Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

ValueAppeal has raised $1.6 million in additional funding a few months after raising a $560,000 angel round. The company will use the money to enhance its web site that helps homeowners lower their property taxes.

ValueAppeal has raised $1.6 million in additional funding a few months after raising a $560,000 angel round. The company will use the money to enhance its web site that helps homeowners lower their property taxes.

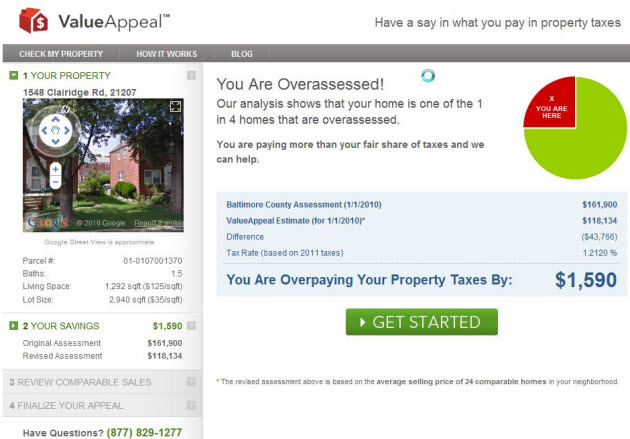

As we noted in our earlier story, there are lots of homes with property tax assessments that are too high, sometimes by as much as 40 percent. That costs homeowners money, but too often it isn’t that easy to appeal your home’s assessed value.

The Seattle-based company has created a service that automates the appeal process. If it decides your assessment is too high, the company will take on the task of proving your case to the local county assessor, for a $99 fee. ValueAppeal can now cover the entire country with its service.

As homeowners deal with economic recovery and crazy home prices, this kind of service is really useful. If you aren’t eligible for a refund, you can find that out in minutes. But if you are entitled to money back, the company can make the process of doing an appeal much easier. As of May, about 80 percent of ValueAppeal customers have had successful outcomes with their appeals and saved an average of $839 per year. If you don’t have a successful outcome, ValueAppeal gives you a full refund.

That’s no small task, since property taxes are assessed at the county level, and the process for appeals is different in all 3,000 counties in the country, said Charlie Walsh, chief executive of the company, in an interview in December. The company went to a lot of trouble to create a system that could handle requests from most of the nation.

The appeals often pay off because county assessors don’t have the staff to do individual assessments. Rather, they do an automated assessment about once a year. Walsh said the result is lots of inaccuracies. But lawyers often charge 50 percent of any estimated tax savings to appeal on behalf of homeowners.

ValueAppeal says it can take owners through an appeal in five steps that take less than 10 minutes total. The company believes 25 percent of all homes in the U.S. are being overassessed.

Basically, you enter your address, register your name and email, and then the service decides whether your home’s assessed value is accurate or not. If you are eligible for an appeal, it calculates how much it could save you. It won’t let you proceed unless it thinks you can save $300 or more. Then you use the site’s comparative analysis tool to assess five to eight similar homes near your house. It creates a report that you can then mail in to the assessor, along with a pre-filled form. The deciding factor is usually the comparative analysis.

The company was founded in 2009 and has 15 employees. Walsh was previously chief executive of ISSI Data, a data storage company that he sold in 2008. Total funding to date is $3.1 million raised from angel investors.