Zynga has taken a beating in its first two days of trading as a public company, with the stock closing at $9.05 a share today, down almost 10 percent from its initial public offering price of $10 a share on Friday.

Zynga has taken a beating in its first two days of trading as a public company, with the stock closing at $9.05 a share today, down almost 10 percent from its initial public offering price of $10 a share on Friday.

But a well-known video game analyst came out with a report today that says Zynga will “outperform” the stock market and hit a price of about $12.50 a share within a year. Michael Pachter, an analyst at Wedbush Securities, issued a 34-page report today that examined the business closely and concluded that “Zynga is well-positioned for revenue growth due to its dominant market share among social game publishers, its track record of releasing very popular and durable games of the highest quality, and its myriad opportunities to expand beyond Facebook.”

[Update: Another veteran game analyst, Atul Bagga of Lazard Capital Markets, also initiated coverage with a “buy” rating today, setting a price target of $12 a share. See more on his report at the bottom].

Pachter noted that Zynga has a big opportunity to expand its advertising revenues, given that the company has more than 200 million monthly active users. Zynga’s ad revenues were 73 percent of its total revenue in 2008, but the company scaled that back to improve the user experience in games. Now, ad revenue is only 6 percent of 2011 revenue year-to-date. If Zynga made $1 in ad revenue from each of its users each month, that would create revenues of $2.4 billion. Pachter thinks that a small increase in ads would boost revenues without alienating users. Branded virtual goods, sponsorships and engagement ads would likely be welcomed by users.

Pachter noted that Zynga has a big opportunity to expand its advertising revenues, given that the company has more than 200 million monthly active users. Zynga’s ad revenues were 73 percent of its total revenue in 2008, but the company scaled that back to improve the user experience in games. Now, ad revenue is only 6 percent of 2011 revenue year-to-date. If Zynga made $1 in ad revenue from each of its users each month, that would create revenues of $2.4 billion. Pachter thinks that a small increase in ads would boost revenues without alienating users. Branded virtual goods, sponsorships and engagement ads would likely be welcomed by users.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

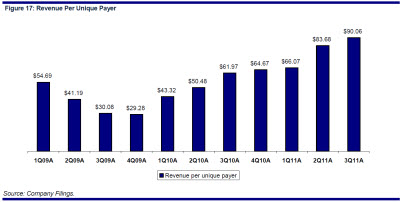

Pachter, a longtime video game industry analyst, was also optimistic about Zynga’s ability to migrate its social games to mobile platforms and monetize them. He said the 12-month price target reflects an estimate of 9.5 times 2013 adjusted EBITDA (earnings before income taxes, depreciation and amortization). Earnings are expected to grow about 93 percent in 2012 and 25 percent in 2013.

Other points that Pachter emphasized:

— Zynga is the leading social game developer and publisher, with six of the top 10 games on Facebook. The company has more monthly active users than the next 12 social game developers combined. Zynga’s titles are durable too, as many of its hits were released before 2011, and Pachter says the quality of Zynga’s games continues to improve. Empires & Allies, for instance, gave Zynga’s players a taste of combat and strategy for the first time. That helped Zynga reach more hardcore gamers, who spend more money. Pachter says that CastleVille, released in November, is like CityVille on steroids, with more built-in longevity and monetization. CastleVille currently has 37.1 million monthly active users, not far from Zynga’s market-leading CityVille at 48.8 million.

— The key to making money from the games, Pachter said, is accumulation of resources. If players lose patience with the time it takes to gather resources, they are more likely to pay to speed up that time. Players can also ask friends to provide them with resources, and that request on its own constitutes a free advertisement for the game, helping a title to spread from friend to friend. That is why Zynga’s games are so viral.

— The company is well-positioned for long-term growth. The company launched several major games such as Adventure World, Mafia Wars 2, and CastleVille — all late in the year — and those are likely to contribute to revenues in 2012. Wedbush believes Zynga revneues could grow from about $1.2 billion in 2011 to $1.53 billion in 2012. Longer term, drivers include growth in the number of Facebook users, growth in the number of games played by Zynga players from the current 1.4 per player, and increased monetization of the Zynga player base.

