Bots are white-hot — but for the fintech industry, trying to implement one with outdated architecture and poor integration can be deadly when it comes to confidential customer financial information. For insight into how banks can mitigate risks with the right infrastructure and design, don’t miss this VB Live roundtable.

“Chatbots are top of mind — but let me be very clear, not for customers,” says Peter Wannemacher, senior analyst at Forrester Research. “Customers are not sitting around saying that I really wish I could talk to a bot today. They are top of mind for a lot of executives, and we’re seeing that across industries. And that’s understandable — AI-based technologies have advanced incredibly in the past five years. And bots are proving interesting, and sometimes valuable for brands in different industries.”

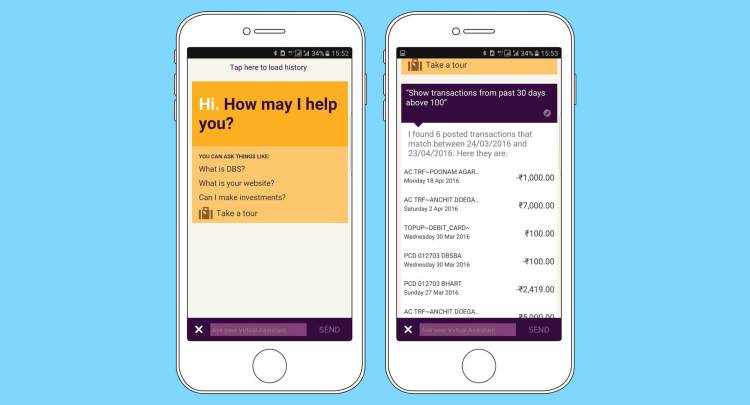

And banks aren’t sitting on the sidelines in these conversations, he adds — Singapore Bank has developed a chatbot, Bank of America has promised a chatbot and European banks have gotten into the act as well.

But there’s a lot to unpack in what seems like a no-brainer solution for customer engagement.

“‘Customer engagement’ means designing for customer outcomes,” Wannemacher says. “Hopefully there are some huge business benefits and cost savings. But it needs to be human-centered design that leads to bot experiences and implementations down the road.”

It’s already a consumer-friendly technology that users are flocking to, says Katy Gibson, vice president of product applications at Envestnet | Yodlee. “People are now spending more time on messaging apps than on social media and that’s a huge turning point,” Gibson says. “So it’s a familiar channel, and data analytics is improving in leaps and bounds and that is really the underlying engine.”

Bots could even revolutionize the way organizations interact with their consumers, she adds, becoming a money-saving automation tool that services consumers 24/7.

“They have the potential to automate simple tasks with a very familiar interface, and there’s no need to download new apps,” she adds. “They can run on existing rails, be it your existing apps or popular messaging applications. So adoption and ramp-up can happen relatively quickly.” And if it’s done right, your bot’s personality can even act as a positive reflection on your brand to enhance it.

That all points to very careful planning and consideration of your bot’s use case — how, where, and, most importantly, why you’re implementing this platform.

“We know — and this is evident in our research but I want to make it the bold headline here — bots are most effective when you set the parameters of the conversation with bank customers or prospects,” Wannemacher explains. “Those parameters include the expectations; they also include the rules the customers can be guided by, because too often we see bots promising that they’re the same as interacting with an agent or a sales rep for a retailer, for instance, when they are not. No bot is ready for that yet.”

“Your best bet is to start with something really specific,” Gibson agrees. ”A very specific use case where the user knows what they can ask, and where they also know that those are probably the only types of questions they can or should ask. That suggests a somewhat linear process with a start point and end point, and the consumer knows what the steps are to go through it.”

The problem is that while Taco Bell can handle a little uncertainty and the occasional early-tech mishap, the fintech industry does not have that luxury.

“What we’re seeing is that the customer’s experience is uneven,” Wannamacher says. “When I say uneven, I mean that it is sometimes effective, clean, and seamless. But very often — about three out of every ten interactions — are either totally ineffective, extremely clunky, or so problematic that it might as well be ineffective.”

So what’s a financial services company to do?

“We believe you should be looking at these types of technologies as an iterative evolutionary process,” Gibson says. “Even though bots have the illusion of simplicity on the front end, a lot of complexity actually goes into creating a great experience.”

And that’s where your money needs to go — not into a right-now solution, but into laying the groundwork for the right solution.

“My advice is not to sit on the sidelines, but to invest wisely,” Wannemacher says. “Invest in what Forrester calls business technology: data infrastructure, systems of insight, an API platform, and API management strategy, back-end integration. There’s a number of things that are invisible to the customer, but essential to making sure that next-gen bot implementations are effective — and hopefully actually brilliant and fantastic, which is what we believe they can be.”

For a deep dive into the short-term data and infrastructure decisions you need to make now, and a long-term view of the steps that follow, watch this free VB Live event now.

Don’t miss out!

Access this VB Live event on demand right here.

By attending this VB Live event, you’ll:

- Re-engineer back-end systems to enable real-time action

- Make progress on platform improvements — or replacements

- Embrace APIs for faster, more dynamic future changes

Speakers:

- Peter Wannemacher, Senior Analyst, Forrester Research

- Katy Gibson, Vice President, Product Applications, Envestnet | Yodlee

- Evan Schuman, Moderator, VentureBeat