Didi Kuaidi, Uber’s market-dominant rival in China, says it has received 1.4 million test drive requests since launching the service in October. That’s based on 1.8 million user sign-ups, and is, by any measure, a staggering number for the first 90 days. We’ve reached out to Didi to clarify how many of those requested test drives were actually delivered.

Update: A Didi Kuaidi spokesperson clarified to VentureBeat:

1.4 million refers to orders, of which 50-60 percent result in actual test drives — a ratio that will improve as the service gets refined.

At the time of Didi’s test drive launch barely three months ago, I wrote about how ridehailing apps are now opening up entirely new advertising channels for car makers (along with revenue streams for the startups/apps themselves) through test-drive services. Margins on rides hailed through the app are likely thin.

Indeed, Didi is today announcing that it plans “to build out its fast-growing test drive business into an open, big data-driven automobile service platform.” That’s quite a mouthful, but makes perfect sense from a business perspective, especially in a huge walled-in market like China, where Didi reigns supreme, and where (as in the U.S.) everyone is attached to their smartphone.

Beyond ridehailing: The new transportation ecosystem

Didi elaborated on those plans in the following release:

In the future, the Didi app will connect carmakers and dealers with Didi’s robust mobile user base to realize a full range of auto-related services including pricing and demand projections, targeted product recommendations, and other auto ecommerce initiatives. Drawing on Didi’s powerful data integration and analysis capabilities, the platform will enable carmakers and dealers to build more effective and mutually-beneficial connections to users, buyers, and car media.

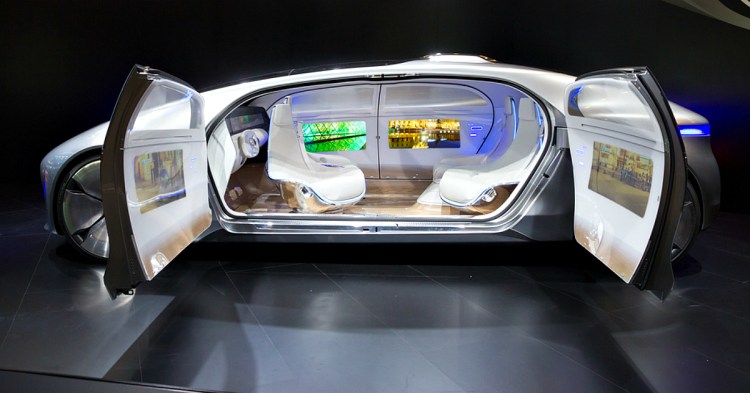

Didi started selling cars online in China last month, in what seems to have been something of a pilot test. It sold 200 new models sourced from among its 19 automobile “partners” (which include brands like Toyota, Mercedes-Benz, Lincoln, and Audi) in just two hours. As of today, Didi’s test-drive service is available in Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, and Hangzhou (Chengdu is notably Uber’s most important city, globally). And Didi says it plans to expand the service into 20 more cities in China this year.

Crucially, this is where Didi gets crystal clear about its intentions to be much more than just a ridehailing competitor to the likes of Uber:

Automobile ecommerce, as well as other services offered by top carmakers and dealers, are expected to become part of Didi’s day-to-day operations in the near future.

So this is how Didi is really going to make use of all that big data it’s been gathering about its users — by helping car makers sell more effectively (through targeted marketing campaigns), and, in turn, making big bucks while competitors like Uber continue to bleed:

The data and networking capabilities from Didi’s test drive platform, for the first time, accurately grasp customers’ car use and purchasing needs … Positioned between car manufacturers and dealers, Didi Kuaidi is in the best position to create customized intermediary services … By optimizing consumption patterns and improving sales efficiency, [Didi] aims to contribute to the transformation of the car industry and the new transportation ecosystem.

As it was last year, China will continue to be an exciting tech market to watch for innovations in 2016 — it’s no longer content to be a copycat, following in the footsteps of the West. And, to me at least, this new development proves that Didi is an incredibly exciting Chinese startup in the transportation space, one that it’s probably foolish to underestimate.