The virtual reality (VR) market in China is expected to reach $860 million in 2016 and accelerate to $8.5 billion by 2020. In the last six months alone, the Chinese VR market has seen a flurry of investments, partnerships and new ventures involving both local and international players. With capabilities in low cost, mass scale manufacturing, a hot investment climate, and international support, China could become the epicenter of the global VR market’s growth.

While the country has been seen as a copier of Western technology, VR is a new medium that could foster innovation and drive China’s future market. The limited number of U.S. head-mounted device (HMD) players and the lack of their presence in China have created a vacuum that is quickly being filled by a growing group of entrepreneurs, many of which are heavily focused on mobile and standalone HMDs. E-commerce behemoths Alibaba and Taobao have reported total sales of over 300,000 units of VR headsets a month (this number excludes offline sales). There are over 100 types of VR headsets in China, with most of these on the lower end, comparable to Google Cardboard. Early leading HMD manufacturers include 3Glasses, DeePoon, and Baofeng Mojing.

Above: The DeePoon headset is advertised as being specially designed for Asian features

During the first quarter of 2016, Baofeng sold 1 million units of its $30 headset through its network of 20,000 brick-and-mortar stores — and it’s targeting 10 million headsets by the end of the year. To put this into perspective, Google Cardboard announced it was shipping 5 million Cardboard headsets in its first 19 months. With the head start Chinese headset makers have gotten, they are more quickly iterating based on market feedback and have the potential to leapfrog the U.S. in mobile VR. Baofeng, for example, is now working on its 5th generation HMD. In the last six months, major brands ZTE, LeTV, and Huawei have also entered the competitive space with their own VR headsets.

With the hardware market booming, what China needs most is compelling content. While none of China’s biggest tech companies – Baidu, Alibaba and Tencent – have released an HMD yet, they each have ambitious plans for VR: They have opened their platforms and are providing seed funding for China’s VR startup space, especially for content creators. Subsidiary video services of all three are working with content partners and investing in VR film, TV, and game content. International efforts are also fueling the content market. 500 Startups will be investing in 20 early stage companies in China. Shanghai Media Group partnered with U.S.-based Jaunt to form Jaunt China and has plans to develop 500 VR productions in the next two years.

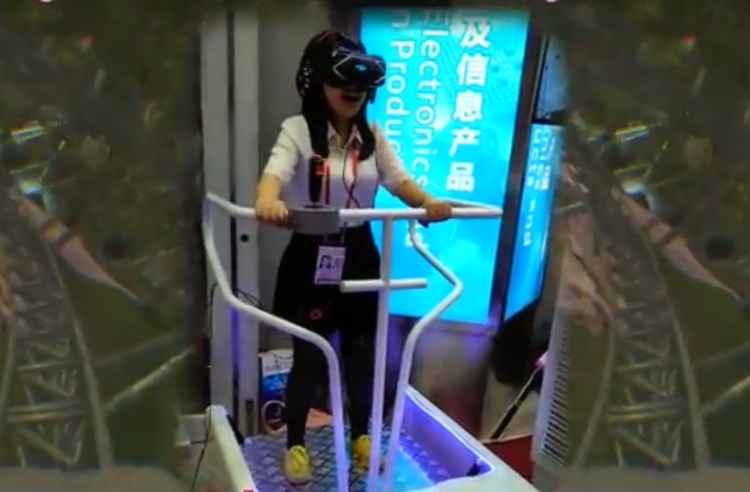

Another area of growth in VR, and one that offers immediate monetization opportunities, is out-of-home and location-based entertainment. “VR stores,” such as an in-mall VR roller coaster experience priced at $6, have existed across the country since last year. Because the high-end, PC-based VR experiences are not accessible to most of China, out-of-home experiences provide the average consumer with curated, high quality VR content, accessible through Internet cafés, malls, other commercial venues, and theme parks. Taiwan-based HTC recently announced plans to open over 10,000 out-of-home VR experiences throughout China in partnership with Chinese electronic retailers Suning Commerce Group and Gome Electrical Appliances Holding Ltd. LA-based SPACES and Songcheng Performance Development Co, one of the world’s largest theme park operators, have recently formed a joint venture to bring VR to its theme parks and also develop standalone parks in China. These are just two of many ventures and partnerships contributing to the burgeoning VR out-of-home market and promoting overall consumer awareness.

With both the proliferation of VR platforms and out-of-home experiences, there has never been a better time for great content creators to dive in.

Mary Ermitanio is a consulting manager for Manatt Digital, an integrated business advisory and legal services firm. She helps media, technology, and emerging growth companies define strategies for M&A and investments, content monetization, and customer acquisition and supports business development initiatives. She previously worked with the major studios to provide insights that helped inform their marketing strategies and product development decisions through analytics in social media, mobile and web.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More