— Revenue growth areas include mobile. At 11.1 million daily active users on mobile, Zynga’s mobile usage grew 10-fold over 2010. Mobile could be 10 percent of Zynga’s revenue by 2013, up from 7 percent in 2011, Pachter said.

— By 2015, Wedbush believes Zynga could grow revenues to $4.5 billion.

— By 2015, Wedbush believes Zynga could grow revenues to $4.5 billion.

— Growth in China is a big opportunity. Zynga has a deal with China’s Tencent social network in a deal where Tencent keeps 70 percent of the revenue. But it provides Zynga with protection against piracy and access to around 700 million users. China revenues are expected to grow from $11.6 million in 2011 to $46.5 million in 2013. International revenues grew to 35 percent in 2011, compared to 32 percent a year earlier.

— Zynga can use its Project Z platform to expand its games beyond Facebook.

— Zynga will likely expand more rapidly in the future. Pachter believes the company will launch 8 to 10 games a year and retire maybe four or five older ones.

Pachter also pointed out some risks for Zynga. Those include changes in game releases, a possible loss of interest in Facebook over time, changes to the economics of its Facebook agreements, inability to create more hits, increased competition, and higher demand for video game console games. Zynga is also spending a lot on game development and other research and development. R&D cost about $400 million in 2011 and it could hit $516 million in 2012. Stock-based compensation could also cost Zynga $400 million a year.

Pachter noted that EA’s team in China is working on a version of SimCity for Facebook, and that could take a toll in Zynga’s games, especially CityVille.

In a report for Lazard Capital Markets, Bagga said the company is a leader, has a meaningful advantage with a large user base, it understands users and their playing habits, and it knows how to manage its audience. He expected continued momentum on Facebook and higher monetization per user, driven by improved conversion of players from free to paid status and by advertising. And he is positive on Zynga’s attempt to create its own social network with Project Z.

Like Pachter, Bagga sees games-as-a-service to be a new and powerful category serving social gamers with an estimated compound annual growth rate of 30 percent over the next five years. Social mobile gaming, meanwhile, could grow at a compound annual growth rate of 34 percent over the next five years. Social mobile games could grow from $1.2 billion in 2010 to $5.2 billion by 2015. On a global basis, mobile games could grow from $3 billion in 2010 to $8.4 billion by 2015.

Since Zynga leads the fast-growing Facebook games category, it is logical it should have higher valuation than its rivals. Ad revenue in social games could grow 35 percent CAGR over the next five years, Bagga said.

Games are a hit-or-miss business, but Zynga is less likely to launch and invest heavily in misses because it can do A/B testing and quickly figure out what works or doesn’t work with its audience. Zynga also has plenty of new markets it can enter, Bagga said.

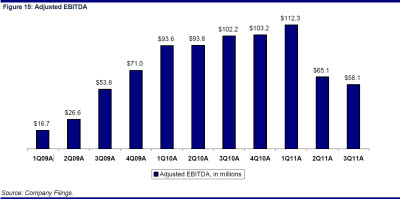

Many have noted that Zynga’s conversion rate, or percentage of users who buy something in a free-to-play game, is a scant 2.5 percent. But this percentage has been growing, from 1.7 percent in 2009, but it is still much lower than the 10 percent to 25 percent rate in China, Korea and Japan.Bagga said that the average revenue per daily active user for Zynga was 6 cents a day, up 66 percent from 2009.

Bagga also noted that real-money wagering of poke could become legal at some point the U.S. and Zynga’s poker game could benefit from that, as real-money online poker could be a $3 billion to $5 billion market in the U.S.

Bagga noted that “whales,” or users who pay huge sums for goods, represent a dependency risk for Zynga. Typically, Bagga said 5 percent of the paying users account for 50 percent of the total revenue. While he acknowledges Zynga’s revenue growth is slowing, he believes the strong pipeline of titles coming will renew that growth in 2012. And despite the growing competition, Zynga has grown its market share of gamers on Facebook from 52 percent to 58 percent in three years.

Bagga believes that Zynga could also launch games in the hardcore sector of social games, currently occupied by rivals such as Kixeye and Kabam. The monetization on these games is much higher than in simulation games.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More