycats. Money will also be used to expand the executive ranks.

“We’ve been doers and makers, and now we need some managers,” said Kalanick.

A look at its jobs page reveals that Uber is hiring operations people in Los Angeles, Miami, Las Vegas, Toronto and Vancouver, and you can bet those are the next cities to come online in Q1 of 2012.

Metrics and more

Kalanick refused to give exact revenue figures, but boasted a 35 percent month-over-month growth in revenue, well into the eight figures with gross receipts. Each rider spends an average of $100 each month.

Interestingly, Uber spends zero dollars on marketing, opting for word-of-mouth referrals and whatever steam they pick up online to attract new customers. Kalanick says they may spend on marketing in the future, especially as their global expansion heats up and clones pop up. This may never be needed, however, as he also points out that they have a “blessed” viral loop of seven: for every seven rides, a new rider is acquired.

Uber has experienced substantial traction thus far, which has allowed it to expand to one city each month at this point. In 2012, with its new funding and accelerated hiring, it will quicken the pace to two cities per month.

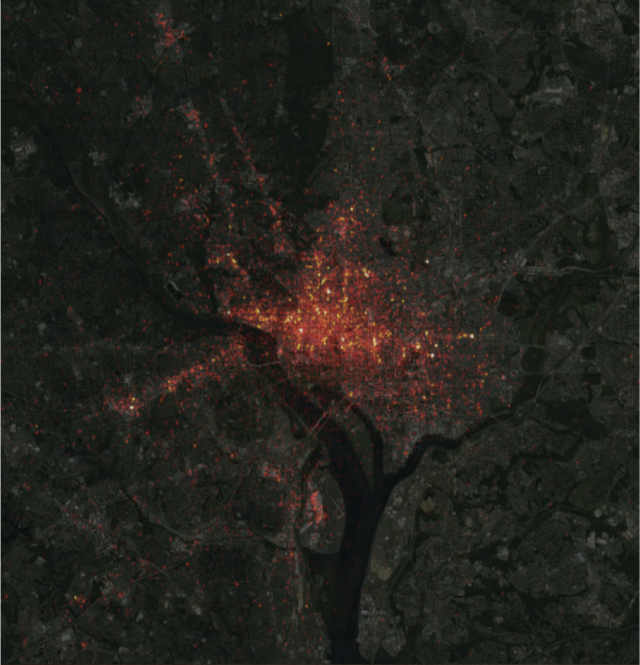

Every city has a different geography. Using his own home city of Los Angeles, which will come online soon in 2012, Kalanick discussed the specific challenges posed by each city’s own urban geography.

Because L.A. is so huge, Uber will be built around “hot zones” where riders may travel within, but not necessarily between, hot zones at opposite ends of town.

This also marks the trajectory of Uber’s expansion: Cities that have similar transportation layouts and quirks will come online in succession, not necessarily those that are close merely by proximity.

This is why Paris debuted before many other U.S. cities, because it was similar in key respects (such as density, transit alternatives, and even the overall culture) to San Francisco, where the logistics have already been perfected.

Dealing with the competition

Dealing with the competition

Kalanick told me that one of the motivators for expanding so quickly was to be able to establish Uber in cities before copycats showed up.

However, he also said that most competitors thus far have gone after the taxi industry directly, not the higher-end on-demand luxury car service industry Uber is after.

One of these competitors, Taxi Magic, aims to connect smartphone owners with existing taxi fleets, and is already in 45 cities, including D.C., where it books more than 1,000 rides a day.

But Kalanick isn’t worried, dismissing services like Taxi Magic by saying, “They’ll do an app for taxi dispatch, but they’re never any good because the supply is still broken. You need to attack this regulated oligopoly from the ground-up.”

The D.C. market should work well for Uber. The city has the highest concentration of people with secondary degrees, and a wide swath are involved in work that befits showing up in a town car, such as government and law.

This seems vindicated by some of the metrics it’s been tracking since the soft-launch a few weeks ago. Again, Kalanick won’t reveal exact figures but says D.C. has been the city to adopt Uber the fastest, despite the service’s cars costing 50 percent more than existing cabs in the area.

It turns out that if you provide people with sufficient incomes, appropriate jobs, and enough tech saavy to know about a useful app or two, they will pay for a convenient and fast way to get around their city.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More